Wells Fargo Downgrades V.F.: What Investors Need to Know

Analysts Forecast a 11.54% Decline in Share Price

Fintel reports that on October 14, 2024, Wells Fargo downgraded their outlook for V.F. (LSE:0R30) from Equal-Weight to Underweight.

Current Price Target Trends

As of September 25, 2024, the average one-year price target for V.F. is 18.31 GBX/share. Forecasts range from a low of 10.24 GBX to a high of 26.62 GBX. This average target indicates a potential decrease of 11.54% from the latest reported closing price of 20.70 GBX/share.

Revenue Projections Show Promise

The projected annual revenue for V.F. stands at 12,738 million, marking an increase of 23.96%. Additionally, the projected annual non-GAAP EPS is 2.65.

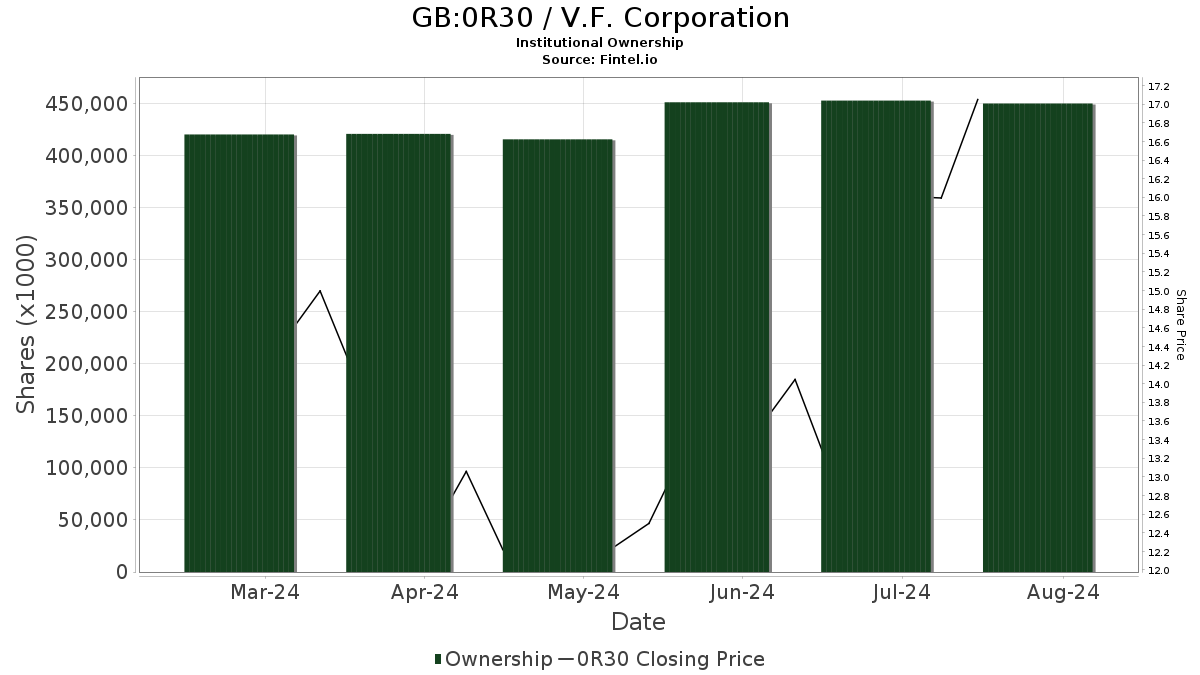

Changing Fund Sentiment

Currently, there are 1,024 funds or institutions holding positions in V.F., reflecting a decrease of 62 owners, or 5.71%, over the last quarter. The average portfolio weight dedicated to 0R30 has increased by 12.86%, now sitting at 0.11%. In the past three months, total shares owned by institutions grew by 10.73% to reach 494,693,000 shares.

Notable Shareholder Movements

Pnc Financial Services Group holds 76,117,000 shares, representing 19.56% ownership. This shows a slight decrease from the previous filing, where it reported ownership of 76,515,000 shares, a decline of 0.52%. The firm has reduced its portfolio allocation in 0R30 by 85.68% in the last quarter.

Dodge & Cox, on the other hand, increased its stake in the company. They hold 42,557,000 shares, equivalent to 10.93% ownership, up from 35,430,000 shares previously, marking a 16.75% increase. Their portfolio allocation in 0R30 expanded by 9.36% over the last quarter.

DODGX – Dodge & Cox Stock Fund currently owns 27,402,000 shares, which is 7.04% of V.F. This is an increase from 23,498,000 shares earlier, reflecting a growth of 14.25%. Their portfolio allocation also rose by 3.17% last quarter.

Northern Trust’s ownership decreased, as they hold 21,505,000 shares (5.53% ownership) compared to 23,160,000 shares before, representing a 7.69% drop. Their portfolio allocation in 0R30 fell by 61.23% during the last quarter.

Lastly, IJR – iShares Core S&P Small-Cap ETF owns 21,374,000 shares, which constitutes 5.49% of the company.

Fintel is a leading investment research platform for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses global coverage and includes fundamentals, analyst reports, ownership data, fund sentiment, and more. Additional exclusive stock picks leverage advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.