Badger Meter Delivers Strong Q3 Results Amidst Mixed Market Reactions

Badger Meter, Inc (BMI) announced earnings per share (EPS) of $1.08 for the third quarter of 2024, exceeding the Zacks Consensus Estimate by 5.9%. This marks a significant improvement from the EPS of 88 cents reported in the same quarter last year.

Stay on track with quarterly releases: Check Zacks Earnings Calendar

Sales Growth Noted, But Marginal Miss on Estimates

Quarterly net sales reached $208.4 million, reflecting a 12% increase from the $186.2 million reported in the prior year. This growth stems from sustained demand for Badger Meter’s customizable water management solutions. However, the reported sales slightly fell short of the consensus estimate by 0.3%. The company anticipates a high single-digit rate of sales growth in the future.

Stock Reaction and Dividend Increase

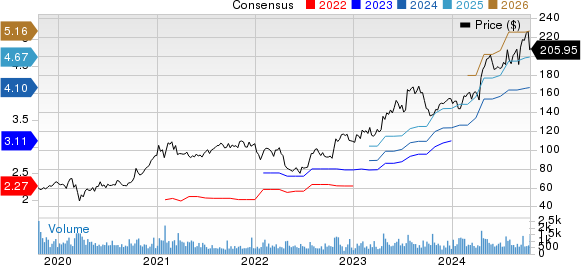

Following the earnings announcement, Badger Meter shares dropped by 6.3%, concluding at $205.95 on October 17, 2024. On a positive note, the company declared a 26% increase in its annual dividend rate, marking the 32nd consecutive year of dividend hikes.

Badger Meter, Inc. Price and Consensus

Badger Meter, Inc. price-consensus-chart | Badger Meter, Inc. Quote

Segment Performance Overview

During the reviewed quarter, sales in utility water rose by 14%, driven by strong adoption of the BlueEdge suite by utility customers. This growth is supported by increased sales of meters and sensors along with the ORION communication endpoints and BEACON Software as a Service (SaaS). Conversely, sales of flow instrumentation products remained stable year over year, as modest growth in water-focused markets offset declines in less prioritized applications globally.

Financial Metrics Highlight Stability

Gross profit for the quarter was $83.9 million, up 15.3% from last year, with a gross margin of 40.2%, an increase of 110 basis points from the prior year. This improvement reflects a favorable sales mix, particularly in Advanced Metering Infrastructure (AMI) and software, bolstered by effective pricing strategies and cost management.

Operating earnings stood at $40.6 million, or 19.5% of sales, compared to $31.4 million or 16.9% of sales in the year-ago quarter. Selling, engineering, and administration expenses were $43.3 million, accounting for 20.8% of sales, an increase driven by rising personal-related expenses including headcount and salaries.

Cash Flow and Liquidity Status

In Q3 2024, Badger Meter generated $45.1 million in net cash from operating activities, rising from $31.4 million a year prior. By September 30, 2024, the company held $259 million in cash and equivalents against $129.2 million in total current liabilities, a slight improvement from the figures of $226.2 million and $138 million as of June 30, 2024. Notably, the company achieved a record quarterly free cash flow of $42 million compared to $28.4 million in the previous year, showcasing robust earnings and working capital management.

Zacks Ranking and Stock Performance

Badger Meter currently holds a Zacks Rank #2 (Buy). Over the past year, its shares have gained 53.4%, significantly outperforming its sub-industry’s benchmark of 25.3%.

Image Source: Zacks Investment Research

Consider These Other Stocks

Investors may also look into other well-ranked stocks in the broader technology sector that have recently released earnings, including BlackBerry Limited (BB), America Movil, S.A.B. de C.V. (AMX), and Netflix, Inc. (NFLX). Currently, BB has a Zacks Rank #1 (Strong Buy), while AMX and NFLX both hold a Zacks Rank #2.

BlackBerry recently reported second-quarter fiscal 2025 results, with revenues of $145 million, up 9.9% from the previous year. The company reported breakeven earnings, surpassing the expected loss of 2-4 cents per share, achieving an earnings surprise of 131.25% over the last four quarters.

America Movil disclosed its third-quarter earnings with an EPS of 11 cents, falling short of the Zacks Consensus Estimate by 73.2%. The quarterly net sales of $11.82 billion represented a 1.1% decline from the previous year.

Netflix’s third-quarter 2024 revenues hit $9.82 billion, exceeding the Zacks Consensus Estimate by 0.6%. Its quarterly EPS was reported at $5.4, beating the consensus estimate of $5.1, showcasing an average earnings surprise of 5.7% over the past four quarters.

Invest in Future Opportunities

Recently released: Experts have identified 7 elite stocks among the current list of 220 Zacks Rank #1 Strong Buys, which they predict to be the most likely candidates for price increases.

Since 1988, this selection has consistently outperformed the market with an average annual gain of +23.7%. Ensure you check out these promising stocks.

Download the latest recommendations and insights from Zacks Investment Research today.

America Movil, S.A.B. de C.V. Unsponsored ADR (AMX): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Badger Meter, Inc. (BMI): Free Stock Analysis Report

BlackBerry Limited (BB): Free Stock Analysis Report

For further details on this article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.