“`html

Exploring High-Growth Stocks: Potential for the Future

Investing in individual growth stocks can be a rollercoaster ride, but the potential rewards can be substantial. Since the 2008 financial crisis, numerous growth stocks have significantly outperformed passive index funds.

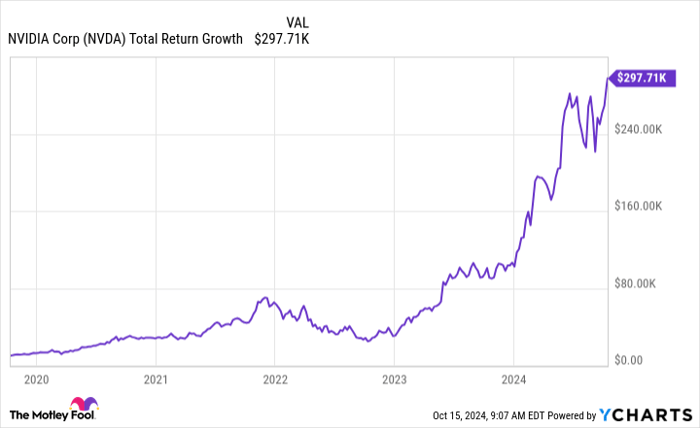

Some standout performers have even delivered returns exceeding 1,000% in less than five years. Nvidia (NASDAQ: NVDA), the chipmaker driving the artificial intelligence (AI) revolution, exemplifies this potential, turning a $10,000 investment into nearly $300,000 over the past 60 months.

NVDA Total Return Level data by YCharts.

My tax-advantaged portfolios include 14 stocks primarily held for their growth prospects. While some of these growth stocks pay dividends, that’s not the main reason for owning them.

Here, I’ll explain why I continue to invest in each of these companies and discuss their 12-month upside potential based on Wall Street’s consensus price targets and year-to-date performance.

Image Source: Getty Images.

Archer Aviation: Leading the Charge in Electric Air Taxis

Archer Aviation (NYSE: ACHR) is making strides in the electric vertical takeoff and landing (eVTOL) aircraft industry. The goal is to transform urban transportation with electric air taxis, potentially tapping into the $1 trillion global urban air mobility market.

Wall Street’s consensus suggests a 209% upside potential for Archer Aviation, indicating optimism for long-term growth despite a challenging 49.8% downturn year-to-date. The company’s advancements in aircraft development and partnerships with major airlines enhance its future prospects.

Aspen Aerogels: Setting New Standards in Insulation

Aspen Aerogels (NYSE: ASPN) specializes in advanced aerogel insulation materials across different sectors, including electric vehicles and sustainable construction. These products provide remarkable thermal performance and energy efficiency.

Aspen Aerogels has outperformed the S&P 500 with a 44.2% gain so far in 2024. Analysts foresee a 43.8% upside over the next year, driven by increasing demand for high-performance insulation materials.

CRISPR Therapeutics: The Future of Gene Editing

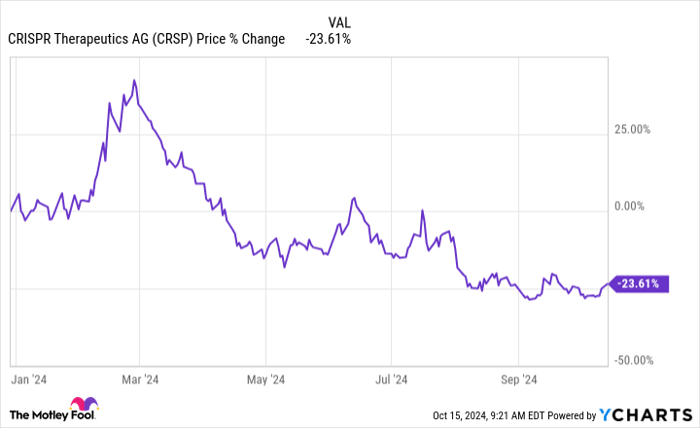

CRISPR Therapeutics (NASDAQ: CRSP) is leading efforts in developing gene-editing therapies. Recently, the company reached a milestone with Casgevy’s approval, a groundbreaking treatment for sickle cell disease and beta-thalassemia, in collaboration with Vertex Pharmaceuticals.

Despite a year-to-date decrease of 23.6%, Wall Street estimates a 72% potential gain over the next 12 months. The approval of Casgevy, the first therapy based on CRISPR technology, may significantly enhance long-term growth.

CRSP data by YCharts.

