Insights from Jefferies

Fintel’s report on September 27, 2024, reveals that Jefferies embarked on covering V.F. (WBAG:VFC) with a Hold recommendation.

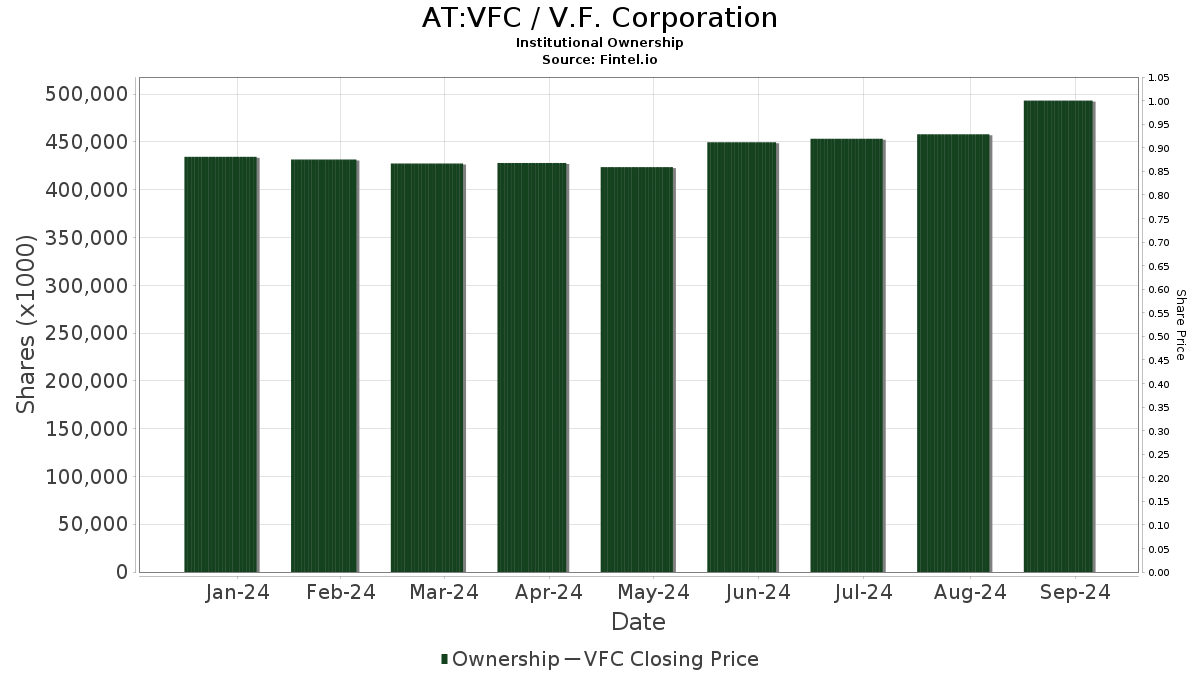

Understanding Fund Sentiment

A total of 1,071 funds or institutions have reported positions in V.F., signaling a decrease of 16 owners or 1.47% in the previous quarter. The average portfolio weight across all funds dedicated to VFC is 0.11%, marking an increase of 12.12%. Over the last three months, total shares owned by institutions surged by 12.91% to 495,886K shares.

Shareholder Actions

PNC Financial Services Group currently holds 76,117K shares, representing 19.56% ownership of the company. The firm reduced its position by 0.52% as per its prior filing, reflecting a decrease of 85.68% in its portfolio allocation in VFC over the previous quarter.

Dodge & Cox owns 42,557K shares, holding 10.93% ownership of V.F. In the prior filing, the firm reported 35,430K shares, marking an increase of 16.75%. Their portfolio allocation increased by 9.36% over the last quarter.

DODGX – Dodge & Cox Stock Fund possesses 27,402K shares, representing 7.04% ownership of the company. The firm reported 23,498K shares in its previous filing, showing an increase of 14.25%. Their portfolio allocation surged by 3.17% over the last quarter.

Northern Trust owns 21,505K shares, representing 5.53% ownership of V.F. Compared to its prior filing of 23,160K shares, this reflects a decrease of 7.69%. The firm slashed its portfolio allocation in VFC by 61.23% over the last quarter.

IJR – iShares Core S&P Small-Cap ETF holds 21,374K shares, amounting to 5.49% ownership of the company.

About Fintel and Investor Resources

Fintel offers a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Data provided includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Additionally, exclusive stock picks are generated by advanced, backtested quantitative models to enhance profits.

Explore more on Fintel by clicking to learn more. This article was originally published on Fintel.

Please note that the opinions expressed herein belong to the author and may not necessarily reflect those of Nasdaq, Inc.