Sidoti & Co. Rates Sylvamo as a Buy, but Analysts Expect Price Drop

New Coverage Highlights Major Price Target Adjustments

Fintel reports that on October 15, 2024, Sidoti & Co. initiated coverage of Sylvamo (MUN:88L) with a Buy recommendation.

Analyst Price Forecast Indicates Significant Decrease

As of December 20, 2023, the average one-year price target for Sylvamo is 50.49 €/share. Predictions vary, estimating a low of 44.44 € and a high of 57.75 €. This average indicates a decline of 35.80% from its most recent closing price of 78.65 € / share.

To explore more, check our leaderboard featuring companies with the largest potential price target increases.

Projected Annual Revenue Shows Slight Decline

The anticipated annual revenue for Sylvamo stands at 3,638MM, reflecting a decrease of 1.65%. The forecasted annual non-GAAP EPS is 5.16.

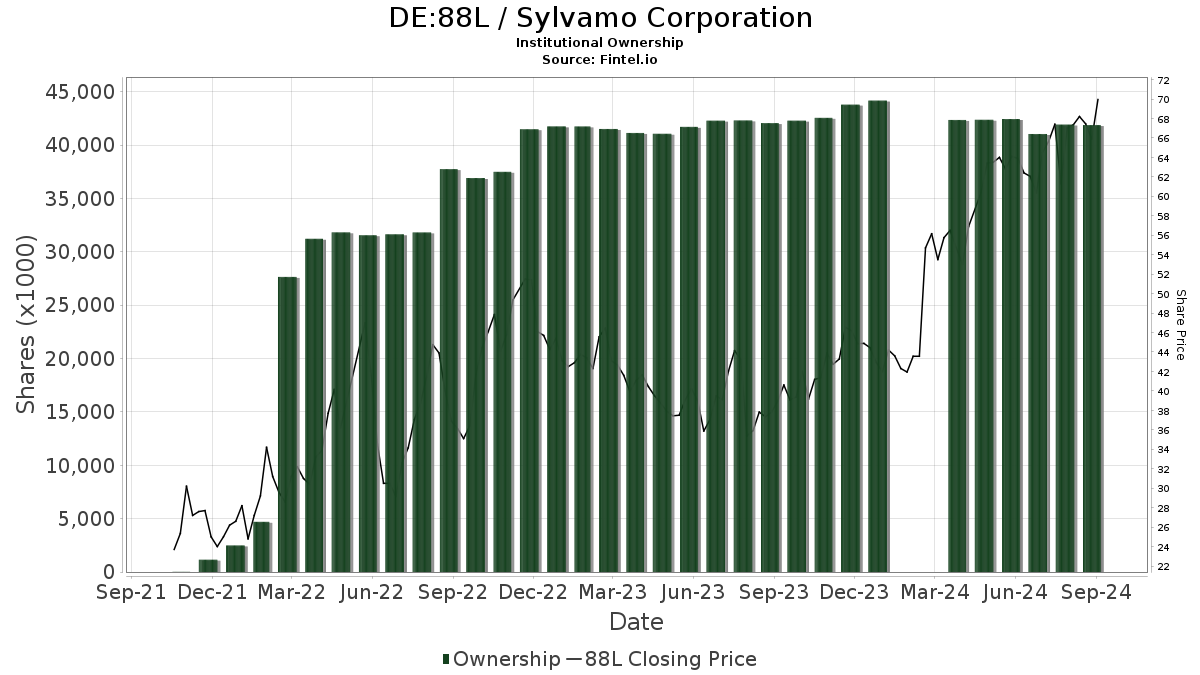

Investment Interest from Funds and Institutions

Currently, 713 funds or institutions hold positions in Sylvamo, an increase of 52 owners or 7.87% from the previous quarter. The average portfolio weight of all funds invested in 88L is 0.22%, which is up by 2.86%. However, total shares owned by institutions have dropped by 0.54% in the last three months to 41,141K shares.

Actions by Major Shareholders

Atlas FRM retains 6,312K shares, representing 15.40% ownership, showing no changes in the last quarter.

The iShares Core S&P Small-Cap ETF holds 2,261K shares, or 5.51% ownership, reflecting a decrease from its previous 2,394K shares, a drop of 5.90%. Notably, the firm enhanced its portfolio allocation in 88L by 8.97% last quarter.

Nomura Holdings maintains ownership of 2,150K shares, accounting for 5.24%, with no changes reported.

Lsv Asset Management has 1,749K shares, representing 4.27% ownership. It previously reported 1,758K shares, marking a reduction of 0.51%. Nonetheless, the firm raised its position in 88L by 17.06% over the past quarter.

Royal London Asset Management holds 1,684K shares, equating to 4.11% ownership, down from 1,957K shares last quarter, reflecting a decrease of 16.26%. This firm also reduced its portfolio allocation in 88L by 2.10%.

Fintel stands out as one of the most comprehensive research platforms for individual investors, traders, financial advisors, and small hedge funds.

Our global data encompasses fundamentals, analyst insights, ownership information, fund sentiments, options trading, insider activities, and more. Additionally, our proprietary stock picks utilize advanced, backtested quantitative models aimed at improving profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.