Keybanc Gives Tenet Healthcare an “Overweight” Rating, Forecasting Strong Growth

Fintel recently reported that on October 11, 2024, Keybanc initiated its coverage of Tenet Healthcare (NYSE:THC) with an Overweight rating.

Analyst Price Forecast Indicates Significant Upside Potential

As of September 25, 2024, the average one-year price target for Tenet Healthcare stands at $178.38 per share. The forecasts vary, with a low of $154.53 and a high of $206.85. This average price target suggests a potential increase of 14.48% from its most recent closing price of $155.82 per share.

Company Financial Projections and Fund Sentiment

Projected annual revenue for Tenet Healthcare is expected to reach $21,258 million, marking an increase of 1.66%. Additionally, the projected annual non-GAAP earnings per share (EPS) is $7.40.

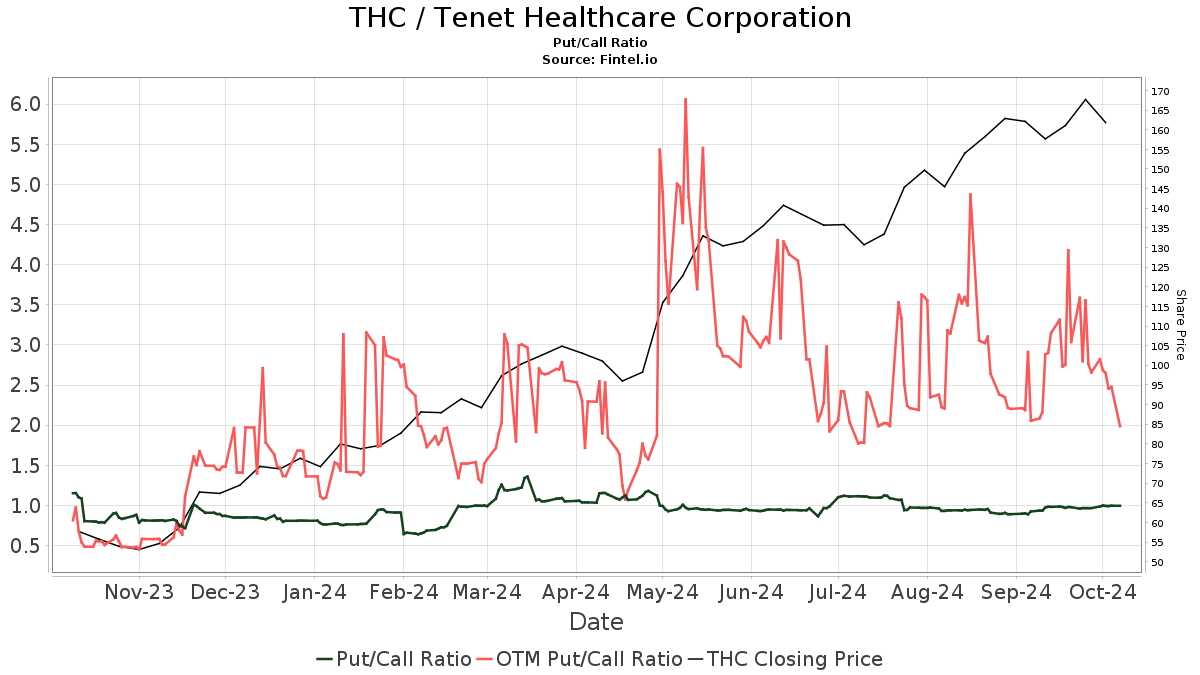

A total of 1,133 funds and institutions have reported positions in Tenet Healthcare, an increase of 158 (16.21%) from the last quarter. The average portfolio weight of all funds allocated to THC is currently 0.41%, reflecting a rise of 7.27%. However, the total shares owned by institutions has decreased by 2.48% over the past three months, amounting to 103,467K shares.  The current put/call ratio for THC is 0.82, indicating investor optimism.

The current put/call ratio for THC is 0.82, indicating investor optimism.

Institutional Shareholder Activity

Price T Rowe Associates holds 8,021K shares in Tenet, which represents 8.37% ownership. This marks a rise from their previous holding of 7,915K shares, an increase of 1.32%. The firm also boosted its portfolio allocation in THC by 25.21% in the last quarter.

Invesco holds 5,651K shares, amounting to 5.90% ownership. However, this reflects a decrease from their prior holding of 5,750K shares, a decline of 1.75%. Their portfolio allocation in THC has sharply reduced by 89.22% over the last quarter.

Glenview Capital Management currently owns 4,666K shares, which yields a 4.87% ownership stake. This represents a notable decrease from their previous 6,327K shares, equal to a drop of 35.61%. Interestingly, despite this reduction, the firm slightly increased its portfolio allocation in THC by 5.05% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 3,090K shares, equivalent to 3.22% ownership. Their previous filing reported 3,156K shares, indicating a 2.12% decrease. Nonetheless, they increased their portfolio allocation in THC by 20.52% last quarter.

Additionally, the iShares Core S&P Mid-Cap ETF holds 3,038K shares for 3.17% ownership, down from 3,162K shares, which is a 4.06% decrease. Committed to THC, they boosted their portfolio allocation by 24.51% over the last quarter.

About Tenet Healthcare

Tenet Healthcare Corporation is a diversified healthcare services provider based in Dallas, employing 110,000 people. The organization operates an extensive care network, including 65 hospitals and around 550 other facilities such as surgical hospitals, ambulatory surgery centers, urgent care centers, and clinics. Tenet also manages Conifer Health Solutions, which offers revenue cycle management and value-based care services to a variety of clients, including hospitals and health systems. Tenet aims to deliver quality, compassionate care in the communities it serves.

Fintel is recognized as a leading investment research platform designed for individual investors, traders, financial advisers, and small hedge funds.

Our comprehensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Our exclusive stock recommendations are driven by advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.