GE HealthCare Technologies, Inc has crossed a major milestone with the FDA giving the green light to Flyrcado (flurpiridaz F 18), a cutting-edge positron emission tomography myocardial perfusion imaging (PET MPI) agent devised to spot coronary artery disease (CAD) efficiently.

Cad is a notorious killer in the United States, with over 695,000 casualties in 2021, according to Science Direct. The recent FDA stamp represents a leap forward in cardiac imaging, offering precision diagnostics for CAD.

Flyrcado, serving up top-notch diagnostic accuracy in CAD detection compared to the conventional SPECT MPI, is poised to make headway in reaching diverse patient cohorts. The approval marks a pivotal point in healthcare imaging by empowering accurate CAD diagnostics.

Inclination of GEHC Stock After Recent Development

With the announcement, GEHC shares showed promise, up by 0.1% to $92.1 in after-hours trading on Friday.

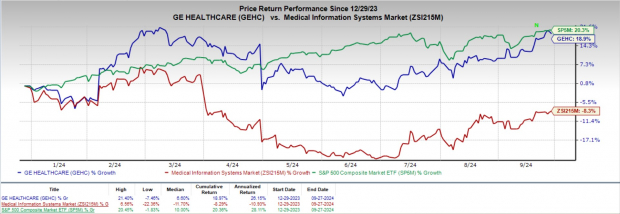

Year-to-date, GE Healthcare registers a solid 11.7% climb as opposed to a decline of 8.3% in the industry. During the same period, the S&P 500 has ascended by 20.3%.

Image Source: Zacks Investment Research

GE HealthCare is primed for a profitable run post the Flyrcado FDA approval. This feat underscores the company’s dedication to personalized healthcare and underscores its innovative prowess in the medical landscape. Market enthusiasm is expected to soar post-approval, potentially driving significant growth for GE Healthcare.

Importance of GEHC’s Flyrcado Pet Tracer FDA Nod

The approval of Flyrcado marks the premiere of the first F 18 PET MPI radiotracer for coronary artery disease, offering superior diagnostic efficiency over existing SPECT MPI.

Flyrcado’s extended half-life, more than 10 times longer than current radiotracers at 109 minutes, allows broad distribution, removing the need for on-site production and generator maintenance. This opens up possibilities for exercise stress testing with cardiac PET imaging for CAD, enabling a more holistic assessment of ischemia. The innovation extends PET MPI accessibility to hospitals and imaging centers, enhancing diagnostic accuracy, especially for complex cases like patients with a high BMI or women.

Flyrcado is poised to revolutionize nuclear cardiology by addressing unmet needs in CAD detection and offering a versatile, robust diagnostic solution.

In-depth Analysis of Flyrcado Pet Tracer

In 2017, GE HealthCare secured exclusive global commercialization rights for flurpiridaz F 18 from Lantheus.

Flyrcado, designed as a PET tracer for coronary artery disease, is slated for launch in the U.S. market in early 2025, with availability set to expand steadily.

Market Conditions Favoring GEHC

As per a report by Future Market Insights, the PET scanners market size reached $1.3 billion in 2023, projected to hit $2.1 billion by 2033 at a CAGR of 5.3%.

The upsurge is primarily fueled by the escalating disease prevalence, notably cancer and Alzheimer’s, necessitating advanced diagnostic tools in medical facilities. PET scanners play a pivotal role in detecting various cancers. Novel approaches such as hybrid imaging systems, SiPM technology, and TSPO PET tracers are set to further boost market expansion.

Zacks Rank & Top Selections

Presently, GE Healthcare holds a Zacks Rank #3 (Hold).

Some noteworthy stocks in the broader medical landscape include Universal Health Services UHS, ATI Physical Therapy (ATIP), and Aveanna Healthcare AVAH. Universal Health Services boasts a Zacks Rank #1 (Strong Buy), while ATI Physical Therapy and Aveanna Healthcare hold a Zacks Rank #2 (Buy) each. A comprehensive list of top Zacks #1 Rank stocks can be viewed here.

Universal Health Services has a projected long-term growth rate of 19%, with earnings consistently surpassing estimates in the last four quarters, averaging 14.58%.

Year-to-date, Universal Health Services has seen a rise of 41.1% compared to the industry’s growth of 34.8%.

ATI Physical Therapy’s earnings have exceeded estimates in each of the past four quarters, with an average surprise of 7.25%.

ATIP’s shares have increased by 5.5% year to date, in contrast to the industry’s 18.6% growth.

Aveanna Healthcare has consistently beaten earnings estimates in the last four quarters, with an average surprise of 47.5%.

AVAH’s shares have surged by 104.5% year to date, surpassing the industry’s 15.7% growth.

Zacks Identifies #1 Semiconductor Stock

Although it’s only 1/9,000th the size of NVIDIA, the semiconductor stock we’ve pinpointed has promising potential for growth despite the strong standing of NVIDIA. With expanding earnings and a growing clientele base, Its growth potential is vast.

The Future of Semiconductor Manufacturing: A Lucrative Investment Opportunity

Positioned for Growth

The semiconductor industry is on the brink of a monumental shift. With the rise of Artificial Intelligence, Machine Learning, and Internet of Things technologies, demand for semiconductors is skyrocketing. Global semiconductor manufacturing, valued at $452 billion in 2021, is projected to surge to a staggering $803 billion by 2028.

Seizing the Opportunity

Investors looking to capitalize on this explosive growth should keep a close eye on companies like Universal Health Services, Inc. (UHS), Aveanna Healthcare Holdings Inc. (AVAH), ATI Physical Therapy, Inc. (ATIP), and GE HealthCare Technologies Inc. (GEHC). These industry players are well-positioned to benefit from the surge in semiconductor demand.

An Industry in Transition

As the semiconductor landscape evolves, opportunities for exponential growth emerge. Companies that adapt to the changing technological landscape and invest in cutting-edge innovations stand to gain the most from this transformation. The recent FDA approval of Flyrcado for GE HealthCare Technologies Inc. is a testament to the industry’s potential for expansion.

Looking Ahead

Given the promising trajectory of the semiconductor industry, investors have a unique chance to benefit from this period of unprecedented growth. By staying informed about the latest trends and developments in the sector, individuals can make informed investment decisions that could yield substantial returns in the years to come.

Conclusion

With the semiconductor industry poised for exponential growth, now is the time to explore investment opportunities in this lucrative sector. By aligning investment strategies with the evolving technological landscape, investors can position themselves for success in an industry that shows no signs of slowing down.