Etsy (NASDAQ: ETSY), an online marketplace for artisans, is facing some tough times. Over the past year, its stock price has dropped by 17%, and it has plummeted 82% from its all-time highs in 2021. Last month, Etsy was removed from the S&P 500 index after being part of it for four years. Increasing short interest in the stock, which moved from 12% to 17% in the past year, suggests that many investors believe its challenges will continue.

Are these concerns justified, or might Etsy be on track for a turnaround? Let’s explore the situation further.

Financial Struggles Facing Etsy

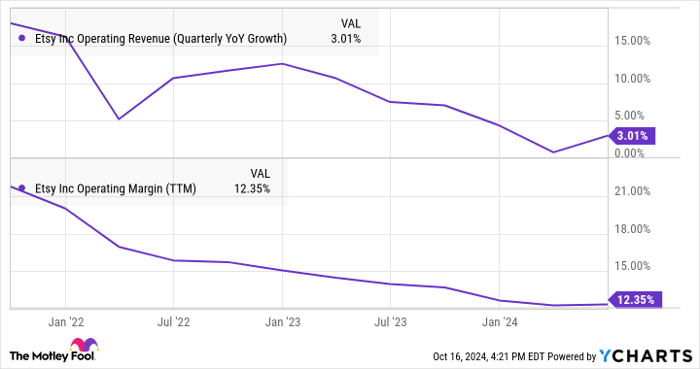

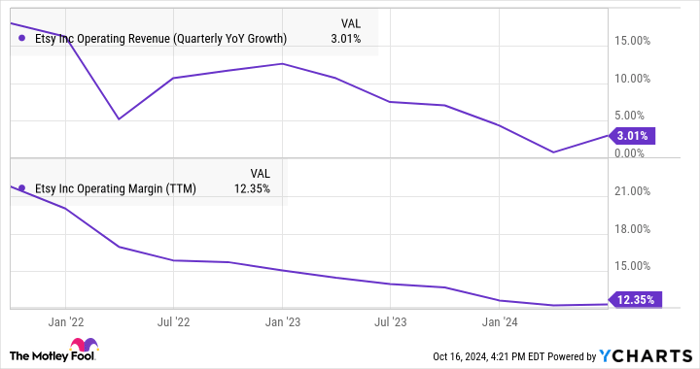

Critics of Etsy point to slowing sales growth and tighter operating margins, and they have valid concerns. The company has indeed shown negative trends in its finances over the last two years:

ETSY Operating Revenue (Quarterly YoY Growth) data by YCharts

However, it’s worth noting that Etsy’s overall revenue continues to grow, and the company is consistently generating strong cash profits. Encouragingly, key financial metrics have shown improvement in the last two quarters.

Etsy’s Strategies for Recovery

While Etsy’s management faces challenges, there are signs of progress. Some improvements stem from external factors, like a stronger economy that encourages consumer spending. Etsy is also implementing changes to enhance its performance.

For instance, Etsy is refining its business model. In the past, the focus was mainly on maximizing gross merchandise sales (GMS). Now, the emphasis is shifting toward providing a better customer experience. Their current marketing strategy promotes gifts, which is expected to gain traction as the holiday season approaches. Features such as gift lists and personalized messages have already shown success, leading to greater sales for gift-marked transactions compared to those in Etsy’s usual catalog.

Data from years of customer interactions, combined with advanced artificial intelligence (AI) analytics, fuels this marketing approach. Rather than only showcasing popular items, Etsy aims to help buyers discover unique products that may interest them, thereby enhancing the shopping experience.

“We’re going to see significant improvements in the variety of items and sellers we’re highlighting,” said CEO Josh Silverman during the latest earnings call. He believes this increased diversity will lead to more frequent visits from customers, as they will recognize the breadth of what Etsy has to offer.

In addition, Etsy is utilizing generative AI tools to assist customers in finding suitable products and creating personalized greeting messages. While it may seem unusual to blend technology with artisan goods, these AI innovations align well with Etsy’s mission.

The Path Forward for Etsy

What does the future hold for Etsy, and how might its stock perform moving forward?

Stock volumes are likely to decline, as Etsy shifts its strategy toward inspiring repeat visits instead of maximizing immediate sales. If this approach proves successful, it may enhance profit margins over time. Additionally, as inflation eases, consumer spending could rebound, benefitting Etsy despite the external factors that the company can’t control. This positive trend is already in motion.

Currently, Etsy shares are considered undervalued compared to their e-commerce counterparts like Amazon and MercadoLibre. For instance, the price-to-sales ratio for Etsy stands at 2.2, and their price-to-earnings ratio is at 24, meaning there’s potential for significant gains if the stock rebounds.

Looking ahead, I am optimistic about Etsy’s prospects. In three years, the company may find itself thriving in a more stable economy. Ideally, consumer confidence will return before the 2024 holiday shopping season, but even if recovery takes longer, the upcoming holiday seasons in 2025 and 2026 could help mitigate any lost opportunities this year, aligning well with the long-term nature of investing.

A Second Chance for Investment Opportunities

Have you ever felt you missed out on investing in successful companies? If so, there’s promising news.

Analysts occasionally identify “Double Down” stock opportunities for companies they believe are set to surge in value. If you feel you’ve let previous chances slip away, now might be an optimal time to invest. The statistics speak for themselves:

- Amazon: Investing $1,000 when a “Double Down” was issued in 2010 would now be worth $21,049!*

- Apple: A $1,000 investment from 2008 would be worth $43,847!*

- Netflix: Investing $1,000 in 2004 would have grown to $378,583!*

Currently, our team has identified three stocks for “Double Down” recommendations, and opportunities like this don’t come often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Etsy, and MercadoLibre. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.