Apple Stocks: Time to Buy or Wait?

Apple (NASDAQ: AAPL) has regained its position as the world’s most valuable stock with a market capitalization of $3.4 trillion. While the company’s growth isn’t accelerating at a rapid pace, many investors remain confident about its future. The recent iPhone launch and the introduction of Apple Intelligence have fueled optimism for potential revenue increases ahead.

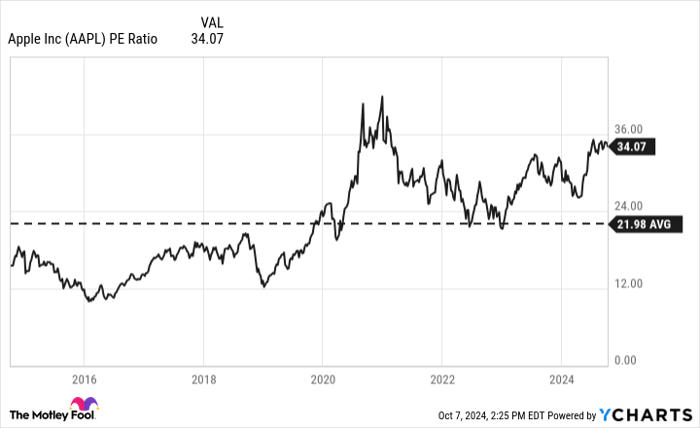

With Apple stock trading at a high level and carrying a price-to-earnings (P/E) ratio of 34, some wonder if it’s wise to hold off on purchasing shares until a dip occurs, or if adding Apple stock to their portfolios is a savvy move regardless of current valuations.

Why Buying Apple’s Stock Might Make Sense Now

Apple has several upcoming factors that could boost its sales. Many customers have delayed phone upgrades, but the latest iPhone, featuring new artificial intelligence (AI) capabilities, may prompt those consumers to finally make the switch. Initial sales numbers suggest strong demand, even if the phone’s features haven’t sparked overwhelming excitement.

Some Apple Intelligence features won’t debut until next year, which could actually renew interest in the iPhone in 2025. This delayed implementation might remind potential buyers of the benefits of upgrading. Additionally, certain AI functionalities could introduce subscription options, adding a new revenue stream and enhancing Apple’s services income.

For long-term investors, the prospects of AI innovations signal significant potential for profit. Historically, Apple has managed to attract customers without revolutionary updates, relying instead on incremental improvements. The anticipation surrounding AI enhancements could drive sales for the next model, the iPhone 16. Getting in on the stock before that surge could mean enjoying substantial returns.

Reasons to Consider Waiting Before Buying

Currently, Apple trades at a high P/E multiple of 34, suggesting that much of the anticipated growth is already factored into its stock price. It is unusual to see a company growing at only 5% carry such a high valuation. This premium indicates that investors expect considerable growth in the near future, meaning that anticipated boosts from AI and new iPhone sales may already be incorporated into the stock’s worth.

AAPL PE Ratio data by YCharts

Despite strong early sales and preorders for the iPhone 16, these numbers are still rough estimates. Investors may find it wise to wait for the next earnings report before forming conclusions about the phone’s impact on future growth. Consumer excitement leading up to the new launch may have inflated initial sales figures, as buyers often rush to acquire products before fully understanding their capabilities.

Even a strong company like Apple can feel the effects of an economic downturn. A recession could lead consumers to defer upgrades if the new iPhone falls short of expectations. If sales do not meet predicted numbers, a decline in Apple’s stock could swiftly follow.

Is It Time to Buy Apple Stocks?

Apple remains a solid investment, but purchasing now might not be advisable. The current high valuation means expectations for forthcoming results are elevated, increasing the likelihood of a potential stock correction. While holding Apple stock for years could still yield positive results, several other growth stocks at more attractive valuations could offer better opportunities than Apple at this moment.

Where to Invest $1,000 Today

Our analysts often uncover valuable stock insights. For instance, Stock Advisor boasts a total average return of 797%, significantly outpacing the S&P 500’s 170% average return.*

They recently announced their top picks, which include the 10 best stocks for investors right now… and Apple is part of the list, but it’s worth noting there are nine other potentially overlooked winners.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.