PepsiCo Q3 Expectations

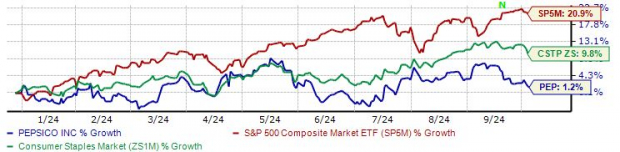

PepsiCo (PEP) shares have only risen 1.2% in 2024, staying flat as investors have been favoring technology stocks over consumer staples. Analysts have lowered Q3 earnings estimates by 2%, expecting a 2.2% growth from last year.

Revenue predictions also dipped slightly by 1%, anticipating a 1.9% increase from the previous year. The company’s revenue growth has slowed recently, as shown in the chart below.

Image Source: Zacks Investment Research

PepsiCo’s current forward 12-month earnings valuation at 19.6X is lower than its historical median of 23.6X, reflecting investors’ tempered growth expectations.

Should You Invest in PepsiCo?

Analysts aren’t overly optimistic about PepsiCo’s upcoming report, having revised earnings and sales expectations downward. Although the stock hasn’t performed well this year, positive guidance could reverse its fortunes.

Given the cautious outlook, it might be prudent to observe the results before making a move. Considering PepsiCo’s defensive nature, any underperformance may not lead to a significant drop in its stock value.

For further insight on PepsiCo (PEP), you can access a free stock analysis report here.

Read more about this topic on Zacks.com here.