Why Microsoft Stands Out in the AI Boom and Dividend Payouts

The artificial intelligence (AI) market is rapidly expanding, creating opportunities for growth-focused companies. Yet, income-seeking investors can also benefit, as prominent AI players like Nvidia, Alphabet, and Meta Platforms offer dividends. Among these, Microsoft (NASDAQ: MSFT) provides the best balance between AI growth potential and dividend returns. Here’s why.

Examining Microsoft’s Dividend Standing

Many leading tech firms capitalizing on AI do not pay dividends, or have only recently begun to do so. For instance, Amazon does not offer a dividend at all, while Alphabet and Meta Platforms have only done so for a short time.

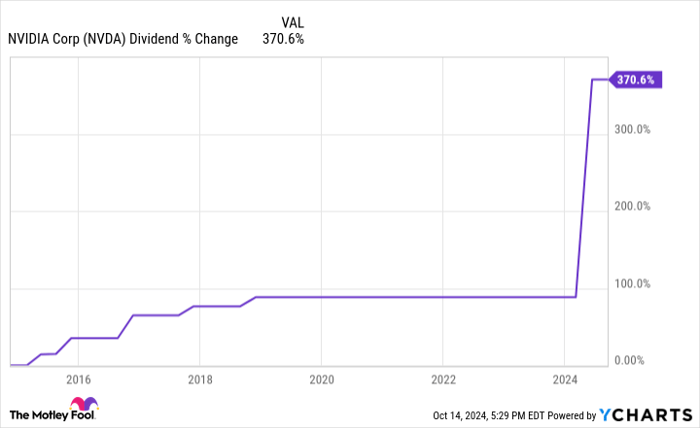

Although Nvidia does have a dividend, it remains minimal. Its forward yield is only 0.03%. This can be attributed in part to the company’s soaring stock prices. While Nvidia has increased its dividend significantly, the total growth of its dividend per share over the past decade stands at 370.6%.

NVDA Dividend data by YCharts

However, Nvidia’s quarterly dividend payment is just $0.01 per share. In contrast, Microsoft delivers a much more attractive forward yield of 0.8%. Microsoft consistently raises dividends and has increased its payouts by 167.7% over the last decade.

MSFT Dividend data by YCharts

With a quarterly dividend per share of $0.83, Microsoft outpaces its tech competitors like Nvidia. Furthermore, its cash payout ratio is just below 30%, indicating significant room for future dividend increases. But does Microsoft have the business stability to support these payouts long-term?

Microsoft in the AI Era

The AI boom can be traced back to the rise of ChatGPT, which Microsoft embraced early. Back in 2019, Microsoft invested in OpenAI, the driving force behind ChatGPT. Following the bot’s success, Microsoft strengthened its partnership with OpenAI. Yet, that represents only part of its foray into the AI field. Microsoft also offers various AI-related services through its cloud computing division, Microsoft Azure.

Demand for these services is robust, leading to impressive growth. In its fourth fiscal quarter of 2024, which ended on June 30, Microsoft reported total revenue of $64.7 billion, a 15% increase year over year. Specifically, Azure’s revenue soared by 29% compared to the previous year. AI has played a substantial role in this growth.

During the earnings conference call, CEO Satya Nadella noted, “Our share gains accelerated this year driven by AI.” Both AI and cloud computing are projected to fuel Microsoft’s growth for the foreseeable future. Beyond this, Microsoft holds a dominant position in the computer operating systems market and continues to excel in gaming.

Microsoft enjoys several competitive advantages. The costs associated with switching away from its productivity tools (like Excel, Word, Teams, etc.) are high, discouraging businesses from leaving. Plus, Microsoft boasts one of the most valuable brand names worldwide, which adds to its competitive edge.

With a strong cash flow and a robust balance sheet, Microsoft is well-positioned for the future, evidenced by its AAA credit rating from Standard & Poor’s—a rating stronger than that of the U.S. government.

Investors can find opportunities for both income and growth in Microsoft, whether from AI initiatives or its other business lines.

Is it Time to Invest $1,000 in Microsoft?

Before making an investment in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now, and Microsoft did not make the list. The selected stocks are anticipated to deliver substantial returns in the coming years.

For context, when Nvidia was chosen on April 15, 2005, a $1,000 investment at that time would have grown to approximately $806,459!*

Stock Advisor provides a straightforward blueprint for investors, offering guidance on portfolio management, regular analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Explore the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Disclosure: John Mackey, former CEO of Whole Foods Market, is a member of The Motley Fool’s board. Randi Zuckerberg, a former director at Facebook, serves on The Motley Fool’s board as well. Furthermore, Suzanne Frey, an executive at Alphabet, is also a board member. The Motley Fool invests in and recommends Microsoft, Nvidia, Alphabet, Amazon, and Meta Platforms. They suggest various options, including long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. You can find their disclosure policy for more details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.