Identifying Promising Investments: Focus on Risk-Adjusted Returns

Recently, I received an intriguing question from a subscriber about investment strategies. This inquiry sparked a discussion worth sharing as we explore the concept of risk-adjusted capital gain potential in big name stocks.

Understanding Risk-Adjusted Returns

To start, let’s break down what a risk-adjusted capital gain is. Essentially, a capital gain refers to the profit earned from selling an asset, such as a stock. When we incorporate the term “risk-adjusted,” we address the returns achieved relative to the risks taken.

This question highlights an important aspect that many individual investors overlook. It’s crucial to assess an investment’s performance against the risks involved. Tools exist, for instance, to compare investments with different risk levels against benchmarks like the S&P 500 or the returns on a 10-year U.S. Treasury bond. These help investors determine if their returns justify the associated risks.

Many may wonder how I evaluate risk, so let me clarify my approach. First, I look at a stock’s volatility rather than its growth trajectory. This is measured through standard deviation. Moreover, I differentiate between positive and negative volatility, which is akin to understanding good cholesterol versus bad cholesterol. This is referred to as the up/down capture ratio.

Lastly, I consider beta, which represents the stock’s risk in relation to the overall market, often labeled as “systemic risk.” I analyze all three factors—standard deviation, up/down capture ratio, and beta—when selecting stocks for our Growth Investor Buy List.

To quantify this relationship between risk and return, I utilize a ratio of alpha to standard deviation. Simply put, this means I identify stocks with substantially better alphas and betas compared to market benchmarks.

Putting the Equation Together: Alpha + Beta multiplied by the market benchmark return equals a stock’s total return.

While I have established methods for these calculations, it’s noteworthy that many investors may find them challenging to perform independently. Therefore, it’s essential to select stocks that align with your risk tolerance. For instance, conservative investors should steer clear of high-risk stocks and, conversely, aggressive investors may seek out such opportunities.

A Top Risk-Adjusted Stock Choice

When considering the question posed by my subscriber, one stock that stands out as a safe, risk-adjusted investment is Eli Lilly and Company (LLY).

Eli Lilly is a respected pharmaceutical firm with a remarkable history extending over 147 years and a portfolio that includes more than 100 drugs. Recently, the company has seen a substantial increase in demand for its diabetes and weight loss treatments, such as Mounjaro and Zepbound. This surge drove a 36% rise in revenue during the second quarter.

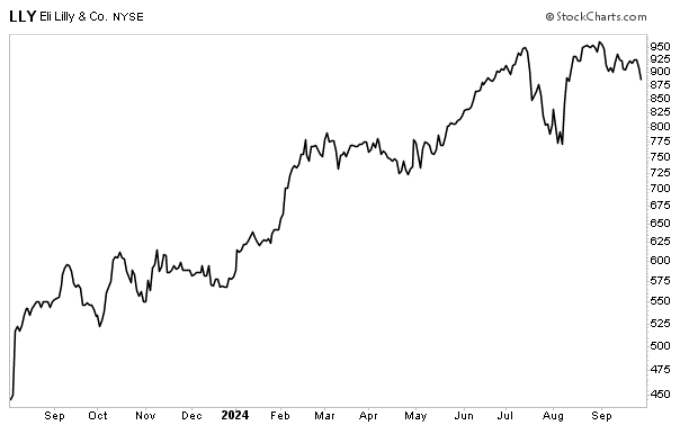

Eli Lilly is classified as a low-risk investment. However, as illustrated in the accompanying chart, this doesn’t preclude all fluctuations in market value. Instead, it indicates that LLY is less prone to significant market volatility.

While it is unrealistic to expect a high-quality growth stock to gain steadily, LLY has demonstrated a quick recovery after dips since joining our Growth Investor Buy List in August 2023. Notably, LLY has gained 51%, significantly outperforming the S&P 500’s 20% increase this year.

Examining Eli Lilly’s Financial Health

Eli Lilly’s fundamentals further reinforce its appeal. In August, the company reported second-quarter revenue of $11.3 billion, exceeding expectations of $9.92 billion by approximately 13.9%. Earnings surged 86% year-over-year to $3.54 billion, translating to $3.92 per share—a significant rise from $1.9 billion or $2.11 per share in the same quarter of 2023. Analysts had anticipated earnings of $2.60 per share, leading to a striking earnings surprise of 50.8%.

Utilizing my Stock Grader tool, Eli Lilly holds a Fundamental Grade of B and a Quantitative Grade of A, culminating in a Total Grade of A. (Subscription required.)

Eli Lilly’s Earnings Surge: A 4,380% Increase Expected This Quarter

On Wednesday, October 30, Eli Lilly is set to announce its earnings for the third quarter, with analysts predicting a substantial increase in profitability.

Impressive Earnings and Revenue Forecasts

The expected earnings per share (EPS) is anticipated to climb an astonishing 4,380% year-over-year, reaching $4.48. Notably, analysts have revised their earnings estimates upward by 17.6% over the past three months. Revenue for the third quarter is projected to grow by 28.52% year-over-year to approximately $12.21 billion.

Looking Ahead: Strong Guidance for 2024

For the full year of 2024, Eli Lilly expects revenues to fall between $45.4 billion and $46.6 billion, marking an increase of $3.0 billion above prior forecasts. This projection surpasses analysts’ current expectations, which sit at $43.01 billion. Furthermore, the company anticipates its EPS for the year will be between $16.10 and $16.60, significantly higher than the existing estimate of $13.76 per share.

Eli Lilly’s Bright Future

Given these promising forecasts, it’s clear that Eli Lilly is likely to continue generating robust financial results in the near future.

Identifying Growth Leaders in the Market

In summary, Eli Lilly stands out as a top risk-adjusted growth opportunity for the next three years. It’s not alone in this regard…

Recently, I introduced another strong pick to my Growth Investor subscribers, a stock that I recommended back in January 2023 and which has already risen nearly 30%. With solid fundamentals, I believe this company will keep thriving.

It’s important to note that all selections in my Growth Investor Buy List are bolstered by robust fundamentals and consistent buying interest.

As of September, my High-Growth Investments Buy List has seen a gain of 2.4%, outpacing the S&P 500’s 1.6%, NASDAQ’s 2.3%, and the Dow’s 1.9% during the same period. I expect these Growth Investor stocks to become market leaders, continuing their upward trajectory.

To access this Buy List, consider joining me at Growth Investor today.

(If you are already a Growth Investor member, click here to log in to the exclusive members-only site.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor discloses that as of the date of this email, they own the following securities mentioned in this commentary:

Eli Lilly & Company (LLY)