Comcast Prepares for Earnings Report Amid Ongoing Challenges

Market Expectations and Analyst Predictions

Philadelphia-based Comcast Corporation (CMCSA), a major player in the media and technology sector, has a market cap of $165.2 billion. Offering services like video streaming, cable television, high-speed internet, and communication solutions, the company is set to release its fiscal third-quarter earnings for 2024 on Thursday, Oct. 31, before markets open.

Projected Earnings Per Share (EPS) Decline

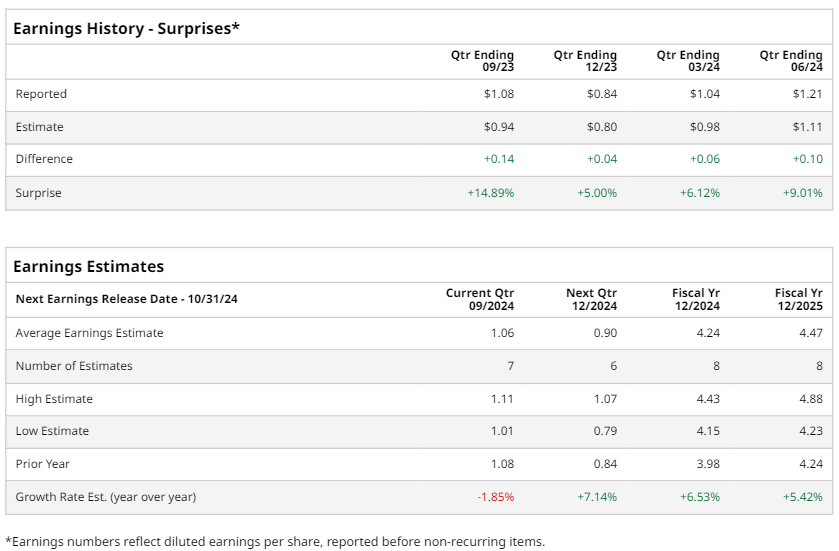

Analysts anticipate a profit of $1.06 per share on a diluted basis, reflecting a 1.9% decrease from last year’s $1.08 in the same quarter. Notably, Comcast has exceeded Wall Street’s EPS estimates in its last four quarterly reports.

Annual Earnings Forecasts

For the full year, analysts project that CMCSA will report an EPS of $4.24, which is a 6.5% increase from $3.98 in fiscal 2023. Looking ahead, its EPS is expected to rise by 5.4% in fiscal 2025 to reach $4.47.

Stock Performance Comparison

Over the past 52 weeks, CMCSA shares have declined by 4.5%, underperforming the S&P 500’s impressive 33.6% gains. Similarly, it lagged behind the Communication Services Select Sector SPDR ETF Fund’s (XLC) gains of 33.5% during the same period.

Challenges Facing Comcast

The company encounters significant hurdles in its traditional cable and broadcasting segments, primarily due to the growing phenomenon of cord-cutting as audiences turn to streaming services. Despite attempts to compete in this space with platforms like Peacock, Comcast finds itself grappling with intense competition. Furthermore, recent data theft incidents impacting a vast number of Comcast’s Xfinity customers have compounded the company’s difficulties.

Past Performance Insights

On July 23, after reporting its Q2 results, CMCSA shares dropped more than 2%. While the adjusted EPS of $1.21 surpassed Wall Street’s expectation of $1.11, revenues of $29.7 billion fell short of forecasts that anticipated $30.1 billion.

Analysts Maintain Optimism

Despite recent challenges, the consensus among analysts remains moderately positive with a “Moderate Buy” rating overall. Out of 29 analysts monitoring the stock, 15 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 12 advise a “Hold,” and one recommends a “Strong Sell.” The average price target for CMCSA stands at $46.77, indicating a potential upside of 10.7% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.