Paramount’s Deal with Skydance in Jeopardy Amid Shareholder Discontent

For those who assumed Paramount’s (PARA) agreement with Skydance was finalized, new developments suggest otherwise. A former bidder is resurfacing, alleging that Paramount acted against its shareholders’ best interests by rejecting their superior offer. Despite this, shareholders appeared unfazed, leading to a slight uptick in shares during Monday’s trading.

The bid from Project Rise Partners (PRP) offered significantly more value than the Skydance deal, claiming to provide “…more cash per share to both Class A and Class B shareholders in Paramount,” as reported by Axios. PRP comprises Malka Investment Trust and Rise Beyond LLC, which source most of their funding from affluent individuals in finance, telecom, and media industries.

Lawyers representing PRP argue that Paramount should have reviewed their offer. Paramount cited “timing issues” as the reason for passing, but PRP’s legal team pointed out that a go-shop period was in place. During that window, at least two other bids emerged, suggesting that the go-shop provision in the agreement with Skydance is unenforceable under a previous Supreme Court ruling.

Leadership Changes and New Directions

As these circumstances unfold, Jeff Shell is set to become President of Paramount. Formerly the CEO of NBCUniversal, Shell is known for his bold approach, which may help Paramount develop innovative strategies moving forward.

However, not all changes may be positive. Recent reports indicate that Paramount+ will lose several Star Trek films, including classics like 1982’s Star Trek: The Wrath of Khan and 2002’s Star Trek: Nemesis, which will migrate to Amazon (AMZN) and Prime Video. This loss could adversely affect Paramount+, and it remains uncertain what titles will take their place.

Evaluating Paramount Stock: Is it Worth the Investment?

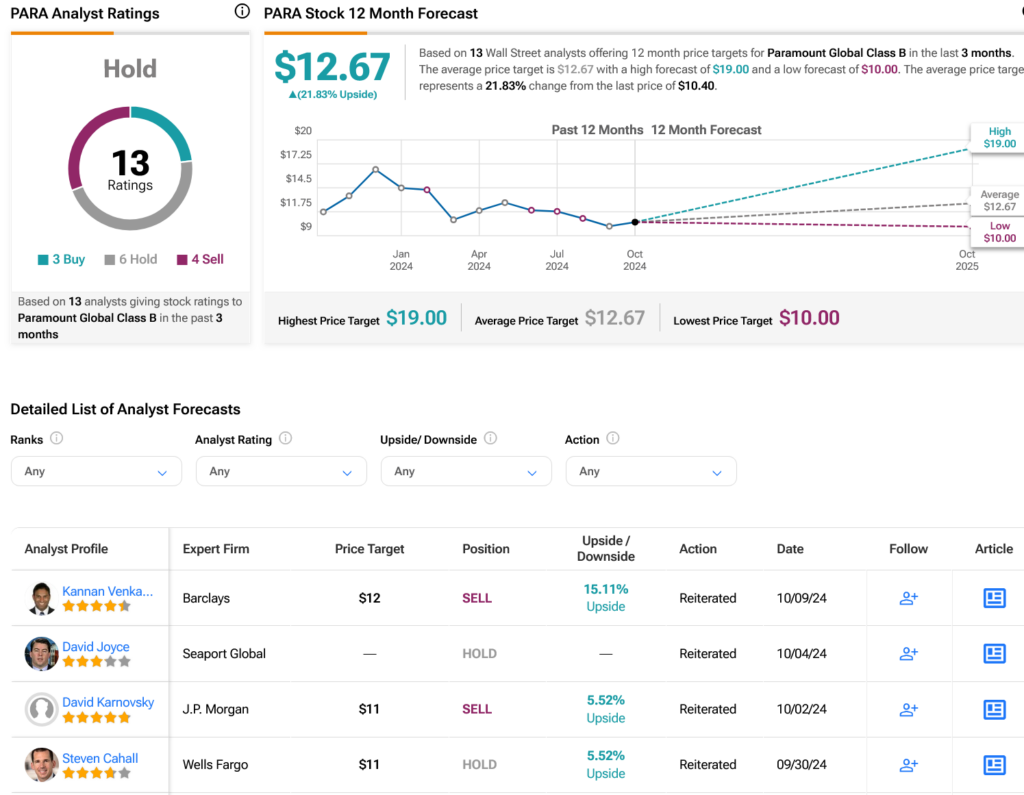

On Wall Street, analysts currently have a Hold consensus on PARA stock, which is based on three Buys, six Holds, and four Sells over the last three months. Despite a 13.49% decline in share price over the past year, the average price target for PARA stands at $12.67, indicating a potential upside of 21.83%.

See more PARA analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.