“`html

Uranium Stocks Heat Up Following Major Energy Deals

Uranium stocks are on the rise.

Recently, Amazon announced a partnership with Dominion Energy, committing over $500 million to nuclear power. This move aligns with Amazon’s increasing demand for clean energy driven by its artificial intelligence (AI) projects.

A large AI model like GPT-3 reportedly requires nearly 1,300 megawatt hours (MWh) of electricity—equivalent to the annual energy consumption of 130 U.S. homes.

For perspective, streaming Netflix for an hour consumes around 0.8 kWh (0.0008 MWh). Therefore, it would take 1,625,000 hours of streaming to match the energy needed to train GPT-3.

Amazon’s deal follows recent news that Microsoft partnered with Constellation Energy to restart the Three Mile Island nuclear facility as part of its AI energy strategy. Additionally, Google has plans to source nuclear power from Kairos Power.

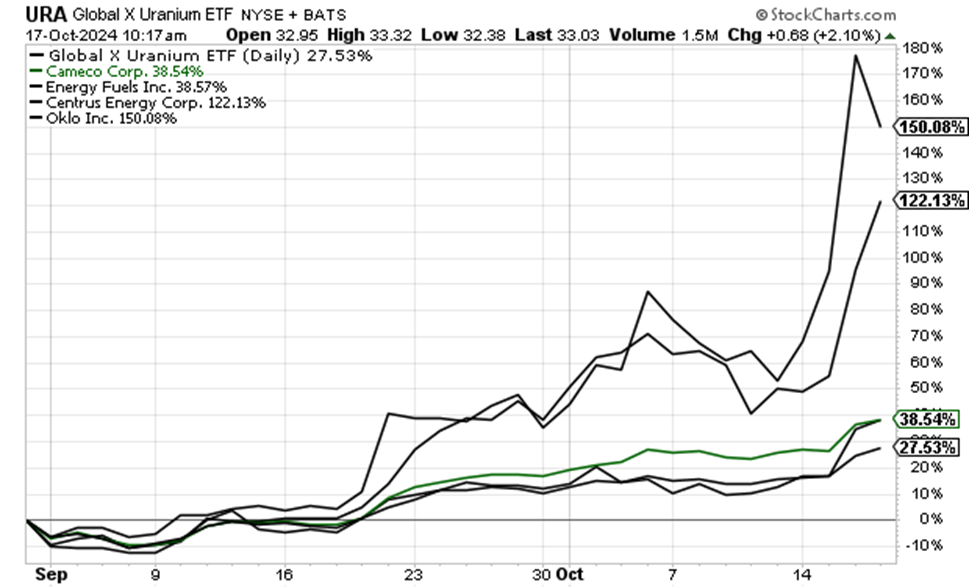

The surge in uranium and nuclear technology stocks is noteworthy. Here’s a list of five prominent investments in this sector:

- Global X Uranium ETF (URA)

- Cameco Corp (CCJ)

- Energy Fuels Inc (UUUU)

- Centrus Energy Corp (LEU)

- Oklo Inc (OKLO)

Since September 1, these stocks have increased in value by 28% to 150%.

Source: StockCharts.com

Congratulations are in order for Luke Lango’s Innovation Investor subscribers. They recently secured a 55% profit on part of their investment in NuScale Power (SMR) within just two weeks.

Eric Fry’s Leverage subscribers also have something to celebrate, as their call option on URA has risen 38% since its opening on October 1.

If you’re looking to enter the market, it’s wise to exercise caution. Luke, in his Innovation Investor Daily Notes, advised:

We are strongly optimistic about nuclear energy stocks. However, we recommend against chasing this rally right now. According to him, it feels like a peak moment of excitement for nuclear energy stocks, suggesting that waiting for a pullback could be prudent.

Big Moves in Big Tech Reflect AI’s Future, But Exercise Caution with New Investments

While the shift toward nuclear power by leading tech companies indicates a solid commitment to AI, caution is still necessary.

Recently, Louis Navellier shared insights on the evolving AI landscape. He cautions investors:

Investing thoughtlessly in early AI stocks may lead to significant losses, as I’ve frequently warned in my 47 years on Wall Street. Navellier notes that understanding market trends is crucial for making substantial gains in 2024.

For deeper insights into this AI transformation, you can explore Navellier’s research.

