Zoom’s Impressive Growth Amidst Sector Declines

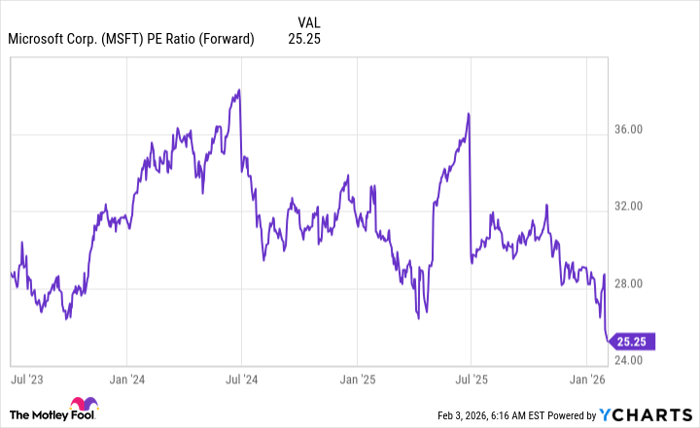

Zoom Video Communications (ZM) has outperformed the Zacks Computer and Technology sector with a 19.9% increase in share value over the past three months, while sector peers like Cisco Systems (CSCO), Microsoft (MSFT), and Alphabet (GOOGL) have experienced declines.

During the same period, Cisco returned 14.7%, while Microsoft and Alphabet decreased by 10.8% and 13.8%, respectively. The industry itself saw a modest 5.3% appreciation.

Zoom’s success is attributed to its global clientele expansion, improved Workplace solutions, and seamless integration of AI in its software.

Zoom Focuses on Enhancements for Workplace Solutions

Zoom Video is continuously enhancing its software offerings to strengthen its Zoom Platform. With 39,333 customers in the second quarter of fiscal 2025, contributing over $100,000 in revenues, Zoom has shown steady growth and customer loyalty.

The company’s efforts in improving user interface, adding capabilities to Zoom Meetings and Zoom Team Chat, and introducing new features like the Zoom Webinar for up to 1 million attendees highlight its commitment to innovation and scalability.

AI Integration Boosts Zoom’s Market Reach

Zoom’s recent introduction of new AI Companion capabilities, aimed at enhancing meeting summaries and productivity, showcases its commitment to leveraging AI technology. The company’s freemium business model has been successful in attracting customers, with over 1.2 million accounts benefiting from these AI features.

Zoom’s AI Companion offers a range of productivity tools like meeting summaries, chat composition, and live translation, ensuring a seamless user experience across all collaboration platforms.

Positive Outlook for Fiscal 2025

Zoom Video expects strong financial performance in fiscal 2025, with revenue projections between $4.63 billion to $4.64 billion and non-GAAP earnings estimated to be $5.29 to $5.32 per share. Additionally, free cash flow is forecasted to be between $1.58 billion to $1.62 billion for the fiscal year.

With earnings consistently exceeding estimates in the past four quarters, Zoom’s positive outlook and strategic investments make it an attractive option for investors.

Is Zoom a Buy?

While Zoom shares are currently deemed overvalued, its expanding product offerings, AI integration, and international presence make it a promising investment. With a Zacks Rank #2 (Buy), now might be the opportune time for investors to consider adding Zoom Video Communications to their portfolio.

Discover Promising Stocks

Investors seeking potential early price pops should explore the Zacks list of 7 Best Stocks for the Next 30 Days, carefully selected by experts for their growth potential and market performance.

To read this article on Zacks.com click here.