Phillip Securities Upgrades Bank of America Preferred Security to Accumulate

On October 18, 2024, Fintel revealed that Phillip Securities has changed its rating for Bank of America Corporation – Preferred Security (NYSE:MER.PRK) from Neutral to Accumulate.

Current Fund Sentiment Overview

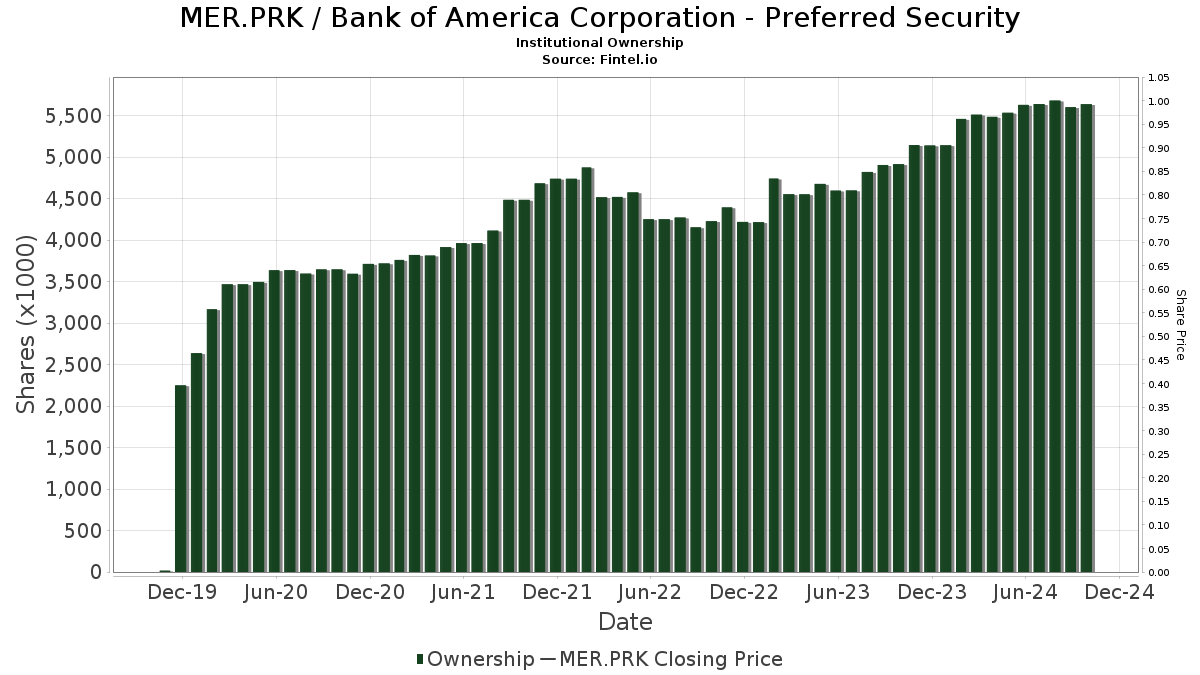

Currently, 17 funds or institutions have reported their positions in Bank of America Corporation – Preferred Security, showing no change compared to the previous quarter. The average portfolio weight of these funds allocated to MER.PRK is at 0.70%, an increase of 0.38%. Additionally, total shares owned by institutions decreased slightly, down 0.01% over the last three months to 5,638K shares.

Actions Taken by Notable Shareholders

The PFF – iShares Preferred and Income Securities ETF owns 2,028K shares, down from 2,102K shares, indicating a decrease of 3.68%. However, it increased its allocation in MER.PRK by 0.32% over the last quarter.

Similarly, the PGX – Invesco Preferred ETF boosted its holdings to 1,292K shares from 1,241K shares, marking an increase of 3.95%. This firm enhanced its portfolio allocation in MER.PRK by 8.83% during the same period.

Meanwhile, the PFFD – Global X U.S. Preferred ETF reduced its shares to 728K shares from 749K shares, which is a decrease of 2.87%. Nonetheless, it increased its allocation in MER.PRK by 1.67%.

Lastly, the PFFV – Global X Variable Rate Preferred ETF holds 429K shares, down from 438K shares, indicating a decrease of 2.22%. This firm has also reduced its portfolio allocation in MER.PRK by 1.66%.

The VRP – Invesco Variable Rate Preferred ETF, however, reported an increase in shares to 330K shares from 309K shares, a rise of 6.47%, yet decreased its portfolio allocation in MER.PRK by 1.90%.

Fintel stands out as a top-tier investing research platform, providing individual investors, traders, financial advisors, and small hedge funds with extensive insights.

The platform offers global data coverage, including fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, options flow, unusual options trades, and more. Their exclusive stock recommendations are bolstered by advanced, backtested quantitative models designed for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.