Bitcoin’s Price Volatility Continues

The cryptocurrency market experienced turbulence as Bitcoin dropped below $60,000 after surpassing $63,000 post a Federal Reserve rate cut in September. Factors contributing to this decline include ongoing geopolitical tensions and consecutive outflows from U.S. spot Bitcoin ETFs.

Despite recent setbacks, Bitcoin remains resilient with a 44.6% year-to-date return, hinting at the potential for an upswing.

Opportunities in Cryptocurrency Stocks

Bitcoin’s rebound to nearly $61,200 signals positivity following statements by Federal Reserve Chairman Jerome Powell regarding a possible series of rate cuts. These remarks align with market expectations, fueling optimism for growth assets like cryptocurrencies.

Potential Winners in the Market

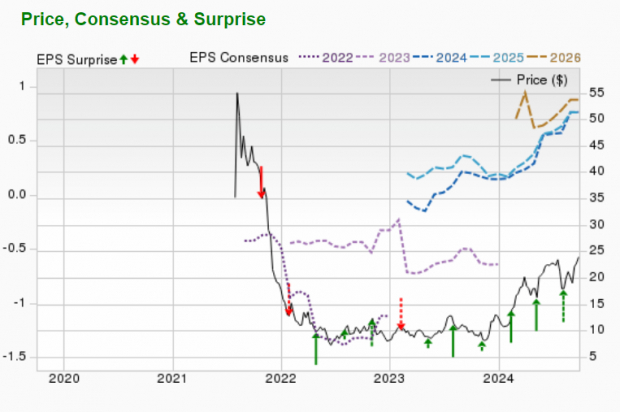

Robinhood Markets, Inc.

Robinhood, a U.S.-based financial services platform, shows promise with over 100% expected earnings growth this year. Its support for various cryptocurrencies positions it well for potential gains.

BlackRock, Inc.

BlackRock, a leading investment manager, demonstrates a resilient stance in the market with a 9.6% expected earnings growth rate. Its engagement in the Bitcoin ETF landscape portrays its progressive approach.

CME Group Inc.

CME Group stands out for offering options that enable buyers to trade cryptocurrency futures contracts, supporting market liquidity and innovation. The company’s 7.3% expected earnings growth rate indicates a favorable outlook.

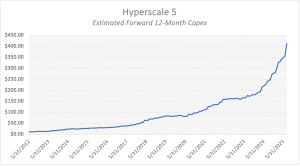

NVIDIA Corporation

NVIDIA, a global leader in visual computing technologies, presents impressive growth prospects with an expected earnings growth rate exceeding 100% this year. The company’s evolution towards AI-based solutions positions it as a key player in various tech sectors.

Unlock Future Potential

Discover the top stocks poised for significant growth, including those predicted to gain over 100%. Director of Research Sheraz Mian highlights a standout stock with innovative solutions and a rapidly expanding customer base, setting the stage for substantial returns in the market.

Stay ahead with expert insights from Zacks Investment Research on CME Group Inc. (CME), BlackRock, Inc. (BLK), NVIDIA Corporation (NVDA), and Robinhood Markets, Inc. (HOOD).

Read the full article on Zacks.com.