JPMorgan and Wells Fargo Shine Amid Economic Outlook Uncertainty

Positive Earnings Reports Boost Market Confidence

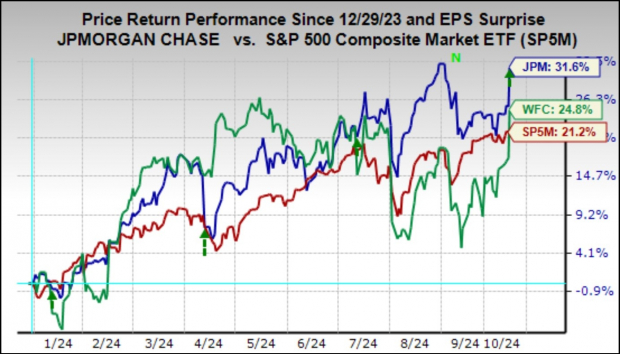

The market responded positively to the latest quarterly earnings from JPMorgan (JPM) and Wells Fargo (WFC). While Wells Fargo fell short of revenue expectations, JPMorgan surpassed both earnings and revenue forecasts. Key to this market reaction were the banks’ insights into business trends and their assessment of the economy’s strength.

Steady Consumer Spending Despite Challenges

Despite some concerns regarding the economy, both banks reported a stable spending environment, particularly at the middle and high-income levels. Their optimistic outlook helped counter any fears arising from discussions about potential delays in the Federal Reserve’s easing measures.

Financial Results Overview for JPMorgan

JPMorgan’s third-quarter earnings showed a decline of 1.9% from the previous year, despite a 7% increase in revenues. The bank’s results benefitted from stronger-than-expected net interest earnings. Although guidance for the upcoming quarter suggests a cautious approach, the market reacted favorably following the positive results.

Investment Banking Gains and Market Activity

Within JPMorgan’s investment banking division, fees surged over 29% in Q3, driven by strong activity in debt capital markets. Industry analysts are hopeful that these developments indicate a rebound in deal-making post-election, especially with the Fed easing its monetary stance.

Overall Finance Sector Performance

As of now, 15.6% of the finance sector’s market capitalization within the S&P 500 index has reported earnings, reflecting a 0.1% dip in total earnings this year on a 4.7% revenue increase. Notably, all the firms surpassed their EPS estimates, while 75% exceeded revenue expectations.

Upcoming Earnings Reports

In the coming week, earnings reports will accelerate, with over 100 companies expected to announce their results, including 40 S&P 500 members. The financial sector will be prominently featured, as well as major names from various industries, such as Procter & Gamble, Netflix, Johnson & Johnson, Schlumberger, CSX Corp., and United Airlines.

Q3 Earnings Snapshot

So far, results from 29 S&P 500 members show a 7.1% earnings increase year-over-year with a 2.8% rise in revenues. Approximately 72.4% have beaten EPS estimates and 65.5% have surpassed revenue expectations. Historical context of these figures highlights the fluctuating nature of Q3 earnings across previous years.

Industry-Wide Earnings Outlook

When combining reported figures with forthcoming estimates, overall earnings growth for the S&P 500 is projected to be around 3.6% this quarter, following a 10.2% increase in the previous period. Current projections indicate that total earnings may reach an all-time record this quarter.

Long-Term Earnings Projections

This year anticipates a 7.7% growth in earnings, which increases to 9.6% when excluding the energy sector. Future forecasts predict continued double-digit earnings growth for 2025 and 2026.

For a comprehensive breakdown of the earnings landscape and future projections, see our weekly Earnings Trends report >>> A Detailed Analysis of Q3 Earnings Expectations

Explore Zacks’ Recommendations

We’re serious about providing value.

Years ago, we surprised our members with a 30-day access offer to all our picks for just $1. There’s no obligation beyond this minimal cost.

Join thousands who have embraced this opportunity to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which successfully closed 228 positions with double- or triple-digit gains in 2023 alone.

Want the latest recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double today.

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.