Rambus Records 27% Decline Amid AI Market Shift

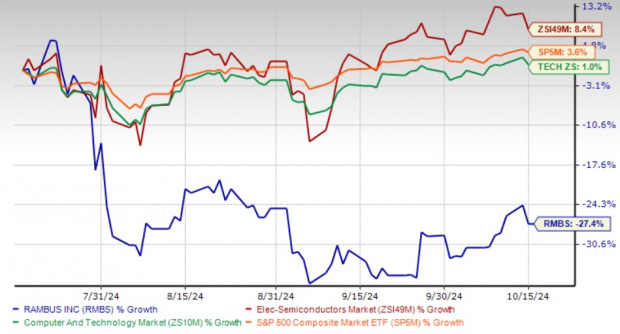

Rambus (RMBS) shares have dropped 27.4% in the last three months, significantly lagging behind the Zacks Electronics – Semiconductors industry’s 8.4% return. The stock’s performance also fell short compared to the Zacks Computer and Technology sector as well as the S&P 500.

Challenges in Revenue Growth

This decline stems largely from disappointing top-line results in the third quarter of 2024. Rambus is experiencing a slowdown in revenue growth as the broader enterprise market shifts its focus towards artificial intelligence (AI) and machine learning, leading to decreased demand for its traditional memory solutions tailored for server systems.

Rambus’ Strategy in the AI Realm

In response to these challenges, Rambus is targeting emerging opportunities in the AI sector. The company is expanding its DDR5 system-on-chips portfolio, which is essential for enhancing memory performance in AI workloads. Recently, Rambus launched memory interface chipsets for Gen5 DDR5 Rank Dual Inline Memory Module (RDIMM) and next-generation DDR5 Multiplexed RDIMMs.

With a fifth-generation registering clock driver (RCD), the Gen5 DDR5 RDIMM offers a processing speed of 8000 MT/s. Conversely, the MRDIMM features a multiplexed RCD and data buffer capable of operating at a speed of 12,800 MT/s. These products incorporate a second-generation Power Management IC, PMIC5030, which provides significant current at lower voltages, further enhancing processing speed.

Rambus 3 Month Performance

Image Source: Zacks Investment Research

Expanding Focus on AI and Data Centers

Rambus’ strategy includes tapping into the growing demand for high-bandwidth, low-latency memory solutions necessary for AI and machine learning applications. Its high-performance memory products, including DDR5 and HBM (high bandwidth memory), are vital for AI data centers that handle vast amounts of information efficiently.

The company’s concentration on next-generation memory solutions positions it to capitalize on the surging need for AI infrastructure. New products like the Client Clock driver chip, PCIe 7 IP solutions, and HBM4 controller chips aim to generate long-term revenues.

Adoption of Patented Technologies

In addition to its AI initiatives, Rambus is witnessing a rise in the adoption of its patented products. Major players like Advanced Micro Devices (AMD), NVIDIA (NVDA), Broadcom, Cisco (CSCO), IBM, Marvell, MediaTek, Micron, Qualcomm, and STMicroelectronics utilize Rambus’ patented technologies.

Collaboration with AMD began in the mid-2000s with a patent license agreement, allowing the use of Rambus’ technologies in various applications like DDR2, DDR3, and PCI Express products. NVIDIA has leveraged Rambus technology for over a decade, while Cisco has also used its security technologies consistently for the past ten years.

For the third quarter, Rambus anticipates revenues between $139 million and $157 million. According to the Zacks Consensus, the estimate stands at $147 million—a year-over-year increase of 9.5%.

Conclusion: Holding RMBS Stock

Despite challenges such as reduced spending on traditional servers impacting top-line growth, Rambus’ commitment to memory solutions and AI-focused products suggests promise for long-term growth. Presently, it holds a Zacks Value Score of D, which implies it may be presently overvalued.

Considering these elements, maintaining a position in this Zacks Rank #3 (Hold) stock may be a strategic move for investors as Rambus adjusts to industry changes and seizes new opportunities. You can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Spotlights Top Semiconductor Stock

As a note, it’s only 1/9,000th the size of NVIDIA, whose stock surged over +800% since a recommendation. While NVIDIA remains stable, this new top chip stock has considerable potential for growth.

The company is set to benefit from robust earnings growth and an expanding customer base, positioning itself to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is forecasted to rise from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest insights from Zacks Investment Research, you can download 5 Stocks Set to Double. Click here for your free report.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.