Amgen’s Investment Outlook downgraded: Trends in Fund Ownership

Fintel reports that on October 14, 2024, Truist Securities downgraded their outlook for Amgen (LSE:0R0T) from Buy to Hold.

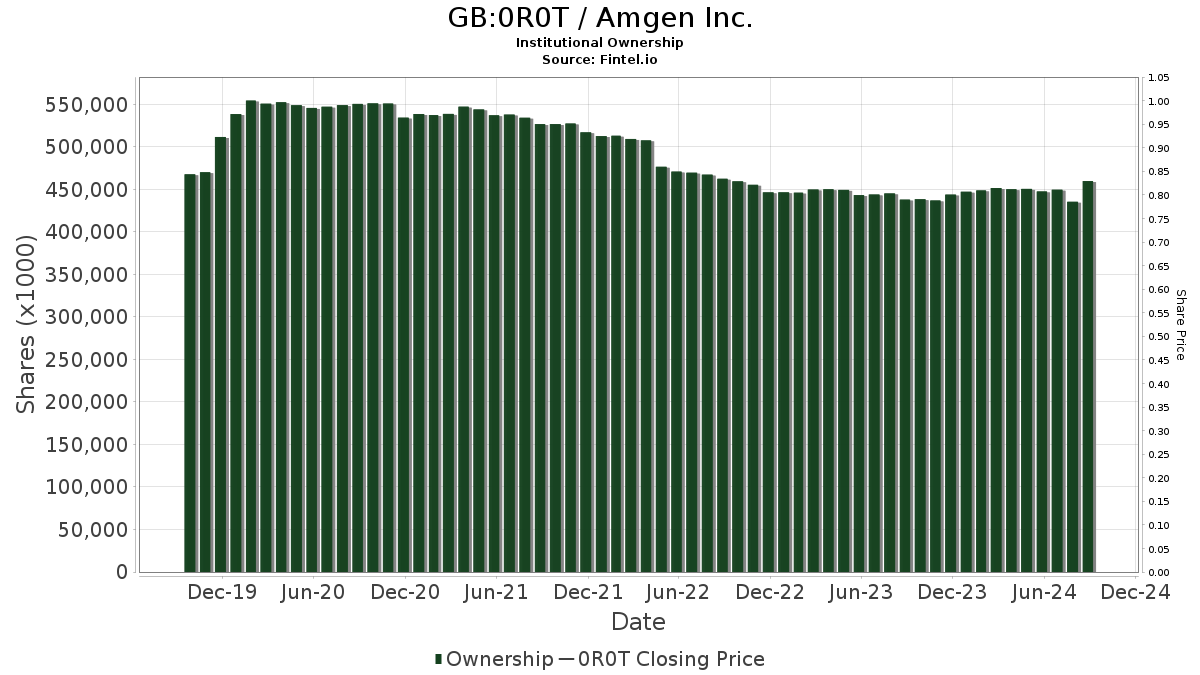

Fund Sentiment Analysis

Currently, there are 4,098 funds or institutions that report their positions in Amgen. This represents an increase of 54 owners, or 1.34%, over the last quarter. The average portfolio weight vested in 0R0T by all funds is 0.55%, which has risen by 4.09%. Over the past three months, the total shares owned by institutions rose by 5.11%, amounting to 457,416K shares.

Actions of Other Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares currently holds 16,954K shares, representing 3.16% of the company. In its previous filing, the firm reported 16,847K shares, which indicates an increase of 0.63%. The firm has boosted its portfolio allocation in 0R0T by 7.54% during the last quarter.

Primecap Management possesses 14,447K shares, accounting for 2.69% ownership of Amgen. Earlier, they reported 14,602K shares, reflecting a decrease of 1.07%. However, their portfolio allocation in 0R0T increased by 5.54% over the previous quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 13,768K shares, giving them 2.56% ownership in Amgen. Their last report indicated ownership of 13,482K shares, marking an increase of 2.07%. The portfolio allocation in 0R0T has been raised by 6.23% recently.

Geode Capital Management now owns 12,019K shares, representing 2.24% ownership. In their prior filing, they noted ownership of 11,643K shares, which signifies an increase of 3.13%. Their portfolio allocation in 0R0T saw an uplift of 7.64% over the last quarter.

Invesco QQQ Trust, Series 1 holds 10,332K shares, representing 1.92% of Amgen. The previous filings show they owned 10,046K shares, marking an increase of 2.77%. Their portfolio allocation in 0R0T also increased by 1.74% recently.

Fintel serves as a comprehensive investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data includes fundamentals, analyst reports, ownership statistics, and fund sentiments, as well as options flow, insider trading, and other relevant insights. Furthermore, our exclusive stock selections are driven by advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.