Understanding Celestica’s Stock Recommendations: Brokers’ Insight vs. Market Reality

When deciding on a stock, many investors rely on insights from Wall Street analysts. But how much weight should these recommendations really carry in investment decisions?

Let’s examine what brokerage firms are saying about Celestica CLS as we explore the reliability of their recommendations and how you can make informed choices.

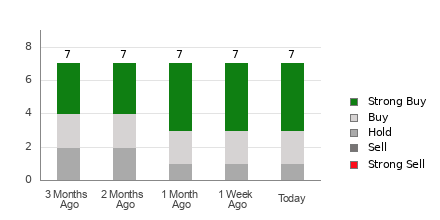

Celestica has an average brokerage recommendation of 1.57 on a scale of 1 to 5, which ranges from Strong Buy to Strong Sell. This average is determined by seven brokerage firms, and a score of 1.57 suggests a leaning towards Strong Buy, as it falls between the two categories.

From the seven recommendations contributing to this average, four are Strong Buy and two are Buy. This means that 57.1% of the recommendations are Strong Buy and 28.6% are Buy.

Understanding Brokerage Recommendations for CLS

While the average brokerage rating suggests buying Celestica, it is crucial to approach investment decisions cautiously. Research indicates that brokerage recommendations often do not reliably guide investors to the best performing stocks.

Why is this the case? Analysts tend to exhibit a strong positive bias in their ratings due to the interests of the brokerage firms. For every “Strong Sell” recommendation made, there are typically five “Strong Buy” endorsements.

This discrepancy suggests that brokerage firms’ interests may not align with those of individual investors, making it challenging to predict actual stock price movements. Consequently, it may be wiser to use these ratings to confirm personal research rather than as the sole basis for investment choices.

A more effective approach is to utilize tools such as Zacks Rank, which evaluates stocks on a scale from #1 (Strong Buy) to #5 (Strong Sell). This system has an impressive track record for predicting stocks’ future price performances, particularly by examining earnings estimate revisions.

Distinguishing Between ABR and Zacks Rank

Though both Zacks Rank and the average brokerage recommendation (ABR) utilize a similar 1 to 5 scale, they measure different factors.

ABR is based strictly on brokerage recommendations, presented in decimal form (like 1.28). In contrast, the Zacks Rank is a quantitative model focusing on changes in earnings estimates, displayed in whole numbers.

Brokerage analysts often deliver overly optimistic ratings because of their firms’ interests, resulting in a misrepresentation of stock potential quite frequently. Their tendency to assign more favorable ratings can mislead investors.

In contrast, the Zacks Rank relies on actual earnings estimate revisions, which have been shown to correlate strongly with stock price movements in the short term. This model maintains a balance across all stocks based on brokerage-backed earnings estimates.

Additionally, the ABR may not always reflect the most current data. In contrast, earnings estimates updated by analysts are quickly incorporated into the Zacks Rank, making it a timelier indicator of future stock price direction.

Assessing Celestica as an Investment

For Celestica, the Zacks Consensus Estimate for this year remains steady at $3.65, unchanged over the past month.

Analysts’ consistent outlook on Celestica’s earnings, as evidenced by the stable consensus estimate, suggests the stock might follow the broader market trends in the near future.

The slight shift in the consensus, along with additional earnings-related factors, has generated a Zacks Rank of #3 (Hold) for Celestica.

Given this context, investors may want to exercise caution in relying solely on the positive ABR for Celestica.

To read this article on Zacks.com, click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.