Understanding Wall Street’s Take on Teradyne: What Investors Need to Know

Many investors rely on Wall Street analysts’ recommendations when deciding whether to Buy, Sell, or Hold a stock. However, do these ratings genuinely influence stock prices? Let’s delve into the insights regarding Teradyne TER to evaluate the weight of these brokerage recommendations.

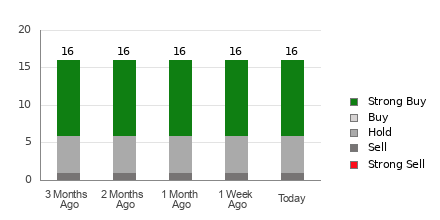

Currently, Teradyne has an average brokerage rating (ABR) of 1.81, determined from 16 brokerage firms’ assessments. This score, which falls between Strong Buy and Buy, indicates an overall positive sentiment towards the stock.

Of the 16 recommendations that contribute to this score, 10, or 62.5%, are classified as Strong Buy.

Current Trends in Brokerage Recommendations for Teradyne

While the ABR suggests that investors should consider buying Teradyne, relying solely on this information may not be wise. Research indicates that brokerage recommendations often fail to help investors select stocks that will see the most price appreciation.

The reason for this challenge lies in the potential bias of brokerage firms. Their analysts sometimes hold a positive bias in order to serve their firms’ interests. For every “Strong Sell” rating, there are typically five “Strong Buy” recommendations, suggesting a skewed outlook.

This means the interests of brokerage firms and retail investors may not always align, and their ratings could mislead investors regarding a stock’s potential trajectory. Consequently, these recommendations should be used primarily to support your own research or analytical methods.

Utilizing Zacks Rank, a unique stock rating system with a strong record, categorizes stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This system effectively indicates future stock price direction, especially when paired with ABR data.

Distinguishing Between Zacks Rank and ABR

Despite both being rated on a scale from 1 to 5, Zacks Rank and ABR represent different evaluation methods.

The ABR is based solely on brokerage ratings, often presented as a decimal (e.g., 1.28). In contrast, Zacks Rank is a quantitative model focused on earnings estimate revisions and is expressed as whole numbers from 1 to 5.

Brokerage analysts tend to be overly optimistic in their assessments. Their ratings frequently reflect a more favorable scenario than warranted due to conflicts of interest, leading to more confusion than guidance for investors.

Zacks Rank, by contrast, relies on actual earnings estimate revisions, which have been shown to correlate strongly with near-term stock price changes, according to empirical studies.

Another significant difference lies in the timeliness of the information. ABR ratings might lag, while Zacks Rank adjusts quickly to changes in analysts’ earnings estimates, keeping it relevant for predicting stock price movements.

Should You Consider Investing in Teradyne?

For Teradyne, the Zacks Consensus Estimate for earnings this year remains at $3.02, unchanged over the past month. This steady outlook from analysts points to a likelihood that the stock will perform in line with the overall market shortly.

The status of the consensus estimate and other related factors have contributed to Teradyne receiving a Zacks Rank of #3 (Hold), suggesting caution even with the positive ABR.

In summary, while Teradyne has a favorable average brokerage recommendation, potential investors should proceed with caution and verify their own insights.

To read this article on Zacks.com click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.