The Quarterly Dividend Check

On February 28, 2024, Digital Realty Trust announced a regular quarterly dividend of $1.22 per share ($4.88 annualized), maintaining the previous payment rate.

To be eligible for the dividend, shares must be acquired before the ex-dividend date of March 14, 2024, with shareholders of record by March 15, 2024, scheduled to receive the payment on March 28, 2024.

Analyzing Dividend Yields

Currently priced at $153.71 per share, the stock offers a dividend yield of 3.17%. Over the past five years, historical data reveals an average yield of 3.60%, with the lowest at 2.65% and the highest at 5.44%. The standard deviation of yields stands at 0.62 from a sample size of 235.

The present dividend yield sits at 0.69 standard deviations below the historical mean, signifying a potential deviation from past trends.

Decoding Dividend Insights

Diving deeper, the company’s dividend payout ratio is 1.61, indicating the portion of income distributed as dividends. A ratio above one implies dipping into savings to sustain dividends, hinting at a risk. Meanwhile, a 3-Year dividend growth rate of 0.05% suggests a gradual increment in dividend payouts over time.

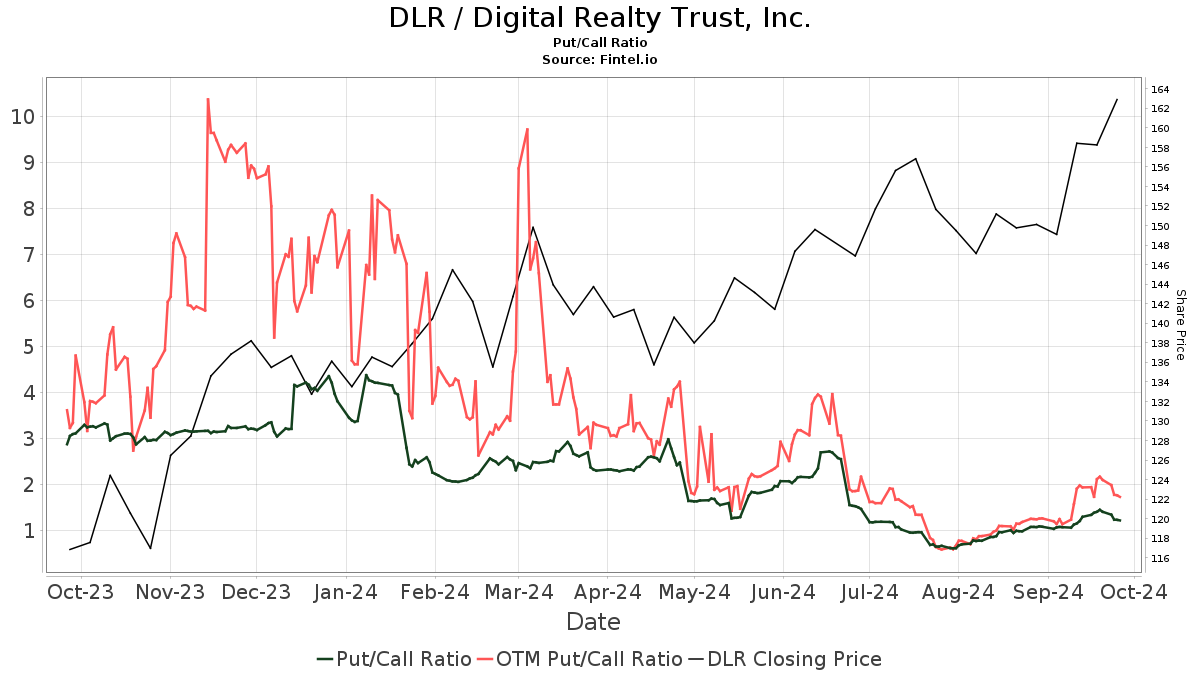

Exploring Fund Sentiment and Price Forecasts

As of the latest report, 1871 funds or institutions hold positions in Digital Realty Trust, marking a 5.71% increase in ownership from the previous quarter. The average portfolio weight of all these funds in DLR is 0.63%, showing a decline of 2.67%.

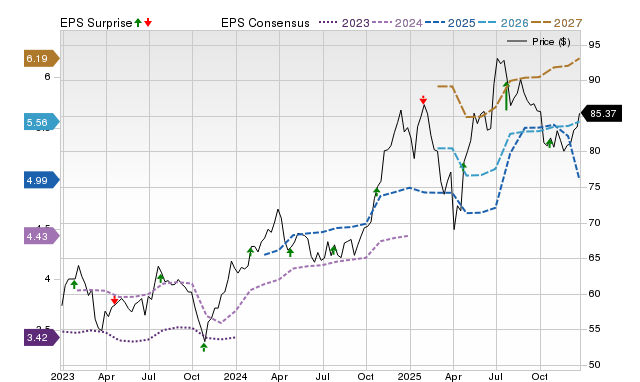

Analysts’ predictions point to a potential downside of 6.19% in the stock price, with estimates ranging from $101.00 to $178.50. The projected annual revenue for Digital Realty Trust is forecasted to increase by 0.86%, with a projected annual non-GAAP EPS of 1.57.

Insights into Shareholder Behavior

Several institutional stakeholders have altered their positions in the company. For instance, Cohen & Steers reduced its stake by 4.36%, while Norges Bank significantly increased ownership by 100.00%. Simultaneously, Vanguard Real Estate Index Fund decreased its shares by 2.30% but raised its allocation by 15.84% over the quarter. Bank Of America made a substantial cut of 17.18% in holdings and lowered its allocation by 77.19% in the same period.

Vanguard Total Stock Market Index Fund Investor Shares witnessed a marginal increase of 0.76% in shares held, with a slight uptick of 0.13% in portfolio allocation for DLR over the quarter.

Company Foundation and Services Provided

Digital Realty aims to support leading enterprises and service providers by offering data center, colocation, and interconnection solutions. Through its global data center platform, PlatformDIGITAL®, the company helps customers scale digital business while efficiently managing data gravity challenges across 290 facilities in 49 metros across 24 countries.

Additional resources include fundamentals, analyst reports, ownership data, fund sentiment, and more, making it a valuable investing platform for individuals and institutions alike.