Deciphering the Best Investments Amidst the “Magnificent Seven”

The “Magnificent Seven” stocks, a term popularized by Bank of America analyst Michael Hartnett, have been at the forefront of the market’s meteoric rise. This elite cohort comprises Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla. While Tesla has faced challenges due to lower demand for electric vehicles, the remaining six have flourished. Nonetheless, not all of them maintain their allure for investors in the current landscape.

Evaluating the Undesirable Stocks in the Current Climate

Companies without a stake in generative artificial intelligence (AI) are now considered outsiders in this exclusive group. Apple’s delayed foray into AI and steep valuation have dented its investment appeal. Similarly, the downturn in the electric vehicle market casts a shadow on Tesla. Nvidia and Microsoft, though stalwarts in their own right, are grappling with lofty valuations compared to the more enticing prospects offered by Amazon, Meta, and Alphabet.

The Resurgence of Amazon’s Cloud Computing Arm

Amazon’s resurgence can be attributed to the robust performance of its cloud computing division, Amazon Web Services (AWS). AWS, despite contributing 18% to Q2 revenue, accounted for a staggering 64% of operating profit. The potential for AWS to mitigate Amazon’s premium valuation showcases the stock’s attractiveness amidst its profit-boosting measures.

Alphabet: The Undervalued Giant

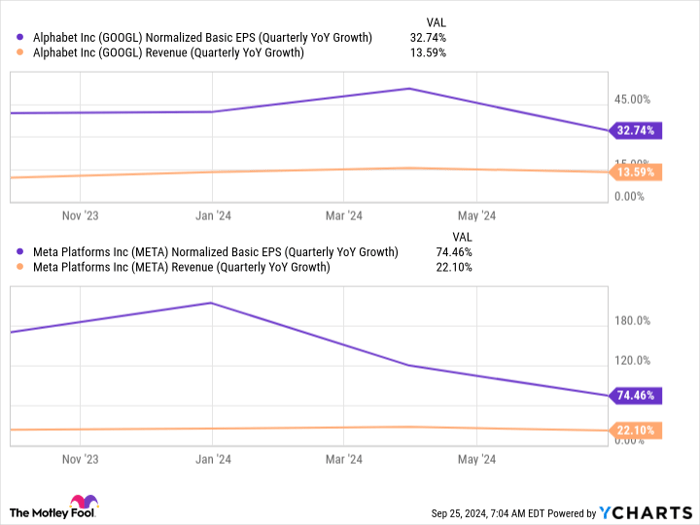

Alphabet, the parent company of Google, boasts a cost-effective investment proposition. With a robust ad business supporting its innovative ventures, Alphabet’s foreseeable growth trajectory is marked by firm but steady gains. An improving operating margin, coupled with aggressive stock repurchases, positions Alphabet as a stock primed for consistent earnings growth and relative outperformance in the market.

Meta Platforms: Accelerating Revenue and Profit Growth

Meta Platforms has quietly emerged as a powerhouse in revenue growth among its peers, trailing only Nvidia in its year-over-year performance. Fueled by ad revenue from platforms like Facebook and Instagram, Meta’s strategic investment in AI, stock buybacks, and dividend growth sets it on a trajectory akin to Alphabet’s but at an accelerated pace. Despite a marginally steeper valuation, Meta Platforms’ robust execution makes it a compelling investment case in today’s market scenario.

Looking Beyond the Horizon

While the Magnificent Seven have enjoyed a stellar run in 2024, discerning investors still find pockets of value within this esteemed group. As market dynamics shift, the foresight to invest in growth-oriented stocks like Amazon, Alphabet, and Meta Platforms could bear fruit in the months ahead.

Unraveling Investment Insights

Before diving into Amazon shares, it’s prudent to consider expert recommendations. The Motley Fool Stock Advisor team has curated a list of the top 10 stocks poised for substantial returns, with Amazon notably absent. Reflect on Nvidia’s inclusion in a past list and the substantial returns it would have yielded, underscoring the potential for informed investment decisions.

Stock Advisor, with its proven track record of outperforming the S&P 500, offers a roadmap for investors seeking exponential growth. The divergence in valuations and growth potential among these stocks invites contemplation on maximizing returns amidst market fluctuations.

*Stock Advisor returns as of September 23, 2024

John Mackey, Randi Zuckerberg, and Suzanne Frey have affiliations with the companies discussed. The insights shared are solely the author’s perspective and do not reflect the opinions of Nasdaq, Inc.