GE Aerospace: Innovating for a New Era

After its recent transformation, General Electric has emerged as GE Aerospace (NYSE: GE), zooming in on its core aviation business. The company is a leader in aircraft engines and systems, ready to capitalize on the recovery in the commercial aviation sector.

GE Aerospace has surpassed the S&P 500 with an impressive 88.8% year-to-date gain. Analysts foresee a 6.3% upside potential, underscoring the company’s focused approach and favorable industry conditions.

Howmet Aerospace: Shaping the Future of Aerospace

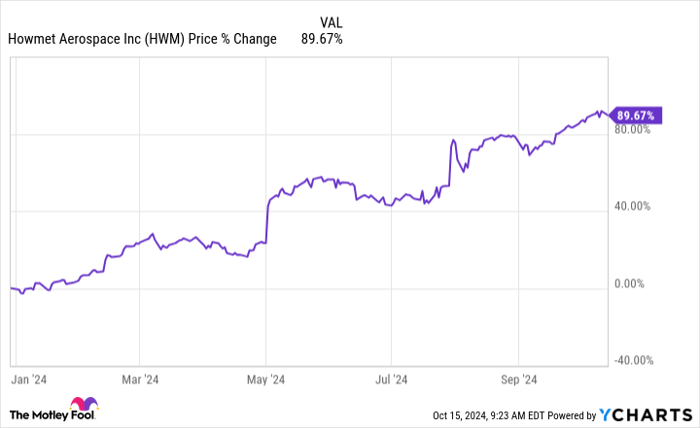

Howmet Aerospace (NYSE: HWM) delivers advanced engineered solutions for aerospace and transportation markets. Its lightweight materials and technologies are essential for enhancing fuel efficiency and performance.

Boasting an 89.6% year-to-date gain, Howmet Aerospace has outperformed the S&P 500 significantly. The modest 2.6% projected upside reflects the company’s strong recent performance and solid position in a recovering aerospace market.

HWM data by YCharts.

Intuitive Machines: Leading Commercial Lunar Missions

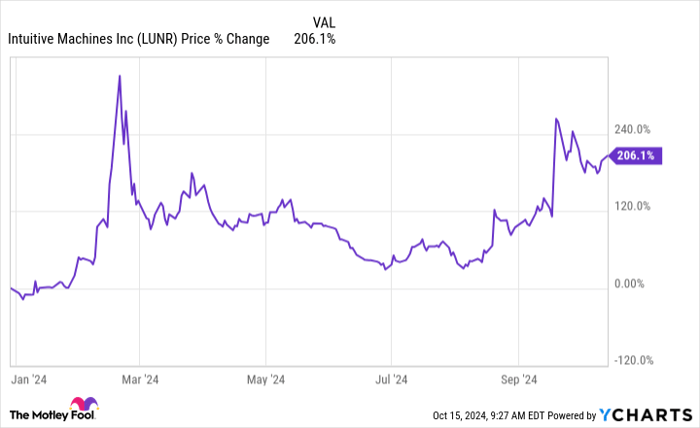

Intuitive Machines (NASDAQ: LUNR) is making a name for itself in commercial lunar payload delivery. The company is positioning itself as a key player in the flourishing commercial space industry with its ambitious lunar missions.

With a remarkable 206% gain year-to-date, Intuitive Machines holds a promising 38.2% upside potential according to analysts, showcasing its significant role in the expanding commercial space market.

LUNR data by YCharts.

Joby Aviation: Revolutionizing Urban Air Travel

Joby Aviation (NYSE: JOBY) is innovating with eVTOL aircraft designed for commercial passenger service. The company is on track to revolutionize urban transportation and has recently received significant investment from Toyota Motor.

Although down 17.2% year-to-date, Joby Aviation shows a promising 45.7% upside potential for the next 12 months, emphasizing its advancements in aircraft development and certification processes that could establish it as a leader in urban air mobility.

Kratos Defense & Security Solutions: Innovating for the Future

Kratos Defense & Security Solutions (NASDAQ: KTOS) specializes in uncrewed systems and cybersecurity for both defense and commercial sectors. Its focus on next-generation defense technologies positions it well in a changing defense landscape.

With a year-to-date growth of 24.9%, Kratos has seen modest success over the broader S&P 500 index. The company’s innovative defense solutions and expanding government contracts strengthen its outlook for the future.

“`

Top Tech Stocks to Monitor: Insights and Projections

As the technological landscape shifts, several companies stand out for their growth potential. However, these stocks are currently seen as fairly valued by Wall Street. Below is a detailed look at some key players in the market.

