Expectations Grow for Constellation Energy’s Q3 Earnings Report

Baltimore-based Constellation Energy Corporation (CEG), known for generating and selling electricity, stands out as the largest carbon-free energy producer in the continental U.S. With a market cap of $85.5 billion, the company is preparing to announce its Q3 earnings on Monday, Nov. 4, before the market opens.

Analysts Predict Profits Will Rise

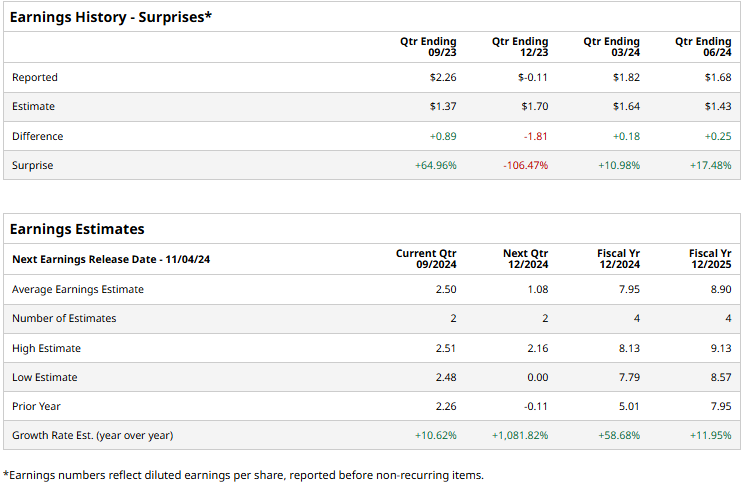

Leading up to the earnings announcement, analysts forecast Constellation Energy will report a profit of $2.50 per share, which marks a 10.6% increase from $2.26 per share reported in the same quarter last year. Notably, the company has beaten Wall Street’s adjusted earnings per share (EPS) expectations in three out of the last four quarters, while falling short once. In its last reported quarter, adjusted EPS dropped 34.3% year-over-year to $1.68, although it still exceeded consensus estimates by 17.5%.

Strong Growth Projected for Fiscal 2024

Looking ahead to fiscal 2024, analysts anticipate an adjusted EPS of $7.95, reflecting a substantial increase of 58.7% from $5.01 in fiscal 2023.

Stock Performance Outshines Competitors

In terms of stock performance, CEG shares have surged 132% year-to-date, far outpacing the S&P 500 Index’s 22.5% increase and the Utilities Select Sector SPDR Fund’s (XLU) 28.7% gains during the same period.

Market Reactions to Earnings Surprises

Constellation Energy’s shares rose 6.5% following the release of better-than-expected Q2 earnings on Aug. 6. In conjunction with this report, the company increased its full-year profit guidance to between $7.60 and $8.40 per share, surpassing what analysts had predicted. Enhanced electricity output from its nuclear fleet and a reduction in outage days contributed to improved operational performance, reassuring investors. Further excitement sprang from a 22.3% stock jump on Sept. 20, sparked by the announcement of a significant power purchase agreement with Microsoft. This deal involves establishing the Crane Clean Energy Center and the restart of the Three Mile Island Unit 1, which had been idled for economic reasons five years prior.

Analysts Viewpoint: A ‘Moderate Buy’

The overall sentiment on CEG stock is cautiously optimistic, with a “Moderate Buy” rating prevailing among analysts. Of the 18 analysts scrutinizing the stock, 11 recommend a “Strong Buy,” while seven suggest a “Hold.” Currently, CEG shares are trading below the average price target of $280.70.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.