DaVita’s Stock Performance and Market Position

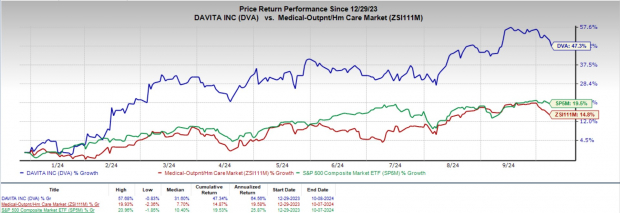

DaVita, Inc. (NYSE: DVA) has outperformed the market this year, with a remarkable 47.3% increase in its share price. Comparatively, the healthcare industry saw a growth of 14.8%, while the S&P 500 composite rose by 19.5% during the same period.

As a top provider of dialysis services in the U.S., DaVita caters to patients with chronic kidney failure. The company operates dialysis centers and offers various medical services, focusing primarily on kidney care and disease management.

Driving Forces Behind DaVita’s Success

DaVita’s exceptional performance can be attributed to its robust dialysis and lab services. The company’s patient-centric approach and diverse treatment models have fueled its growth. Moreover, strategic partnerships in kidney health have enhanced patient care and strengthened its market presence in countries like Brazil, Colombia, Chile, and Ecuador.

DaVita’s solid second-quarter results in 2024, along with an optimistic business outlook and raised earnings projections, have attracted investor interest. The company is expanding globally through acquisitions and partnerships, positioning itself for sustainable growth.

Potential Risks and Financial Projections

Despite its success, DaVita faces challenges if patients transition from private insurance to government programs, affecting its profitability due to lower reimbursement rates. However, the company’s estimated earnings for 2024 and 2025 signal a positive outlook, with projected improvements year-over-year.

Analysts forecast a steady rise in DaVita’s revenues for 2024 and 2025, indicating consistent growth momentum for the company.

Comparative Analysis and Investment Climate

Other top-performing stocks in the medical sector include Rockwell Medical (NASDAQ: RMTI), Quest Diagnostics (NYSE: DGX), and RadNet (NASDAQ: RDNT). Each company’s unique strengths position them favorably in the market, offering investors a diverse range of investment opportunities.

Rockwell Medical, Quest Diagnostics, and RadNet exhibit strong earnings performance and consistent stock growth, showcasing potential for long-term investment success.

The healthcare industry’s upward trajectory, coupled with DaVita’s strategic initiatives, underscores a promising outlook for the company and investor confidence in its future growth prospects.