The Rise of Buy Now, Pay Later: Is Affirm Set for Success?

More young consumers are turning to buy now, pay later (BNPL) options for loans. These loans provide flexible payment methods without the risk of accruing credit card debt. Each loan is assessed on a per-transaction basis, giving borrowers a better sense of control. Notably, many BNPL loans do not incur interest charges.

Affirm (NASDAQ: AFRM) is positioned among key players in this burgeoning sector, anticipated to expand by more than 24% annually in the U.S. through 2030.

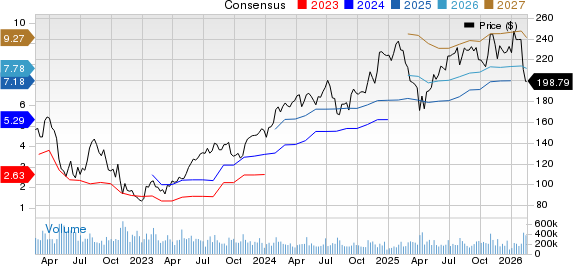

Since its public debut during the “everything bubble” of 2021, Affirm’s stock price has significantly decreased. Still, its $15 billion market cap suggests potential for growth, positioning it as a promising long-term investment opportunity.

Strategic Partnerships Fuel Growth

While anyone can lend money, maintaining a strong presence in the BNPL market is challenging. This became evident when Apple entered the BNPL space last year but quickly exited in favor of partnering with Affirm. The collaboration allows Affirm to leverage relationships with major retailers to increase its visibility among consumers.

Currently, about 18.6 million consumers utilize Affirm’s services, which include partnerships with Shopify, e-commerce giant Amazon, and over 303,000 merchants. The company’s revenue streams consist of interest from loans and merchant fees. Encouragingly, Affirm’s gross merchandise value reached $7.2 billion last quarter, marking a 31% increase from the previous year.

Currently, BNPL is primarily an online phenomenon, but that could change. The aforementioned growth estimates factor in new point-of-sale opportunities. Affirm is at the forefront, having launched a physical charge card that allows users to split purchases into BNPL loans either during the transaction or afterward. Since its introduction in 2021, approximately 1.2 million people have adopted the Affirm Card.

This ability to capture point-of-sale transactions, coupled with its strategic alliances, paves the way for significant growth and market share expansion in the coming years.

Moving Toward Profitability

Though Affirm has not yet reached profitability, it shows promising signs of progress. The company recently reported a non-GAAP operating profit and aims to maintain this upward trajectory. As CEO Max Levchin noted in a recent letter to shareholders, “The path to reaching any profitability goal is simply more transactions.”

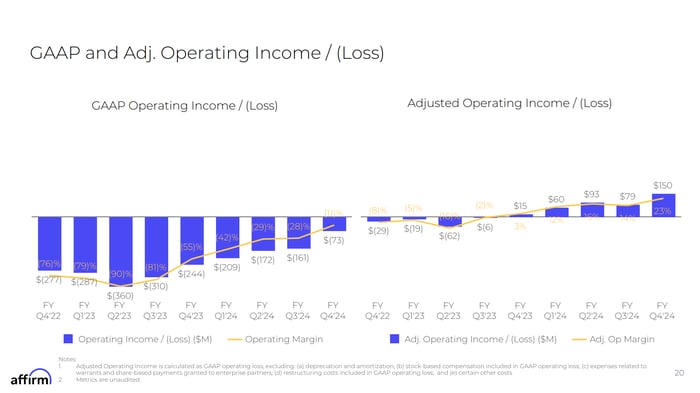

The following chart illustrates the company’s quarterly operating income/loss over time:

Image source: Affirm Holdings.

Affirm’s positive trend inspires confidence in its business model’s ability to achieve profitability eventually. The company holds $2.1 billion in cash and has generated over $290 million in free cash flow in the past year, reinforcing its financial stability.

The Millionaire Maker Potential

Affirm’s future hinges on two critical questions:

- Will BNPL services significantly replace traditional credit cards? This will determine the overall market size.

- What market position will Affirm occupy amidst competition? This will define its market share.

On a positive note, the financial services sector is worth trillions. With some payment companies valued in the hundreds of billions, Affirm’s current $15 billion market cap highlights the opportunity for growth. A future where millions rely on Affirm’s BNPL services is feasible.

BNPL’s popularity among younger consumers, particularly millennials and Gen Z, favorable for the industry’s growth trajectory. Affirm’s strong partnerships, especially with Apple, could significantly bolster its market presence moving forward.

Valuing Affirm’s stock based on current financials is tricky since it’s still early days. However, if it sustains its growth rate over the next five years and becomes a household name, the stock could yield high returns. The potential for becoming a millionaire-making investment exists, though clarity on that outcome remains elusive.

Seize This Potential Investment Opportunity

Have you ever felt you missed a vital investment opportunity? You’re in luck now.

Our team of specialists occasionally issues a “Double Down” stock recommendation for companies poised for rapid growth. If you are concerned that you’ve passed your chance to invest, now might be the ideal moment to act before it disappears. The statistics are compelling:

- Amazon: If you had invested $1,000 when we doubled down in 2010, you’d have $21,266!

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $43,047!

- Netflix: $1,000 invested at doubling down in 2004 would have soared to $389,794!

Currently, we’re recommending “Double Down” alerts for three exceptional companies, and opportunities like this are rare.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has positions in Affirm. The Motley Fool has positions in and recommends Amazon, Apple, and Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.