Regeneron Pharmaceuticals Prepares for Q3 Earnings Announcement

Company Overview

Regeneron Pharmaceuticals, Inc. (REGN), based in Tarrytown, New York, is known for discovering and developing medicines that treat a variety of diseases. With a market capitalization of $112 billion, Regeneron operates across North America, Europe, and Asia. The company will release its fiscal Q3 earnings results before the market opens on Thursday, Oct. 31.

Analysts’ Expectations

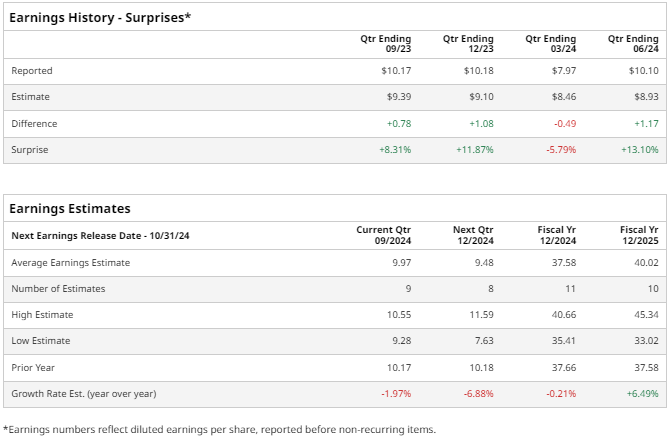

Analysts predict that Regeneron will report a profit of $9.97 per share for Q3, reflecting a 2% decrease from last year’s $10.17 per share. Over the past four quarters, Regeneron has beaten Wall Street’s profit predictions three times, falling short only once. For the latest quarter, the company’s adjusted earnings reached $10.10 per share, exceeding expectations by 13.1%.

Future Projections

Looking ahead to fiscal 2024, analysts forecast Regeneron’s EPS to be $37.58, showing a slight decrease from $37.66 in fiscal 2023.

Stock Performance

As of now, REGN stock has increased by 14.8% year-to-date (YTD), although it lags behind the broader S&P 500 Index, which has gained 22.5%. Notably, the stock has outperformed the Healthcare Select Sector SPDR Fund (XLV), which has risen by 12.4% during the same period.

Market Reactions

On September 24, REGN’s stock fell more than 4%, a notable dip in the Nasdaq 100, following a downgrade from Leerink Partners, which changed its rating from “Outperform” to “Market Perform.” In contrast, shares climbed 1.3% after the company announced better-than-expected Q2 earnings on August 1.

Analyst Ratings

The overall sentiment toward REGN stock is highly positive, currently holding a “Strong Buy” rating. Out of 25 analysts reviewing the stock, 18 recommend a “Strong Buy,” one suggests a “Moderate Buy,” five advise a “Hold,” and one recommends a “Moderate Sell.” This sentiment has slightly shifted compared to a month earlier when there were 19 “Strong Buy” ratings. Analysts project an average price target of $1,142.83 for REGN, indicating a potential upside of 13.4% from current trading levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.