Bitcoin’s Recent Breakout: A Sign of Genuine Strength or Just Another False Alarm?

At the end of September, Bitcoin briefly climbed above its long-standing downtrend, prompting speculation about a possible recovery.

Luke, our crypto analyst, identified $64,000 as a critical level to watch. Establishing this price as new support could confirm a bullish outlook for Bitcoin.

Unfortunately, Bitcoin fell below this threshold, dipping nearly to $60,000 by early October.

Source: StockCharts.com

Recently, Bitcoin has rebounded somewhat, surging about 10% and hitting $68,000 briefly before retreating.

While this gain is encouraging, past experiences remind us to be cautious. Our stance from the October 1 Digest still stands:

Though we appreciate these gains, we would be more confident if Bitcoin revisited $64,000 as a new support level. This transition would signify a solid foundation for potential future growth.

A Historical Look at Bitcoin Shows Upcoming Potential

Bitcoin’s recent stagnation is not only rare but might indicate a forthcoming surge.

According to Luke’s update in Crypto Investor Network, this month marks Bitcoin’s 8th consecutive month without a movement over 20%.

“““html

Bitcoin’s Unusual Stability: What to Watch for Next

Bitcoin’s Monthly Movements Remain Below 20%

Bitcoin’s price changes have stayed under 20% since February. If this trend persists, it will mark the eighth consecutive month of minimal movement.

This pattern is rare for Bitcoin.

Interestingly, Bitcoin has only experienced one instance before where it had eight months of less than 20% movement. This occurred in the summer of 2015. During that period, Bitcoin hovered around $250 without significant fluctuations from February to September.

The situation changed dramatically in October 2015 when Bitcoin surged nearly 40%. By the end of 2016, its value had more than tripled.

Key Price Levels to Monitor

As we look ahead, there are important price points to keep in mind.

First, a pullback to $64,000 would be ideal, allowing Bitcoin to stabilize before climbing again.

Next, the $68,000 mark is notable as it represents a double-top from July. Yesterday, Bitcoin briefly exceeded this level before being pushed back down.

Additionally, watch for the $71,000 resistance level, and finally, the all-time high of $73,835.

Overall, we anticipate a pattern of “two steps forward, one step back” in the coming weeks, with a general upward trend. Luke will provide updates on this situation in the Digest.

Be Cautious: Market Valuations Matter

Frequent readers of the Digest know we have addressed the current high market valuations. While there’s potential for profit in this bullish environment, it’s important to acknowledge the risks associated with overvaluation.

Eric, our macro expert, shares a similar view in his October issue of Investment Report:

Valuation matters.

U.S. stock valuations are nearing record highs, which typically indicates low potential for future wealth accumulation, all else being equal…

While today’s stock market does not show the same extreme enthusiasm as during the dot-com bubble, it still presents serious valuation concerns…

For instance, Eric highlights the S&P’s price-to-earnings (P/E) ratio. Currently standing at 26.4, this level suggests that history indicates greater chances of losses over the next decade:

At 26.4 times earnings, today’s P/E ratio is not simply in the highest decile since 1953; it is among the highest of that decile, a particularly ominous sign.

When valuations have reached this level or higher, they have only produced a 10-year gain 27% of the time, leading to a loss 73% of the time.

This data doesn’t mean Eric plans to exit the market. However, he advises maintaining a selective approach to new investments, focusing on those with solid valuations for long-term stability.

Additional Factors to Consider in Stock Selection

Beyond attractive valuations, Eric looks for companies with a robust economic moat and those that are unlikely to be replaced by AI.

In his July issue, he provided examples of resilient industries such as:

· Shipping

· Cosmetics

· Lumber

· Energy Generation and Storage

· Travel

· Sporting Goods

· Rail Transit

· Agriculture

While these industries may not be entirely immune to the impact of AI, they are considerably more secure.

Invest in AI, given the vast funds being allocated by Big Tech toward nuclear power as evidence of AI’s permanence. Nevertheless, balance your portfolio with stocks that can endure, or even flourish, irrespective of AI’s influence.

To explore more of Eric’s insights as a subscriber of Investment Report, click here.

In summary: Stay engaged with this bullish market, but recognize that not all rising stocks will yield long-term profits given current valuations.

Have a good evening,

Jeff Remsburg

“`