Xcel Energy Prepares for Earnings Release Amid Mixed Analyst Sentiment

Xcel Energy Inc. (XEL), based in Minneapolis, is a key player in electricity generation and distribution. With a robust market cap of $35.24 billion, the company provides services to millions of customers across eight U.S. states. Investors are eagerly awaiting the announcement of its Q3 earnings, which is scheduled for Thursday, Oct. 31, before the market opens.

What’s Expected in the Upcoming Earnings Report

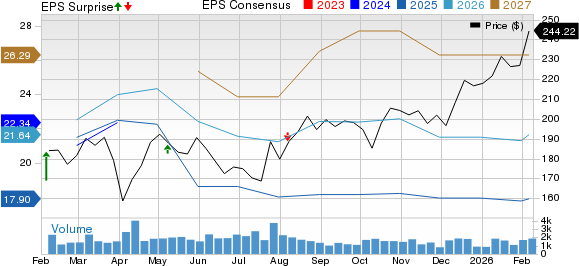

Analysts have high expectations for Xcel, predicting a profit of $1.31 per share for the latest quarter, marking a 6.5% increase from last year’s $1.23 per share. Despite these expectations, Xcel has struggled to meet Wall Street’s earnings estimates in three out of the last four quarters.

Review of Recent Performance

In its last quarter, Xcel posted adjusted earnings of $0.54 per share, which was 1.8% lower than the consensus forecast. The decline was attributed to rising operating costs and a dip in demand, which contributed to XEL’s second-quarter earnings miss.

Looking ahead, analysts foresee Xcel reporting earnings of $3.55 per share for the fiscal year 2024, a growth of 6% compared to $3.35 in fiscal 2023.

Stock Performance and Market Position

XEL stock is currently up 3.4% year-to-date. However, this performance lags behind the S&P 500 Index’s ($SPX) impressive 22.5% gains and the Utilities Select Sector SPDR Fund’s (XLU) 29.8% increase in the same period.

After releasing its Q2 earnings on Aug. 1, XEL stock increased by 1.4%. The company reported a revenue of $3.03 billion, falling short of the expected $3.28 billion.

Analyst Ratings and Future Outlook

The current outlook for XEL shares is moderately positive, reflected in an overall “Moderate Buy” rating from analysts. Out of 16 analysts, half recommend a “Strong Buy,” while the other half suggest investors “Hold” their shares.

Analysts set an average price target of $67.60 for XEL stock, indicating a potential upside of 5.6% from current prices.

More Stock Market News from Barchart

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.