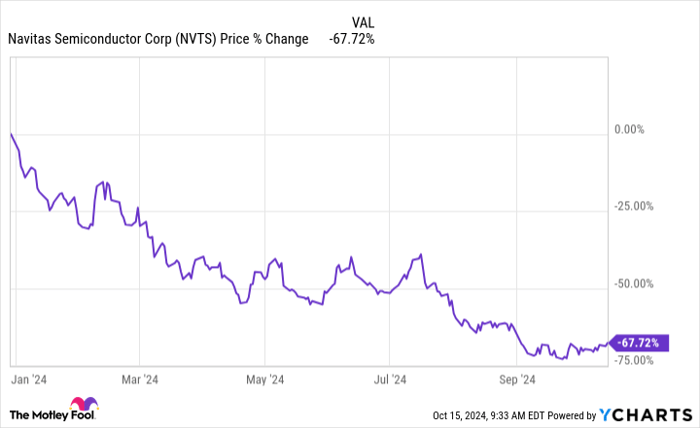

Navitas Semiconductor: A Leader in Power Efficient Solutions

Navitas Semiconductor (NASDAQ: NVTS) specializes in gallium nitride (GaN) power integrated circuits. These chips outperform traditional silicon solutions in efficiency and performance and are vital for fast charging, renewable energy, and electric vehicles.

This year, Navitas Semiconductor’s stock has declined by 67.7%. Yet analysts project a remarkable 114% upside, driven by the rising adoption of GaN technology across different industries.

NVTS data by YCharts.

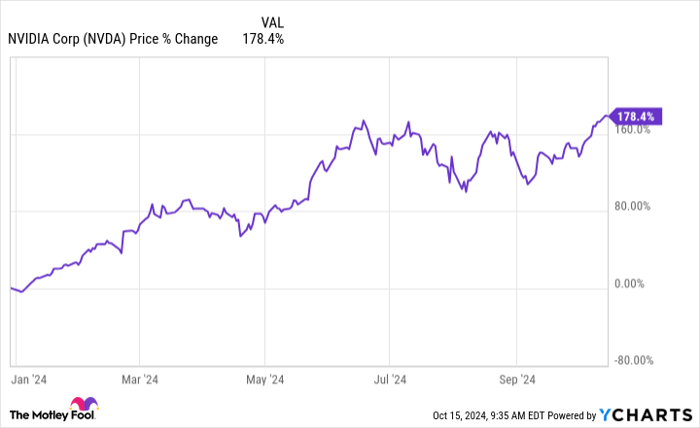

Nvidia: The Power Behind AI Innovations

As a giant in graphics processing units (GPUs), Nvidia is pivotal in the AI computing surge. Its chips are integral for training advanced AI models, placing the company in a favorable position to tap into the expanding AI market.

With a remarkable 178% gain so far this year, Nvidia has significantly outperformed the S&P 500. Analysts anticipate continued growth, projecting a 10.4% increase over the next year.

NVDA data by YCharts.

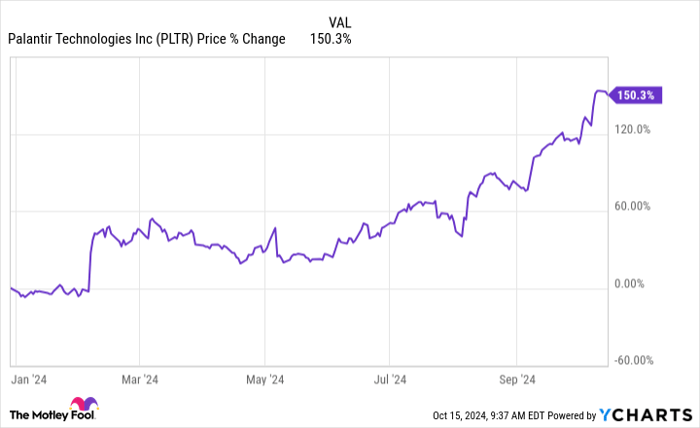

Palantir Technologies: Transforming Data into Decisions

Palantir Technologies (NYSE: PLTR) offers software for data analytics tailored for government and commercial clients. Its AI-powered platforms help organizations navigate complex data effectively.

This year, Palantir’s stock surged by 150%, significantly outpacing the S&P 500. However, analysts indicate a potential downside of 34% from current levels. Despite this, the growth of its commercial business and AI capabilities may foster long-term expansion.

PLTR data by YCharts.

