LifeSci Capital Recommends Outperform for Liquidia

LifeSci Capital started covering Liquidia (MUN:LT4) on October 3, 2024, with an Outperform rating. The average one-year price target for Liquidia as of December 21, 2023, is 13.55 €/share, indicating a potential 46.26% upside from its current closing price of 9.26 €/share.

Financial Projections for Liquidia

Based on forecasts, Liquidia is expected to achieve an annual revenue of 37 million euros, reflecting a substantial 148.32% increase. The projected annual non-GAAP EPS stands at -1.19.

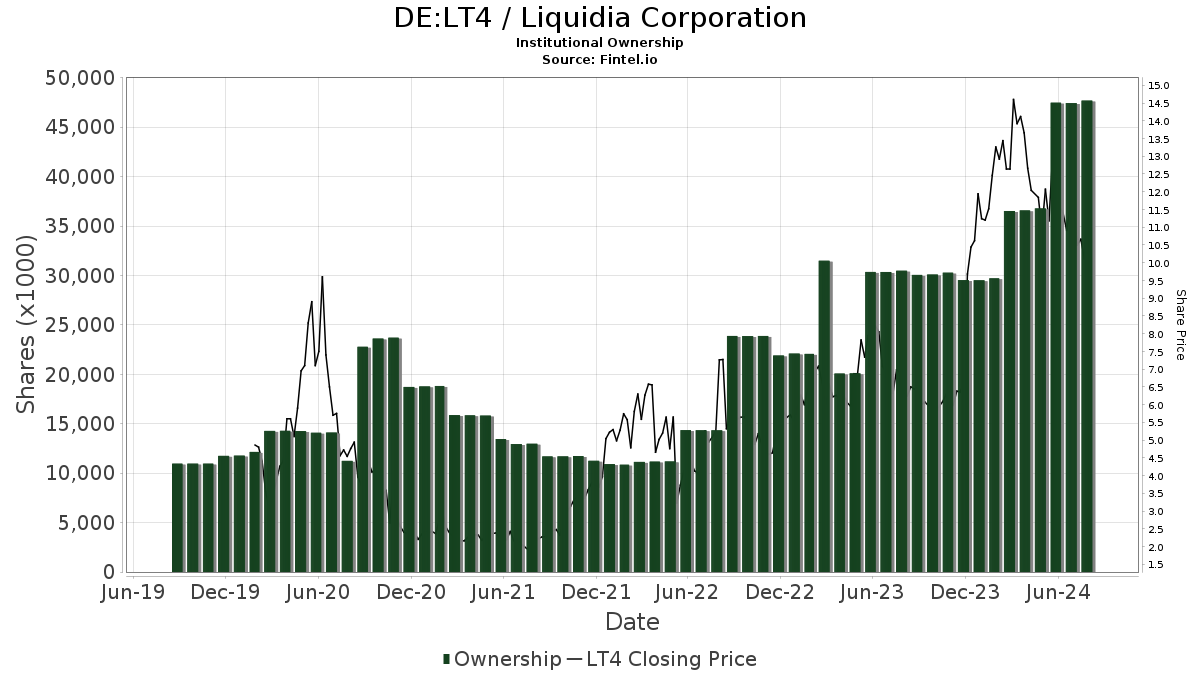

Ownership and Fund Sentiment

Currently, 266 funds or institutions hold positions in Liquidia, marking a 1.92% rise in the last quarter. The average portfolio weight of all funds dedicated to LT4 has increased by 20.47% to 0.40%. Institutional shares have increased by 2.12% in the last three months to a total of 47,749K shares.

Major Shareholders

Key shareholders include Caligan Partners with 10,361K shares (12.28% ownership), Patient Square Capital with 7,183K shares (8.51% ownership), Findell Capital Management with 2,400K shares (2.84% ownership), Farallon Capital Management with 2,055K shares (2.44% ownership), and VTSMX – Vanguard Total Stock Market Index Fund Investor Shares with 1,883K shares (2.23% ownership).

Findell Capital Management, in a previous filing, reported an increase of 12.29% in shares and a 14.66% decrease in portfolio allocation. VTSMX also reported a rise in shares by 18.58% and a 2.83% decrease in portfolio allocation over the last quarter.

Fintel provides a thorough investing research platform for various market participants, offering comprehensive data and exclusive stock picks powered by advanced models for better profitability.

For more insights, visit Fintel.

The views expressed here are those of the author and not necessarily Nasdaq, Inc.