An Unraveling Tapestry: Costco

In the latest earnings report, Costco displayed a mixed bag of results sending its shares on a downward spiral. Despite narrowly missing revenue targets, the company managed to surpass bottom-line estimates. With a backdrop of challenging consumer spending habits, Costco’s success story is one many peers envy.

Impressively, Costco’s earnings for the quarter saw a 6.1% increase on a 1% revenue rise. The company’s same-store sales in the U.S. and Canada grew by 5.3% and 5.5%, respectively. Notably, Costco continues to shine in discretionary categories like jewelry, furniture, and tires, showing robust digital growth with a substantial uptick in comps by 19.5%.

The Tale of Valuation and Volatility

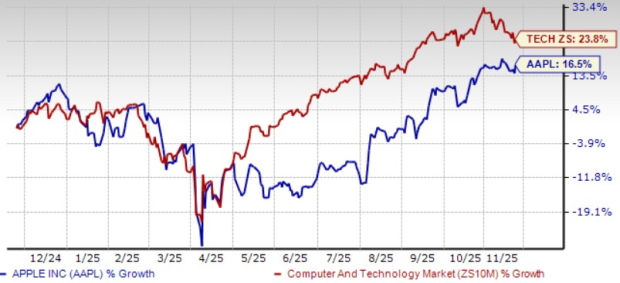

The decline in Costco shares post-results can be attributed to the stock’s lofty valuation after a stellar run this year. Outperforming both the Zacks Retail sector and the broader market, Costco saw a 34.7% surge versus 20.3% and 20.5% for its peers and the S&P 500, respectively. Trading at 50.8X forward 12-month consensus EPS estimates, Costco inhabits a premium valuation territory that demands flawless results. While the recent results were good, they lacked the pristine touch evidenced by the revenue slip.

A Glimpse into the Earnings Realm

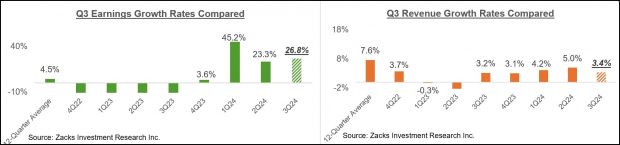

As we delve deeper into the earnings season, notable players such as FedEx, Oracle, and more contribute their narratives. These voices, including Costco, paint a preliminary picture for the 2024 Q3 earnings season. Out of the 14 S&P 500 members who have shared their results, 71.4% have beaten EPS estimates, with total earnings up by 26.8% and revenues higher by 3.4%.

Peering into the Future

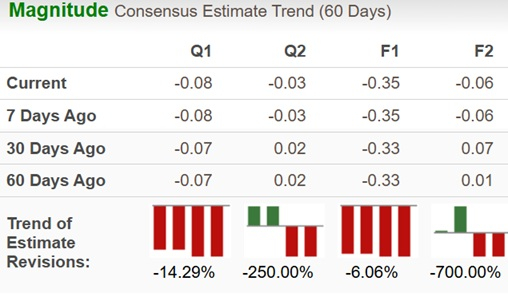

The broader scope of the S&P 500 earnings paints a promising picture of a +3.34% gain from the previous year, coupled with a 4.5% rise in revenues. Despite a recent uptick in negative revisions dampening Q3 expectations, a notable trend emerges. With 14 out of 16 sectors witnessing downward revisions, the Tech and Finance sectors stand as exceptions to this prevailing pattern, hinting at a nuanced financial landscape.

Beyond Q3: The Magnificent 7 and Tech Giants

As the spotlight shifts towards Tesla and the elite ‘Mag 7’, expectations run high for Q3 performances, with double-digit revenue growth on the horizon. Charting the future trajectory, investors eagerly await the unveiling of another chapter in the financial saga.

The Tech Sector Dominance: A Profitable Powerhouse in the S&P 500

The Mag 7 Phenomenon

Seven tech titans, known as the “Mag 7”, have been wielding significant influence, collectively representing 21.4% of all S&P 500 earnings for the quarter. This domination has played a crucial role in the surging Q3 earnings for the broader index.

Robust Growth Projections

Anticipated to soar by a staggering +30.7% this year on +10% higher revenues, the Mag 7 are positioned for tremendous gains. Looking ahead, the forecast remains bright with expected earnings to rise by +16.4% in 2025 and further +17.9% in 2026.

Market Dynamics

The U.S. stock market stands out in the OECD group, with the Tech sector comprising 39.4% of the S&P 500 index by market capitalization. Not only immensely profitable, this sector is experiencing robust and ongoing growth, underpinning its significance in the market landscape.

Earnings Comparison

Comparing the earnings contributions of the Zacks Tech sector with those of the Zacks Finance and Energy sectors reveals the unparalleled dominance and substantial impact of tech on the financial markets.

The Future Outlook

With the Tech sector expected to witness a remarkable +11.6% earnings growth in Q3 compared to the previous year and a projected +10.7% uptick in revenues, the future appears promising for tech investors. The charts demonstrating these growth expectations paint a compelling picture of the sector’s trajectory.

Seeking Investment Opportunities

Zacks Investment Research offers insights into potential investment opportunities within the tech sector, presenting 5 handpicked stocks set to potentially double in value. The report underscores the historical success of Zacks’ stock recommendations, providing investors with a chance to capitalize on lesser-known gems in the market.

Accessing Expert Analysis

For a comprehensive overview of the current earnings landscape and projections for upcoming periods, the weekly Earnings Trends report by Zacks Investment Research serves as a valuable resource. Investors can stay informed and make informed decisions based on expert analysis and market insights.