Bank OZK Posts Strong Q3 Earnings Amid Rising Costs

Bank OZK’s OZK third-quarter 2024 earnings per share of $1.55 exceeded the Zacks Consensus Estimate of $1.53. This represents a 4% increase from the same quarter last year.

Stay informed on quarterly releases: Check Zacks Earnings Calendar.

Revenue Growth Driven by Interest and Fees

The bank’s non-interest income and net interest income (NII) played crucial roles in its success, buoyed by rising interest rates and improved loan and deposit balances. Nevertheless, the growth in revenues faced headwinds from higher expenses and credit loss provisions.

Net income available to common shareholders totaled $177.1 million, marking a 4.4% increase from the previous year. This figure surpassed our forecast of $164.5 million.

Net Revenues Rise—But So Do Expenses

Net revenues reached $423 million, up 7.6% year over year, beating the Zacks Consensus Estimate of $419.1 million. NII also climbed to $389.3 million, reflecting a 6% rise from last year and exceeding our estimate of $387.3 million.

The net interest margin (NIM) fell by 50 basis points (bps) year over year to 4.55%, while our estimate for NIM was 4.64%. Additionally, non-interest income surged to $33.6 million, representing a 30.6% increase compared to the previous year, attributed mainly to higher asset sale gains and loan service fees. Our expectation for non-interest income was $29.9 million.

Despite these gains, non-interest expenses rose to $140.4 million, an increase of 8.9% from the last year. This uptick resulted from higher salaries and increased operating expenses; we had anticipated expenses of $143.1 million.

Bank OZK’s efficiency ratio improved to 32.95% from 33.60% in the prior-year quarter, indicating enhanced profitability.

As of September 30, 2024, total loans stood at $29.2 billion, marking a 1.9% sequential increase. Total deposits also rose to $30.6 billion, an increase of 2.1%.

Challenges in Credit Quality

The quality of loans showed some strain, with net charge-offs to average total loans climbing to 0.36%, up 21 bps year over year. The provision for credit losses increased by 5.5%, reaching $46.4 million, though we anticipated a provision of $55.5 million. Additionally, the ratio of non-performing loans rose to 0.60%, up 26 bps as of September 30, 2024.

Declining Profitability Ratios

By the end of the third quarter, the return on average assets was recorded at 1.90%, down from 2.13% a year prior. The return on average common equity also dropped to 13.65% from 14.81%.

Update on Share Buybacks

During the quarter, Bank OZK repurchased 11,903 shares, totaling $0.5 million.

Analyzing Bank OZK’s Future

Bank OZK’s solid loan growth, branches consolidation, and higher fee income point to a positive revenue outlook moving forward. However, the rising operational expenses and declining asset quality indicate potential troubles in the near term.

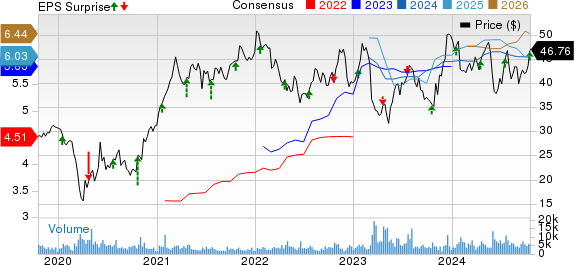

Bank OZK Price, Consensus, and EPS Surprise

Bank OZK price-consensus-eps-surprise-chart | Bank OZK Quote

Currently, the company holds a Zacks Rank #3 (Hold). For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Performance of Other Banks

First Horizon Corporation’s FHN third-quarter adjusted earnings per share (excluding notable items) reached 42 cents, surpassing the Zacks Consensus Estimate of 38 cents, and a remarkable 55.6% increase from the previous year.

FHN’s results saw benefits from a rise in NII and non-interest income, along with increases in deposits and lower provisions. However, they faced challenges from rising expenses and declining loan balances.

Hancock Whitney Corp.’s HWC third-quarter 2024 earnings per share stood at $1.33, beating the Zacks Consensus Estimate of $1.31, and up from $1.12 a year ago.

HWC’s results improved due to higher non-interest income and NII, with lower expenses and provisions as added positives. Nevertheless, dropping total loans and deposits posed some challenges for HWC.

7 Stocks to Watch in the Coming Month

Experts have identified 7 standout stocks from Zacks Rank #1 (Strong Buy), considered “Most Likely for Early Price Pops.” Since 1988, this selection has outperformed the market over twice with an average annual gain of +23.7%. Don’t miss out on these curated picks.

First Horizon Corporation (FHN) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

Read the complete article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.