Investing in Electric Vehicles: A Look at Tesla and Rivian

Are you considering adding long-term growth stocks to your portfolio? Electric vehicle (EV) manufacturers offer promising opportunities.

While many EV companies have experienced soaring sales, their stock prices haven’t always reflected that success, providing chances for savvy investors. Currently, the market presents attractive entry points for potential buyers.

If you’re interested in joining the global shift toward electric vehicles—a trend with decades of growth potential—two stocks stand out. One is a well-known giant; the other holds surprising promise.

Investing in Tesla: A Popular Choice

The leading name in the industry is Tesla (NASDAQ: TSLA). Known for its charismatic CEO, Elon Musk, the company has nearly $100 billion in sales and leads in several major markets, particularly in the United States.

Tesla’s vehicle lineup includes luxury models such as the Roadster and Model S, as well as more affordable options like the Model 3 and Model Y, priced under $50,000—an important price point for mass-market appeal.

While Tesla is involved in energy generation and storage, over 90% of its revenue comes from electric vehicle sales. Its tremendous growth—over 1,000% in the last decade—can largely be attributed to the popularity of its mass-market vehicles, showcasing the higher sales volume possible in this price range compared to luxury models.

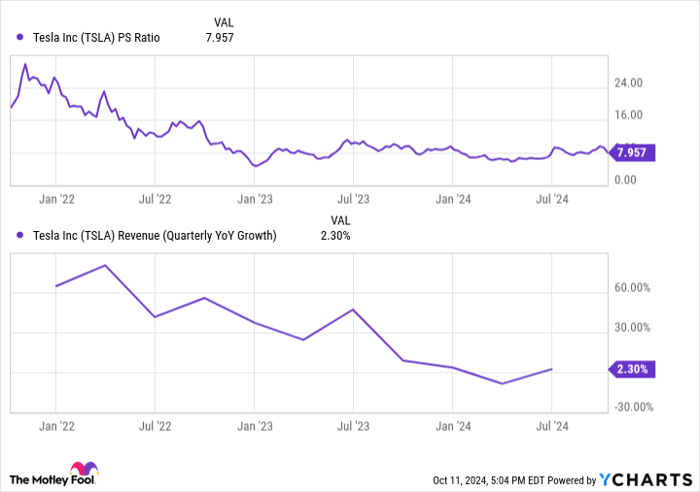

Despite a slowdown in sales growth across the EV sector this year, Tesla’s shares currently trade at 7.9 times sales, a valuation similar to two years ago when sales were growing at a rate of 30% per quarter.

Investing in Tesla now is not just about immediate returns; it’s about positioning for the long-term expansion of the EV market. According to the International Energy Agency (IEA), demand for electric vehicles is projected to grow by double digits for many years. With solid access to capital, Tesla remains a viable investment for those betting on the future of electric vehicles.

TSLA PS Ratio data by YCharts.

Rivian: The Hidden Gem in EV Investments

If you’re looking for a potential rival to Tesla, consider Rivian (NASDAQ: RIVN). Though it lacks Tesla’s name recognition, Rivian could quickly gain traction in the upcoming years.

The company plans to introduce its R2, R3, and R3X models aimed at the mass market by 2026. Based on Tesla’s trajectory, Rivian could see a rapid increase in sales thereafter.

Currently, Rivian shares trade at a significant discount to Tesla on a price-to-sales basis, raising questions about the disparity in valuations.

RIVN PS Ratio data by YCharts.

However, as a smaller player with a sales base of just $5 billion, investor skepticism lingers about Rivian’s ability to scale its operations successfully. While Tesla has flourished, many other EV companies have faced bankruptcy. Rivian must not only secure billions in funding but also establish production capabilities and deliver cars that appeal to consumers at reasonable prices.

Due to these uncertainties, Rivian’s stock price has dropped by approximately 55% this year, while Tesla’s shares have declined by only 12%. This situation creates a buying opportunity for investors willing to accept higher risks in exchange for potentially greater rewards as they identify the next major EV brand.

Is Now the Right Time to Invest in Tesla?

Before purchasing Tesla stock, consider this:

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks to buy now—Tesla is not among them. These selections could yield significant returns in upcoming years.

For instance, if you had invested $1,000 in Nvidia on April 15, 2005, you would have had $826,069 today!

Stock Advisor offers guidance for building a successful investment portfolio, including regular analyst updates and two new stock recommendations each month. Since its inception, the service has more than quadrupled the returns of the S&P 500.

Discover the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.