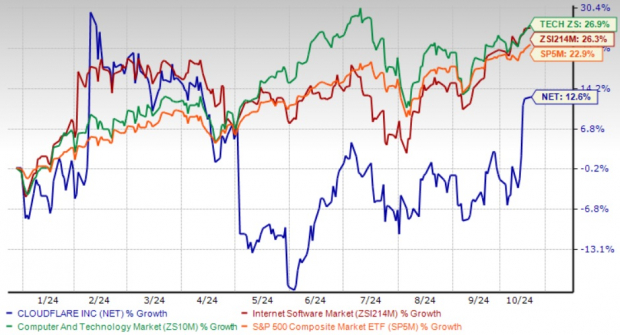

Cloudflare NET shares have risen by 12.6% year-to-date (YTD). However, this performance falls short of the Zacks Internet Software industry, the Zacks Computer and Technology sector, and the S&P 500 index, which have recorded returns of 26.3%, 26.9%, and 22.9%, respectively, YTD.

Given this disappointing performance, investors are questioning if the slow stock growth indicates fundamental weaknesses or simply presents a temporary stagnation that might serve as a buying opportunity.

Cloudflare’s Stock Struggles Amid Concerns of Slowing Growth

Deceleration of Growth Impacts Cloudflare’s Stock Value

The underwhelming performance of NET stock can be linked to the company’s slowing growth, which raises questions about its short-term outlook. Since its IPO in 2019, Cloudflare has shown remarkable growth; however, recent quarterly earnings reveal a downward trend. Although revenue growth remains strong, it is not at the explosive rates witnessed previously.

Up until 2022, Cloudflare enjoyed nearly 50% year-over-year revenue growth. This rate dropped to 33% in 2023, and forecasts for 2024 and 2025 suggest a further decline to about 27%.

Moreover, Cloudflare has significantly improved its earnings performance, becoming non-GAAP profitable in 2022 and posting a 272% increase in 2023. However, projected earnings growth for 2024 and 2025 are approximately 45% and 18%, respectively.

Looking ahead, the company might face challenges due to waning IT spending as businesses delay major technology investments amidst macroeconomic uncertainties and geopolitical tensions. Consequently, the near-term outlook appears cautious.

Cloudflare Year-to-Date Performance

Image Source: Zacks Investment Research

Concerns Over Valuation Pressures Cloudflare’s Future

Cloudflare’s current valuation raises some eyebrows, particularly concerning its price-to-earnings (P/E) ratio. Currently, the stock trades at a forward 12-month P/E ratio of 116.13X, well above the Zacks Internet – Software industry average of 35.41X. This elevated valuation may indicate potential risks for its sustainability.

Despite the concerns over slowing growth and high valuation, there are positive aspects to consider. The company maintains a strong market presence and continues to explore opportunities within the AI sector, which could lead to significant long-term growth.

Strong Market Position Fuels Customer Expansion

Cloudflare has established itself as a leader through its innovative offerings in content delivery, Internet security, and edge computing. Its vision of creating a better Internet resonates with a diverse client base, from small businesses to large corporations.

The company’s expansive global network, coupled with a commitment to performance and security, continues to foster customer growth. In its latest earnings report, Cloudflare revealed a 21% year-over-year increase in its total paying customers, reaching 210,200.

During the quarter, NET welcomed 168 new customers contributing over $100,000 in annual revenues, bringing the total to 3,050. This success is further supported by a high net retention rate, reflecting loyal customers and the ability to sell additional services effectively.

Advancements in AI to Propel Cloudflare’s Future Growth

Cloudflare is making strides in the artificial intelligence (AI) sector by rolling out pioneering products. This year, NET introduced security services for AI, including Firewall for AI and Defensive AI. These innovations protect Large Language Models from cyberattacks and secure devices against AI-based threats.

Partnerships with industry leaders, such as Hugging Face Hub, CrowdStrike CRWD, Microsoft MSFT, and NVIDIA NVDA, have facilitated Cloudflare’s expansion into the AI field. Collaborating with Hugging Face, developers can swiftly create AI applications on NET’s network.

This partnership with CrowdStrike combines Cloudflare’s Zero Trust security with CrowdStrike’s AI-enhanced cybersecurity solutions to avert large-scale breaches. Additionally, Cloudflare has partnered with several other notable companies in 2024 to broaden its capabilities beyond just AI.

In collaboration with Microsoft, Cloudflare aims to help businesses deploy AI models across various platforms using ONNX runtime. Furthermore, NET announced plans to integrate NVDA’s GPUs and Ethernet switches into its global network to optimize AI accessibility for users.

Investor Guidance: Caution Advised Amid Growth Challenges

While Cloudflare’s strong market position and ventures into the AI sector are promising, its high valuation calls for a cautious approach. Slowing growth rates and macroeconomic uncertainties present near-term risks for the company.

Given these considerations, prospective investors are advised to wait for a more favorable entry point in this Zacks Rank #3 (Hold) stock. For those interested, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Infrastructure Stock Boom to Sweep America

A massive initiative to rebuild the U.S. infrastructure is on the horizon. This effort is bipartisan, urgent, and unavoidable, with trillions set to be invested and fortunes to be made.

The key question is, “Will you invest in the right stocks early to maximize potential growth?”

Zacks has prepared a Special Report to assist you with this endeavor, available for free. Discover five companies poised to benefit the most from the construction and repair of roads, bridges, buildings, cargo transportation, and energy transformation on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest stock recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to access this complimentary report.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.