Analysts Predict Upside for First Trust Growth Strength ETF

At ETF Channel, we analyzed the trading prices of ETFs and their underlying holdings. Specifically, for the First Trust Growth Strength ETF (Symbol: FTGS), our research indicates that the implied analyst target price for the ETF stands at $35.13 per unit.

Current Market Conditions

With FTGS recently trading at approximately $31.66 per unit, analysts believe there is a potential upside of 10.95% based on the average targets of the ETF’s underlying holdings. Notably, three of these holdings are showing significant promise: Cadence Design Systems Inc. (Symbol: CDNS), Cencora Inc. (Symbol: COR), and EOG Resources, Inc. (Symbol: EOG). CDNS, currently priced at $269.47 per share, has an average analyst target of $321.00, indicating a potential upside of 19.12%. Similarly, COR’s recent price of $233.12 suggests a 12.14% upside to its target of $261.43 per share. EOG is expected to achieve a target price of $142.44, showing an 11.91% upside from its recent price of $127.28.

Performance Snapshot

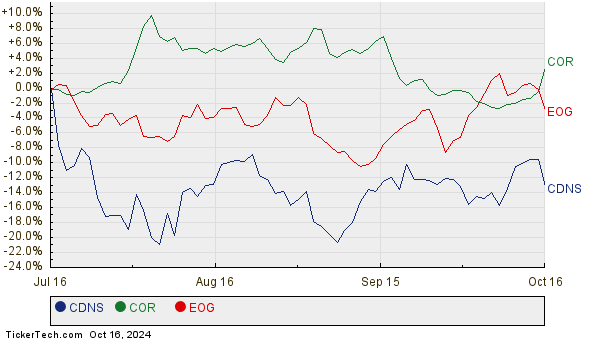

Below is a chart that compares the twelve-month price history of CDNS, COR, and EOG:

Combined, CDNS, COR, and EOG constitute 5.70% of the First Trust Growth Strength ETF. The table below summarizes the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Growth Strength ETF | FTGS | $31.66 | $35.13 | 10.95% |

| Cadence Design Systems Inc | CDNS | $269.47 | $321.00 | 19.12% |

| Cencora Inc | COR | $233.12 | $261.43 | 12.14% |

| EOG Resources, Inc. | EOG | $127.28 | $142.44 | 11.91% |

Analyzing the Forecasts

The question remains: Are analysts justified in their target prices, or are they too optimistic? Investors should consider whether these targets are based on sound reasoning or if they reflect outdated projections. While high price targets can signify confidence in a company’s future, they also risk becoming unrealistic and invite potential downgrades. Such inquiries warrant deeper analysis from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding DEWJ

• WELX Insider Buying

• EZM Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.