Two Companies Poised for Strong Performance Ahead of the S&P 500

Consistently outperforming the S&P 500 over five years is a challenging feat, even for experienced hedge fund managers. If you’re aiming to achieve this goal, consider focusing on companies with a proven history of above-average returns. While these factors are not the only criteria for success, they serve as a useful starting point.

With that in mind, let’s examine two companies that fit this profile: HCA Healthcare (NYSE: HCA) and Vertex Pharmaceuticals (NASDAQ: VRTX). Here’s why investing in their stocks could yield rewards that surpass the S&P 500 by 2030.

1. HCA Healthcare: Thriving in a Competitive Landscape

HCA Healthcare operates as a prominent hospital chain in the U.S., managing 186 hospitals and over 2,000 care centers. Breaking into the hospital industry poses numerous challenges, such as overseeing multiple medical facilities and fostering solid relationships with physicians and patients.

Yet, HCA Healthcare has excelled in these areas. The company’s market share increased from 24% in 2012 to 27% by 2022, despite facing obstacles during the pandemic and economic pressures that included costly contract labor. This suggests that HCA is performing well compared to its competitors.

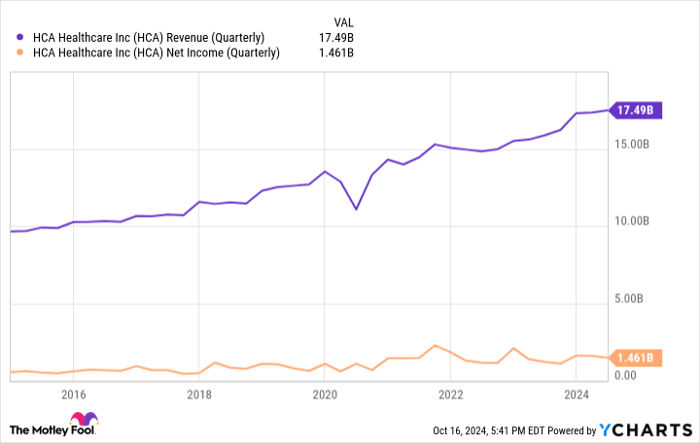

HCA Healthcare’s financial strength has been evident, as shown in its revenue trends:

HCA Revenue (Quarterly) data by YCharts.

Investments in facility upgrades and advanced services underline HCA’s success. The company aims to capture 29% of the market by 2030, maintaining a strategy that has consistently proven effective. Based on its past performance, there is reason to anticipate continued success through the next decade.

2. Vertex Pharmaceuticals: Innovating in Biotech

Strong financials are key in the biotech sector, but Vertex Pharmaceuticals also needs to demonstrate clinical and regulatory progress to attract investors. It appears poised for significant achievements in both areas through 2030.

Vertex is known for its cystic fibrosis (CF) treatments, being the only manufacturer of medicines that address the root causes of the disease. This unique position has contributed to the company’s steady performance over the last decade:

VRTX Revenue (Quarterly) data by YCharts.

A recent net loss occurred due to a nearly $5 billion acquisition, but Vertex is now expanding its focus. Its new gene-editing therapy, Casgevy, targets sickle cell disease and beta-thalassemia, promising strong future revenue contributions.

On the regulatory front, Vertex awaits approval for a combination therapy for CF and a treatment for acute pain, both expected next year. With clinical trials ongoing for several new therapies, including one for type 1 diabetes, Vertex seems well-positioned for growth.

Long-term investors should find Vertex Pharmaceuticals an appealing choice, as it continues on its path to deliver strong returns through the end of the decade.

Exploring New Opportunities for Investment

Wondering if you’ve missed out on investing in successful stocks? Here’s an insight.

Our team occasionally identifies a “Double Down” stock—for companies poised for significant rises. If you think you’ve missed your chance, now is an opportune moment to invest. The impressive returns from previous “Double Down” recommendations include:

- Amazon: An investment of $1,000 in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment from 2008 has grown to $44,456!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, your investment would have soared to $411,959!*

Currently, we have “Double Down” alerts for three promising companies, presenting a timely opportunity for potential investors.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Prosper Junior Bakiny holds positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends HCA Healthcare and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not reflect the opinions of Nasdaq, Inc.