Keybanc Backs UnitedHealth Group with Overweight Rating

Analyst Prediction Hints at Potential Growth

Fintel reports that on October 11, 2024, Keybanc initiated coverage of UnitedHealth Group (XTRA:UNH) with a Overweight recommendation.

The average one-year price target for UnitedHealth Group, as of September 25, 2024, is set at 573.51 €/share. Estimates vary, ranging from a low of 517.25 € to a high of 643.76 €. This average suggests a 4.48% increase from its latest reported closing price of 548.90 € / share.

For further insights, check our list of companies with the highest price target upsides.

The projected annual revenue for UnitedHealth Group stands at 390,531 million euros, marking a rise of 2.91%. Expected annual non-GAAP earnings per share (EPS) is 28.57.

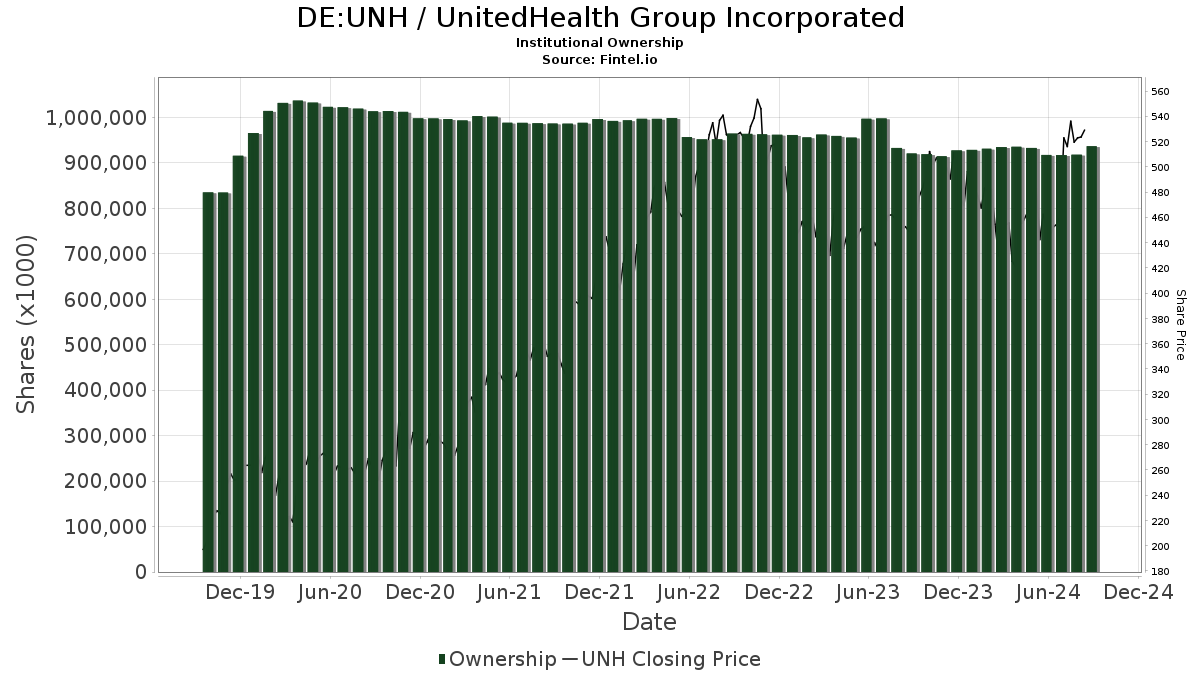

Institutional Investment Trends

There are 5,234 funds or institutions reporting positions in UnitedHealth Group, a rise of 27 owners or 0.52% since the last quarter. The average portfolio weight of all funds in UNH increased to 0.99%, up by 1.88%. In the past three months, total shares held by institutions grew by 5.17% to 939,681K shares.

Ownership Changes Among Major Investors

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 29,080K shares, which is 3.15% of the company. Their latest filing shows a slight increase of 0.02% from owning 29,075K shares last time, representing a 0.12% increase in their UNH allocation over the last quarter.

Capital World Investors holds 28,023K shares, representing 3.03% ownership. Previous data indicated they owned 28,322K shares, reflecting a decrease of 1.07%, although they increased their portfolio allocation in UNH by 0.35% in the latest quarter.

Price T Rowe Associates has 26,021K shares, making up 2.82% ownership. Their prior report indicated ownership of 26,063K shares, with a minor decrease of 0.16%. They increased their allocation in UNH by 0.34% over the last quarter.

Wellington Management Group LLP holds 25,884K shares, representing 2.80% ownership. Their previous filing showed ownership of 24,283K shares, indicating an increase of 6.18%. However, they reduced their portfolio allocation in UNH by 84.42% in the last quarter.

JPMorgan Chase possesses 24,349K shares, equating to 2.64% ownership. Last reported figures indicated they owned 23,841K shares, reflecting an increase of 2.09%. Their portfolio allocation in UNH decreased by 84.01% over the recent quarter.

Fintel provides an extensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our platform offers comprehensive data, including fundamentals, analyst reports, ownership metrics, fund sentiment, options trading insights, insider trading information, and much more. Additionally, our exclusive stock recommendations are driven by advanced, backtested quantitative models designed for improved profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.