Implied Analyst Target Price Reveals Positive Outlook

Financial analysts have pegged the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) with an implied target price of $165.66 per unit, signaling a potential 19% upside from its current trading price of $139.21 per unit. Notable holdings like Talos Energy Inc, Civitas Resources Inc, and Kosmos Energy Ltd are also poised for substantial growth according to analysts.

Stock Performance Trends and Target Prices

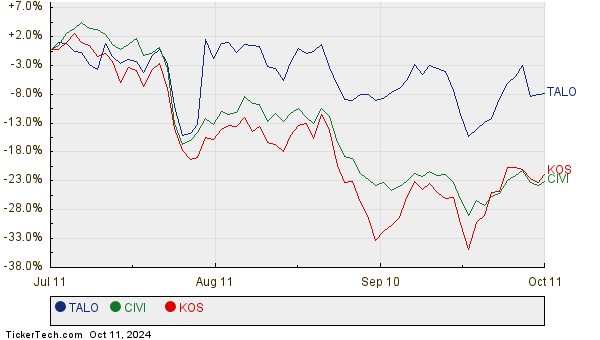

A comparison among these holdings shows Talos Energy Inc with a 60.11% upside, Civitas Resources Inc with a 54.96% potential growth, and Kosmos Energy Ltd expected to reach a target price 51.01% higher than their current values. The historical price chart of these stocks over the past twelve months further illustrates their potential growth.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Oil & Gas Exploration & Production ETF | XOP | $139.21 | $165.66 | 19.00% |

| Talos Energy Inc | TALO | $10.93 | $17.50 | 60.11% |

| Civitas Resources Inc | CIVI | $53.66 | $83.15 | 54.96% |

| Kosmos Energy Ltd | KOS | $4.47 | $6.75 | 51.01% |

Interpreting Analyst Targets

The analysts’ optimistic outlook can be a positive sign for the potential growth of these stocks. However, investors should investigate further to understand the justification behind these targets. While high target prices can signify future growth prospects, they may also indicate a need for an update if based on outdated information. These questions highlight the importance of conducting thorough research before making investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Cheap Dividend Stocks

ESS Next Dividend Date

BKR DMA

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.