In the ever-evolving landscape of technology, cloud computing stands as a behemoth sector, driving innovation and financial growth. Among the titans in this domain, Amazon and Microsoft reign supreme. Amazon, known for its e-commerce prowess, has boldly ventured into cloud services with Amazon Web Services (AWS), while Microsoft, long-established in software, has made significant strides with its Azure cloud platform.

Microsoft Corporation (MSFT) and Amazon (AMZN) hold positions as two of the most prominent tech companies globally. Each with its own strengths – Amazon excels in e-commerce and leading cloud services, while Microsoft is revered for its software legacy and AI-powered cloud offerings.

Despite the allure of both companies’ stocks in high-demand sectors like cloud computing and AI, investors grapple with the decision of which could offer superior returns in the future. Let’s delve into the intricacies and potential of each to determine the better investment choice at present.

Amazon: The Cloud Pioneer and Dominant Force

Amazon boasts a market capitalization of $2.02 trillion, primarily renowned for its retail dominance. AWS, Amazon’s cloud arm, made waves since its inception in 2006, commanding a significant portion of the global cloud infrastructure market, with a commanding 31% share by 2024.

The stock of Amazon has surged by 26.8% year-to-date, outperforming the S&P 500 Index’s 20% gain.

AWS offers a comprehensive suite of services, from computing power to machine learning, meeting the needs of startups, large enterprises, and governmental entities. The division significantly contributes to Amazon’s revenue, showing a robust 19% year-over-year growth in the second quarter, reaching $26.3 billion. With an operating income of $9.3 billion in Q2, AWS stands as Amazon’s most lucrative segment, boasting higher margins than its core e-commerce operations. The remaining performance obligations (RPO) for AWS hit $156.6 billion in Q2, indicating substantial forthcoming revenue.

Amazon’s CEO Andy Jassy emphasizes AWS’s appeal to businesses transitioning to cloud infrastructure and seizing AI opportunities, solidifying its market leadership.

Trading at 33.4x forward 2025 earnings estimates, Amazon stock may seem lofty, yet analysts project earnings growth rates of 62.9% in 2024 and 22.6% in 2025.

Wall Street’s View on AMZN Stock

Wall Street resonates a bullish sentiment on Amazon stock, with 43 out of 46 analysts rating it a “strong buy.” The average price target of $225.43 indicates a potential upside of 16.8% from current levels, while a high target of $265 forecasts a remarkable 37.3% rally in the coming year.

Microsoft: The Ascendant Competitor

With a market cap of $3.18 trillion, Microsoft’s rich history, coupled with strategic acquisitions, has propelled it to stellar financial heights. Though Azure trails AWS in market share, it holds a formidable 25% and is swiftly narrowing the gap, posing a significant challenge in the cloud computing realm.

Microsoft stock has gained 14.8% year-to-date, outperformed slightly by the Nasdaq Composite’s 20.4% gain.

Microsoft’s robust ties with enterprises through its suite of products offer a competitive edge. Azure synergizes seamlessly with Microsoft 365 and other services, providing a holistic solution for diverse businesses. Additionally, strategic AI investments, including the 2019 collaboration with OpenAI, augment Azure’s offerings.

Azure AI boasts over 60,000 customers, marking a 60% yearly growth in Q4 of fiscal 2024. Intelligent Cloud, contributing significantly to Microsoft’s quarterly revenue of $64.7 billion, saw a 19% increase to $28.5 billion in revenue from Azure and other cloud services. The segment’s operating income surged by 31% to $11.7 billion.

Predictions point to an 18%-20% revenue growth in Microsoft’s cloud segment for Q1 of fiscal 2025, with Azure expected to lead the charge, growing by 28%-29%.

Despite Azure’s progress in narrowing the gap, AWS’s incumbency and expanded AI offerings pose substantial hurdles. Nonetheless, with a strong focus on AI and technological prowess, Microsoft holds promise to surpass Amazon in the foreseeable future.

