Palantir Technologies: Navigating a Comeback in the AI Era

Data analytics software company Palantir Technologies (NYSE: PLTR) has seen significant fluctuations since its public debut in late 2020. Shortly after its IPO, Ark Invest CEO Cathie Wood gained attention for enthusiastically discussing Palantir’s potential on financial news programs, which led to a surge in its stock price.

However, this rapid rise was soon followed by challenges. The next couple of years were difficult for Palantir, as the overall enterprise software market struggled amid economic troubles. By the start of 2023, Palantir’s stock had fallen to just $6.

Fortunately, the tech sector has rebounded sharply over the last 18 months, driven by growing interest in artificial intelligence (AI). Palantir has capitalized on this AI boom, and investor interest in the stock has surged. Since the beginning of 2023, Palantir’s shares have skyrocketed by 575%.

In this article, I will explore Palantir’s current $43 share price and assess whether it is overvalued.

Key Factors Driving Palantir’s Stock Price

Given the dramatic rise in Palantir’s stock, it’s worthwhile to consider the key factors contributing to this momentum. Simply attributing the gains to AI demand does not fully explain the situation.

Here are five primary reasons I believe are driving Palantir’s stock higher:

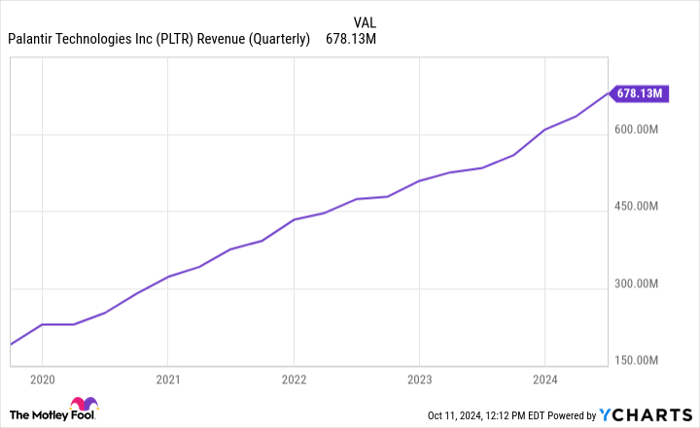

1. Revenue Growth: Palantir’s quarterly revenue growth has varied since its IPO, as highlighted in the chart below. Although revenue has generally increased, there have been periods of fluctuation that had investors uncertain about the company’s future.

PLTR Revenue (Quarterly) data by YCharts

Starting in early 2023, however, revenue growth began to steepen significantly. This coincided with the launch of Palantir’s fourth major software offering, the Palantir Artificial Intelligence Platform (AIP), in April 2023, which has since driven accelerated growth.

While AIP’s success plays a crucial role, other factors also contribute to Palantir’s growth.

2. Diversified Use Cases: Historically, Palantir primarily relied on government contracts, mainly with the U.S. military and related agencies. The arrival of AIP has dramatically expanded its market potential.

To promote AIP, Palantir has organized immersive seminars allowing corporate leaders to test the software’s capabilities. This initiative has proven successful, as the company has diversified into the private sector significantly over the last few years.

Image source: Investor Relations.

3. Profitablity: Palantir’s better revenue growth, combined with successful private sector penetration, has resulted in improved operating margins and consistent profitability.

Achieving profitability allowed Palantir to be included in the S&P 500, trading as part of the index since September. This inclusion suggests a positive outlook for the company, indicating that its growth is more than a temporary AI trend.

4. Institutional Investment: Joining the S&P 500 is a commendable achievement, but the real benefit may come from attracting more institutional investors willing to invest in Palantir.

5. Strategic Partnerships: Palantir’s collaborations with tech giants like Microsoft and Oracle earlier this year are pivotal. The company remains a vital player in the public sector, presenting lucrative opportunities as AI advances in defense technology.

Image source: Getty Images.

Assessing Valuation

While the factors mentioned indicate a promising future for Palantir, investors should carefully evaluate the company’s valuation fundamentals.

Currently, Palantir trades at a price-to-earnings (P/E) ratio of 256, which is exceedingly high and not the best metric for appraisal. Despite being profitable, the company’s net income remains relatively modest.

Even with several catalysts that may boost profits, the P/E ratio appears disconnected from the company’s fundamentals. Additionally, compared to other AI software-as-a-service (SaaS) competitors, Palantir’s price-to-sales (P/S) valuation has notably expanded.

PLTR PS Ratio data by YCharts

Is Palantir Stock Overvalued?

In my honest opinion, Palantir’s stock appears to be somewhat overvalued right now. Although I personally own shares and maintain a positive outlook, investors should proceed with caution when considering stocks with such high momentum.

A significant decline back to $6 seems unlikely. However, a potential 20% drop is certainly a possibility.

Ultimately, whether to invest now or wait for a more reasonable valuation is a personal choice. It’s crucial to remember that timing the market can be impractical.

Instead, focus on long-term trends that drive specific sectors and identify companies that are likely to emerge as leaders. In my view, Palantir fits this description in the AI space.

Growth stocks inherently carry higher volatility, and no company is shielded from macroeconomic influences. While I continue to believe in Palantir’s potential, investing at this high price means accepting a premium valuation. This isn’t inherently negative, but prospective buyers should weigh long-term considerations carefully.

Explore a Second Chance for Investment

Do you ever feel like you missed out on investing in successful stocks? If so, consider this opportunity.

Occasionally, our team of expert analysts issues a “Double Down” stock alert for companies they believe are on the verge of significant growth. If you’re worried you’ve missed your chance, now may be the perfect time to act before it’s too late. The facts speak volumes:

- Amazon: An investment of $1,000 in 2010 would be worth $21,122!*

- Apple: A $1,000 investment in 2008 would have grown to $43,756!*

- Netflix: Investing $1,000 in 2004 would have yielded $384,515!*

Currently, we are issuing alerts for three outstanding companies, and this may be one of your last chances.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Adam Spatacco has positions in Microsoft and Palantir Technologies. The Motley Fool has positions in and recommends Microsoft, Oracle, Palantir Technologies, ServiceNow, and Snowflake. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.