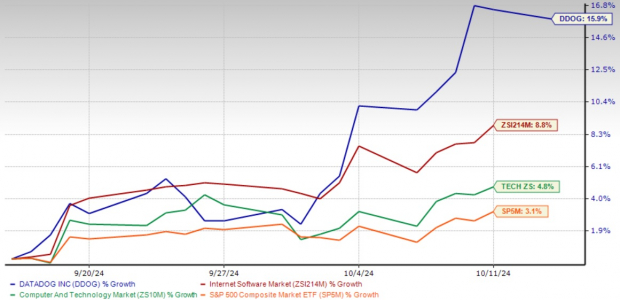

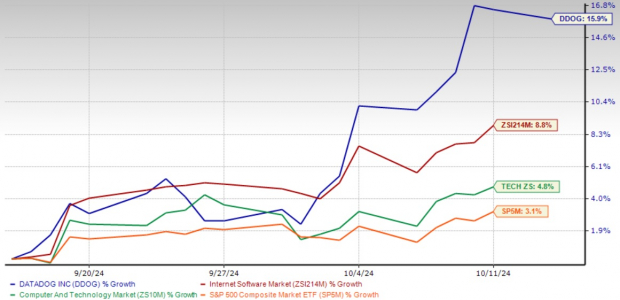

Datadog’s Stock Soars 15%: A Closer Look at Its Growth and Strategies

In a significant rise over the past month, shares of Datadog (DDOG) have jumped 15%. This performance surpasses the Zacks Computer and Technology sector’s 4.8% growth, attracting the interest of investors and analysts. Datadog specializes in providing real-time insights into cloud infrastructure and application performance, offering a cloud monitoring and analytics platform that is gaining traction as businesses speed up their digital transformation in 2024.

Strong Business Model and Customer Growth

Datadog has broadened its service offerings with features like serverless monitoring and security monitoring, demonstrating a strong commitment to meet evolving customer needs. As of the second quarter of 2024, Datadog reported 3,390 customers with an annual run rate (ARR) of $100,000 or more, marking a 13% increase from the previous year. Notably, about 87% of total ARR comes from these premium customers, underlining their importance to the company’s revenue.

A multi-product strategy has led to 83% of customers using two or more products, while 49% rely on four or more. This trend suggests successful cross-selling efforts and indicates Datadog’s strong position in the lucrative enterprise market, which may provide a robust foundation for future revenue growth.

1-Month Performance

Image Source: Zacks Investment Research

AI and Cloud Partnerships Fuel Stock Success

Datadog’s strategic focus on artificial intelligence (AI) and machine learning (ML), along with strong integrations with major cloud platforms, has greatly influenced its stock performance. The company’s multi-cloud strategy makes it a key player in cloud computing, providing a comprehensive monitoring solution across various environments.

Key to Datadog’s success is its ability to offer complete visibility across multi-cloud infrastructures. By closely integrating with leading services such as Amazon (AMZN) AWS, Alphabet (GOOGL) Google Cloud, and Microsoft (MSFT) Azure, Datadog helps organizations streamline their monitoring and optimization processes. This unified approach is vital as businesses shift toward hybrid and multi-cloud strategies to maintain flexibility and prevent vendor lock-in.

Datadog’s partnership with AWS is particularly important, as it holds the status of an AWS Partner Network Advanced Technology Partner with Cloud Monitoring Competency certification. This partnership ensures seamless integration of Datadog’s tools with AWS, providing valuable insights into AWS infrastructure. Furthermore, its presence on the AWS Marketplace simplifies adoption for customers using AWS services.

Similarly, Datadog’s integration with Google Cloud is extensive, covering services such as Compute Engine and Kubernetes Engine. This allows customers to maintain clear visibility over their Google Cloud resources within the Datadog interface.

The collaboration with Microsoft Azure enhances observability and security for Azure clients and extends Datadog’s security features to Azure environments, providing a complete view of cloud infrastructure security.

Datadog’s financial results are strong, with revenue growth of 26.9% year-over-year to $611.25 million in the second quarter. For 2024, the company anticipates revenues between $2.62 billion and $2.63 billion, and non-GAAP earnings between $1.62 and $1.66 per share. This reflects a projected year-over-year growth of 23.4% in revenue and 24.2% in earnings.

Image Source: Zacks Investment Research

By aligning closely with industry giants like Amazon, Google, and Microsoft, Datadog has positioned itself as a valuable resource for companies navigating complex cloud infrastructures. This strategic alignment, combined with innovative AI and ML capabilities like Bits AI, suggests continued growth potential in the cloud monitoring and analytics sector.

Competitive Landscape and Valuation

Datadog competes in a challenging market, facing rivals like New Relic, Dynatrace, and Splunk. Although Datadog has carved out a niche with its unified platform and multi-cloud integrations, these competitors also offer substantial solutions and possess established customer bases. Moreover, tech giants like Microsoft and Amazon have their monitoring solutions, presenting a potential threat to Datadog’s market share.

The stock trades at a premium relative to broader Zacks Internet – Software industry comparisons, with a forward 12-month P/S ratio around 14.24. This premium reflects investors’ high growth expectations and is bolstered by Datadog’s strong revenue growth and expanding customer base.

DDOG’s P/S Ratio Reflects Stretched Valuation

Image Source: Zacks Investment Research

Conclusion

Datadog’s strategic alliances and product innovation position the company well for continued growth in the cloud monitoring and analytics market, despite intense competition and high investor expectations. The company’s wide-ranging observability solutions suit the shift towards multi-cloud and hybrid cloud environments, signaling that the stock remains a strong investment opportunity. Datadog currently holds a Zacks Rank #2 (Buy) and a Growth Score of A, indicating its potential as an appealing choice for investors.

For those interested in identifying promising stocks, Zacks has released a Special Report detailing five companies poised to benefit from the significant investment in U.S. infrastructure projects. Discover more to position yourself ahead of market trends.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.