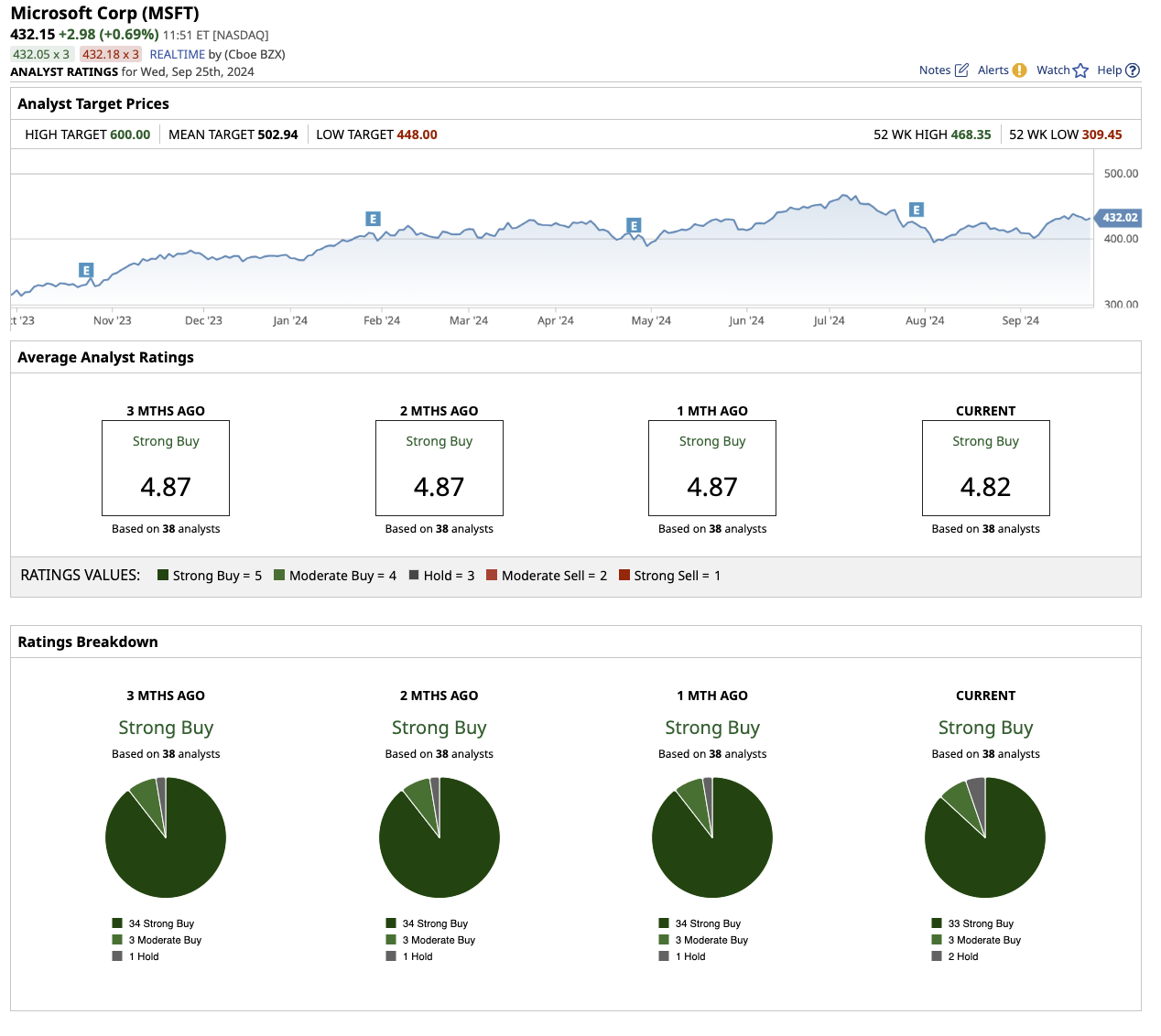

Wall Street’s View on MSFT Stock

Wall Street regards Microsoft stock favorably, with 33 out of 39 analysts recommending it as a “strong buy.” Three analysts rate it a “moderate buy,” while two maintain a “hold.” The average price target of $502.94 hints at a possible 16.4% upside, with an optimistic high target of $600 suggesting a substantial 38.9% rally in the next year.

Trading at 32.6 times the consensus forward 2025 earnings estimate, Microsoft’s valuation closely rivals Amazon. Analysts foresee a more modest earnings growth of 11.5% in 2025 and 16.1% in 2026, in stark contrast to Amazon’s more substantial growth estimates.

AMZN vs. MSFT: The Investment Dilemma

The choice between Amazon and Microsoft proves challenging as both stand as premier cloud giants. Microsoft’s Azure growth, coupled with its AI prowess and enterprise relationships, positions MSFT stock favorably for long-term investors eyeing future technologies.

However, for those seeking a cloud leader with dominant market share and high-profit margins, Amazon’s AWS emerges as the safer bet. Driven by a vast array of offerings and diversification into various sectors, Amazon appears primed for sustained growth and market dominance.

For more insights on the stock market, visit Barchart.

The author, Sushree Mohanty, has no direct or indirect positions in any securities mentioned. The information provided in this article is purely for informational purposes. Refer to Barchart’s Disclosure Policy for further details.

The views expressed herein solely belong to the author and not necessarily Nasdaq, Inc.