Nvidia (NVDA), the AI powerhouse, stood resilient despite a recent market cap stumble post-Q2 earnings, only to bounce back with a 5% surge in the past week. Having grazed the $3 trillion milestone earlier, the future of NVDA sparks curiosity; my confidence in NVDA remains steadfast. It’s the daring AI frontrunner with limitless growth horizons, making it a prime target for investors.

NVDA’s AI Excellence Points to Long-Term Growth

Embraced by bigwigs like Microsoft, Alphabet, Meta, and Amazon, NVDA’s AI penetration continues to burgeon across industries worldwide. Enterprises are increasingly leveraging NVDA’s AI prowess, establishing a rosy outlook for NVDA stock. What sets NVDA apart is its all-encompassing AI infrastructure, a rarity among its global competitors.

As enterprises scurry to NVDA for their AI dreams, the company thrives as the premier provider of AI GPU processors and a complete end-to-end AI ecosystem, outshining its peers. Its collaborative ventures with top-tier businesses reinforce its dominance in the AI realm.

NVDA’s Persistent Margin Growth as an All-In-One AI Hub

Under CEO Jensen Huang’s visionary leadership, NVDA is shaping up to be an all-encompassing AI-fueled data center giant. This strategic metamorphosis allows NVDA to command premium prices, nurturing a steady growth trajectory in profit margins. While skeptics fear a slowdown in revenue growth ahead, NVDA’s remarkable shareholder reports paint a different picture.

Although NVDA’s stratospheric 217% data center revenue growth in fiscal 2024 may moderate to around 130% in 2025, these projections remain robust. With bullish estimates fueling my optimism, NVDA’s disruptive genitive AI potential is just starting to unfold, promising a bright future ahead.

Decoding Nvidia’s Impressive Quarterly Performance

Nvidia’s Q2 earnings in August 2024 were a spectacle, with adjusted earnings soaring to $0.68 per share, trumping analysts’ expectations. The 122% year-over-year revenue surge amounted to $30.04 billion, particularly driven by the Data Center division’s 154% growth to $26.3 billion. Despite investor qualms over subdued Q3 guidance, NVDA’s unwavering performance is a testament to its indomitable spirit in the tech realm.

Dispelling Concerns Over Insider Selling at NVDA

Insider selling, though a recent cause for NVDA’s stock decline, has been misconstrued. CEO Jensen Huang’s calculated sales were part of a predetermined plan, denoting no red flags. With Huang retaining a substantial stake in NVDA, his strategic sales should not deter investor confidence in NVDA’s bright prospects.

NVDA’s Valuation: Justified by Earnings Growth Prowess

Amidst debates on NVDA’s steep valuation, critics fail to acknowledge its forward P/E of 43x, undercutting some industry peers. With a history of outperformance and robust growth projections, NVDA’s valuation seems justified. Any market dips could be construed as buying opportunities, considering NVDA’s limitless AI potentials.

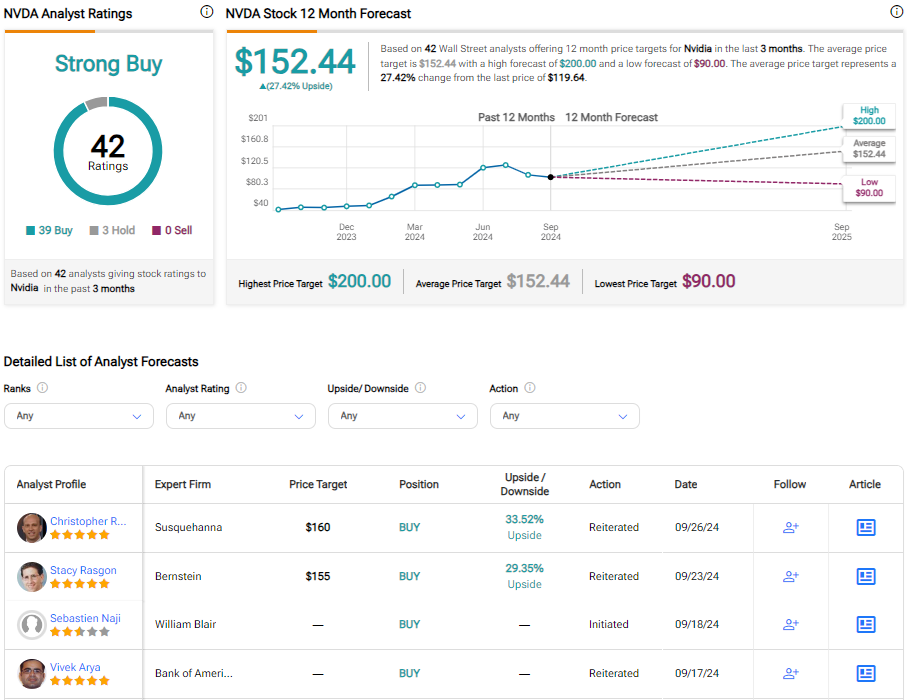

Analysts’ Verdict: A Resounding ‘Buy’ for NVDA Stock

With a chorus of 39 ‘Buys’ against three ‘Holds’ in the last quarter, analysts stamp a ‘Strong Buy’ on NVDA. The average target price of $152.44 suggests a promising 26% upside in the coming year, further spotlighting NVDA’s investment appeal.

Conclusion: NVDA — a Beacon of AI Excellence for Long-Term Investors

Despite recent market jitters, NVDA’s meteoric rise over the past year underscores its allure. Post-earnings volatility, largely profit-motivated, shouldn’t cloud NVDA’s future potential. Amidst economic uncertainties, dips remain buying chances for NVDA enthusiasts, given its enduring AI prowess.