Merck Prepares for Q3 Earnings Amid Sluggish Stock Performance

Merck & Co., Inc. (MRK), based in Rahway, New Jersey, is a leading healthcare company. Known for its work in pharmaceuticals, vaccines, and animal health, Merck is dedicated to providing innovative treatments that enhance global health. With a market cap of $279.7 billion, the company is expected to announce its Q3 earnings report on Thursday, Oct. 31, before the market opens.

Analysts Anticipate Earnings Decline

Prior to the earnings release, analysts project that MRK will report a profit of $1.59 per share, a decrease of 25.4% from the $2.13 earned in the same quarter last year. Notably, the company has consistently outperformed Wall Street’s earnings expectations for the past four quarters.

In its last quarter, Merck delivered adjusted earnings of $2.28 per share, exceeding analyst predictions by 5.6%. The strong performance was largely driven by increased sales of Keytruda and improvements in oncology, cardiovascular, and vaccines, which helped offset weaker results in diabetes and virology.

Looking Ahead to Fiscal 2024

For fiscal year 2024, analysts forecast MRK’s earnings per share (EPS) to reach $7.85, reflecting an impressive 419.9% increase from $1.51 in fiscal 2023.

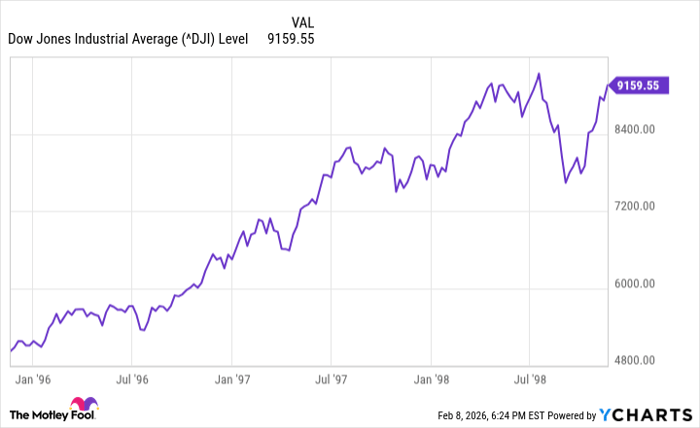

Stock Performance Lags Behind Indices

Year-to-date, MRK shares have risen 1.3%, which is significantly lower than the 22.5% gains of the broader S&P 500 Index ($SPX) and the 12.4% increase of the Health Care Select Sector SPDR Fund (XLV). This underperformance is attributed to rising competition in the diabetes medication market along with challenges in revenue growth.

Investor Sentiment Remains Positive

Despite some challenges, analysts maintain a positive outlook on MRK, giving it an overall “Strong Buy” rating. Among the 25 analysts covering the stock, 23 recommend a “Strong Buy,” while two suggest a “Hold.”

The average analyst price target stands at $140.39, indicating a potential upside of 27.1% from the current trading levels.

More Stock Market News from Barchart

On the date of publication, Rashmi Kumari did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.