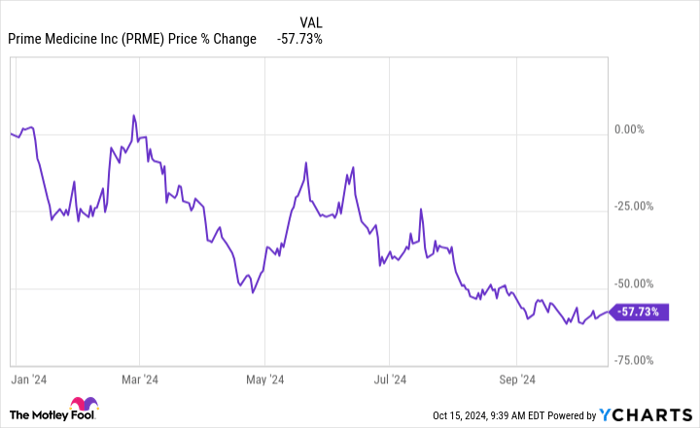

Prime Medicine: Innovating in Gene Editing

Prime Medicine (NASDAQ: PRME) is pioneering a next-generation gene-editing platform known as prime editing, which presents advantages over current CRISPR technologies. The company aims to create treatments for various genetic disorders.

Despite a 57.7% drop in stock price this year, Wall Street sees a promising 269% upside potential. Prime Medicine’s cutting-edge technology and wide therapeutic possibilities are expected to fuel growth in the future.

PRME data by YCharts.

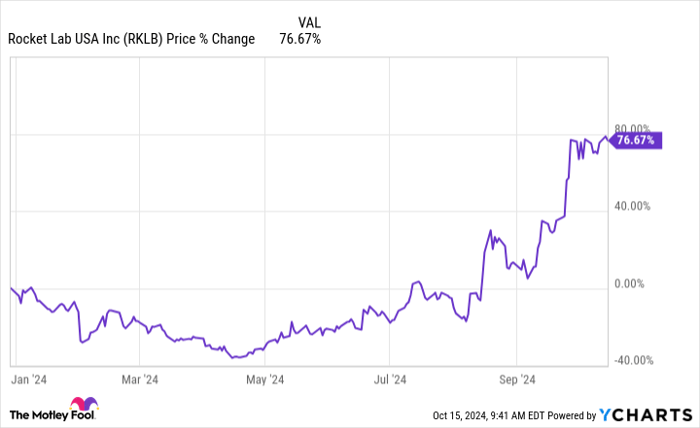

Rocket Lab USA: Advancing Space Access

Rocket Lab USA (NASDAQ: RKLB) specializes in launch services and spacecraft solutions aimed at the small satellite market. The company focuses on enhancing access to space through its innovative rocket technology.

With a 76.6% increase year-to-date, Rocket Lab has outpaced the S&P 500. However, analysts foresee a potential downside of 20%. Yet, its growing launch capabilities and space systems division could sustain long-term growth in the commercial space sector.

RKLB data by YCharts.

Taiwan Semiconductor Manufacturing: A Giant in Chip Production

Taiwan Semiconductor Manufacturing (NYSE: TSM) stands as the largest contract chipmaker globally, providing advanced semiconductors to major tech companies. Its leading technology and size position it strongly in the growing semiconductor market.

This year, Taiwan Semiconductor has gained 84.8%, outperforming the S&P 500. Analysts project a modest 3.7% upside, reflecting the firm’s robust performance and vital role in the technology supply chain.

Is Now the Right Time to Invest in Nvidia?

Before purchasing Nvidia stock, consider this:

The Motley Fool Stock Advisor team has recently highlighted what they believe are the 10 best stocks for investors today, and Nvidia is not among them. These selected stocks could yield substantial returns in the coming years.

For context, on April 15, 2005, Nvidia made that list; if you’d invested $1,000 then, it would now be worth $806,459!

Stock Advisor equips investors with a straightforward strategy, providing ongoing updates and two new stock recommendations each month. Since 2002, the service’s returns have more than quadrupled those of the S&P 500.

Discover the 10 stocks »

*Stock Advisor returns as of October 14, 2024

George Budwell holds positions in Archer Aviation, Aspen Aerogels, CRISPR Therapeutics, GE Aerospace, Howmet Aerospace, Intuitive Machines, Joby Aviation, Kratos Defense & Security Solutions, Navitas Semiconductor, Nvidia, Palantir Technologies, Prime Medicine, Rocket Lab USA, Taiwan Semiconductor Manufacturing, and Toyota Motor. The Motley Fool holds positions in and recommends CRISPR Therapeutics, Nvidia, Palantir Technologies, Taiwan Semiconductor Manufacturing, and Vertex Pharmaceuticals. The Motley Fool also recommends Rocket Lab USA. For more details, see the Motley Fool’s disclosure policy.

The views expressed in this article represent those of the author and do not necessarily reflect the views of Nasdaq, Inc.