Banks Exceed Expectations, Mixed Results for AI Chip Producers

The third quarter earnings season has begun with varied performances among key sectors.

Major banks, including JPMorgan, Goldman Sachs, Morgan Stanley, Bank of America, and Citigroup, reported earnings that surpassed forecasts. This success can be attributed to increased fees from investment banking and stronger trading revenues compared to the previous year.

In contrast, the early reports from the AI chip sector offered a mixed picture. TSMC is optimistic, predicting that revenue from advanced AI chips will more than triple this year. However, ASML revealed that orders for chip-making equipment were less than half of what analysts had expected, indicating weaker demand for traditional chips used in devices like PCs, smartphones, and cars.

Broader Earnings Growth Beyond Mega Caps

Overall, the projected earnings growth for the S&P 500 in the third quarter is +2.9% year-over-year, marking the fifth consecutive quarter of positive earnings growth.

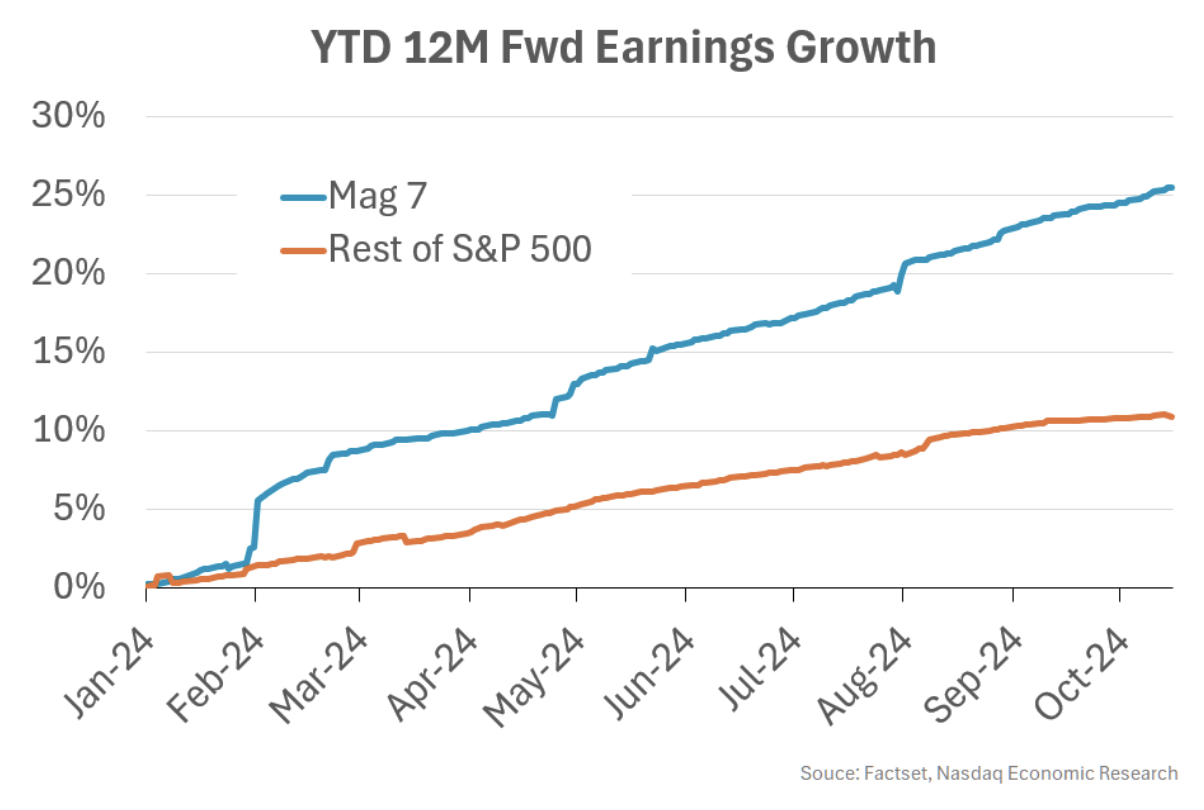

While the mega-cap group known as the Mag 7 continues to be a significant driver of growth, it is important to note that earnings are expanding beyond these top performers.

So far this year, forward earnings for the rest of the S&P 500 have risen by over +10% (as shown by the orange line in the chart), although they still lag behind the Mag 7’s impressive +25% growth (represented by the blue line).

Mag 7 Sees Earnings Growth but Faces Price Stagnation

Despite the Mag 7’s strong earnings growth, their stock prices have not reached new highs recently.

In fact, these stocks have not set a new record in three months and are currently 4% below the record highs seen in July (as illustrated in the chart below).

Conversely, the rest of the S&P 500 has set 17 new record highs in the last three months, thanks to increasing earnings.

One challenge facing the Mag 7 is the high level of investment needed for AI progress, which has fueled much of their stock price growth over the past few years. For instance, Amazon, Google, Meta, and Microsoft are collectively expected to spend $231 billion this year, reflecting a 56% increase from $155 billion in the previous year.

This situation suggests that mere optimism around AI investment is no longer sufficient. Investors are now seeking tangible results from these expenditures before driving stock prices higher.

Small Caps Struggle With Negative Earnings

While large-cap earnings are beginning to expand, small-cap companies continue to face hurdles.

The S&P 600, which represents small-cap stocks, is projected to experience another quarter of negative earnings growth, adding to two consecutive years of declines (highlighted in the chart below).

Small caps have been particularly affected due to holding a significantly larger share of floating rate debt—five times more than large caps. As a result, the Federal Reserve’s rate hikes have squeezed their profit margins more severely.

With the Fed recently shifting to a rate-cutting approach at the end of Q3, it is expected that small-cap earnings will not recover until Q4 and possibly into 2025, benefiting from relief on margins as rates decrease.

In summary, while the third quarter shows growth in earnings for large caps, small caps are still navigating through difficult conditions.

The information contained above is provided for informational and educational purposes only. It should not be considered investment advice for specific securities or overall investment strategies. Nasdaq, Inc. and its affiliates do not recommend buying or selling any security or making representations about the financial health of any company. Results may vary from those expressed or implied. Past performance is not indicative of future results, and investors should conduct their own research and consulting from a financial advisor is advised. © 2024. Nasdaq, Inc. All Rights Reserved.