Key stock indices show gains today: the S&P 500 Index ($SPX) (SPY) is up by 0.76%, the Dow Jones Industrials Index ($DOWI) (DIA) rises by 0.07%, and the Nasdaq 100 Index ($IUXX) (QQQ) soars by 1.25%.

Tech Stocks Drive Market Uptick

Stocks are rising today, particularly the Nasdaq 100, hitting a 1-week high fueled by robust performance from megacap tech companies. Comments from New York Fed President Williams on the economy’s soft landing and a decrease in the US Aug trade deficit to a 5-month low are boosting investor sentiment.

Market Influences

Higher T-note yields are impacting stocks negatively, with the 10-year T-note yield reaching a 2-1/4 month high. Hawkish comments from St. Louis Fed President Musalem and a drop in crude oil prices are also weighing on the market. Geopolitical tensions in the Middle East add further uncertainty.

Fed and Economic Updates

The US Aug trade deficit reduced to $70.4 billion, indicating positive signs for Q3 GDP. Fed officials emphasize the importance of balancing inflation concerns with sustainable employment growth. Market attention shifts to Thursday’s US consumer price data and upcoming quarterly earnings reports from major US banks.

Global Market Movement

Overseas markets show mixed results, with the Euro Stoxx 50 down by 0.47%, China’s Shanghai Composite hitting a 2-3/4 year high, and Japan’s Nikkei Stock 225 dropping by 1.00%.

Interest Rates and Bonds

Today, the 10-year T-note yield climbs to 4.039%, impacting T-notes adversely. European government bonds see a decline after an initial rise. Notably, German Aug industrial production surpasses expectations, indicating economic growth.

Stock Highlights

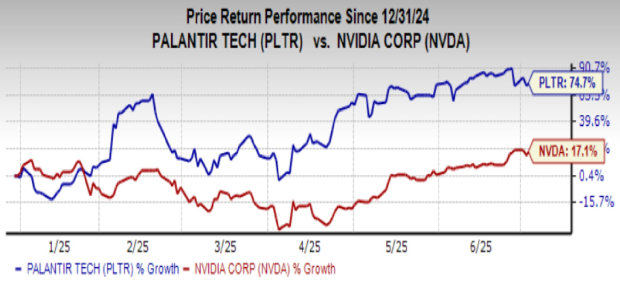

Megacap technology firms like Netflix (NFLX), Tesla (TSLA), and Apple (AAPL) lead market gains. Other notable movers include Palo Alto Networks (PANW) and Nvidia (NVDA). Energy stocks suffer due to falling crude prices, impacting companies like Marathon Petroleum (MPC) and APA Corp (APA).

Market Reactions

US-listed Chinese stocks experience a downturn following China’s economic planning agency’s lack of major stimulus announcements. Mining stocks, including Freeport McMoran (FCX), are hit by falling copper prices. Stocks like American Express (AXP) and Constellation Brands (STZ) face downgrades, affecting market sentiment.

Upcoming Earnings Reports

Earnings reports scheduled for October 8, 2024, include companies like Accolade Inc (ACCD) and PepsiCo Inc (PEP), drawing investor attention.

Stay updated with the latest stock market news on Barchart.