TD Cowen Lowers Outlook for Expeditors International: Analysts Suggest Caution

Analysts See Potential Decline in Stock Price

On October 14, 2024, TD Cowen downgraded Expeditors International of Washington (LSE:0IJR) from Hold to Sell.

Forecast Indicates 3.91% Drop in Stock Value

The projected average one-year price target for Expeditors International stands at 118.52 GBX per share as of September 25, 2024. Predictions vary, with estimates ranging from a low of 85.87 GBX to a high of 143.88 GBX. Compared to its last closing price of 123.34 GBX per share, this average target reflects a potential decline of 3.91%.

The company is also expected to see annual revenues of 11,763MM, marking a 29.07% increase. Furthermore, analysts project a non-GAAP EPS of 5.25.

Current Fund Sentiment on Expeditors

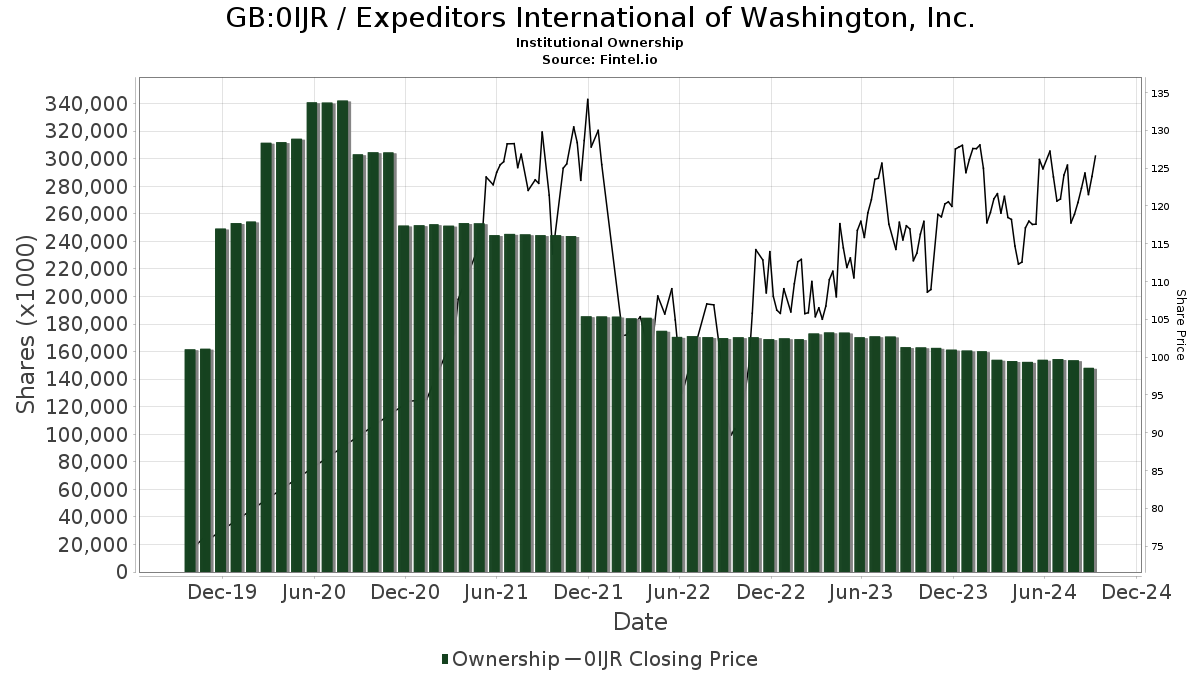

Expeditors International has 1,588 funds or institutions reporting their positions. This figure represents a slight decrease of 0.19%, or three owners, from the previous quarter. The average portfolio weight for all funds holding 0IJR increased by 0.63% to 0.21%. However, total institutional shares owned have declined by 2.57% over the past three months, now totaling 148,282K shares.

Action from Major Shareholders

Loomis Sayles & Co L P currently holds 6,123K shares, equating to 4.34% ownership of the company. This is a slight increase from their previous holding of 6,069K shares, reflecting a growth of 0.88%. They have raised their allocation to 0IJR by 0.36% over the last quarter.

Meanwhile, the Vanguard Total Stock Market Index Fund (VTSMX) has reduced its stake from 4,562K shares to 4,455K shares, resulting in a 2.39% decrease. Their portfolio allocation in 0IJR also decreased by 2.51% in the past quarter.

Similarly, the Vanguard 500 Index Fund (VFINX) cut its holdings from 3,664K to 3,625K shares, a drop of 1.06%, while decreasing its portfolio allocation by 3.85%.

In contrast, Geode Capital Management has significantly reduced its holdings from 3,642K shares to 3,342K shares, an 8.99% decline, along with a drastic drop in portfolio allocation of 53.35%.

On the other hand, Vanguard Mid-Cap Index Fund (VIMSX) increased its portfolio allocation slightly, now holding 3,026K shares, up from 3,159K shares.

Fintel provides comprehensive investment research tools for individual investors, traders, financial advisors, and small hedge funds.

The platform encompasses global data, including fundamental analysis, ownership insights, and options sentiment, along with advanced stock picks derived from quantitative models.

Click to Learn More

This story was originally published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.