Analyst Predicts Huge Gains for Neonode Following Buy Recommendation

Major Price Upside Projected for NEON Shares

Fintel reports that on October 18, 2024, Ladenburg Thalmann started coverage of Neonode (NasdaqCM:NEON) with a Buy recommendation.

Analyst Price Forecast Suggests 311.11% Upside

As of September 25, 2024, analysts have set an average one-year price target for Neonode at $37.74 per share. This prediction varies from a low of $37.37 to a high of $38.85. With its latest reported closing price at $9.18 per share, this represents a potential increase of 311.11%.

For further insights, check out our leaderboard highlighting companies with significant price target upsides.

The projected annual revenue for Neonode stands at $11 million, reflecting a remarkable increase of 153.04%. Meanwhile, the estimated annual non-GAAP EPS is 0.31.

Fund Sentiment Toward Neonode

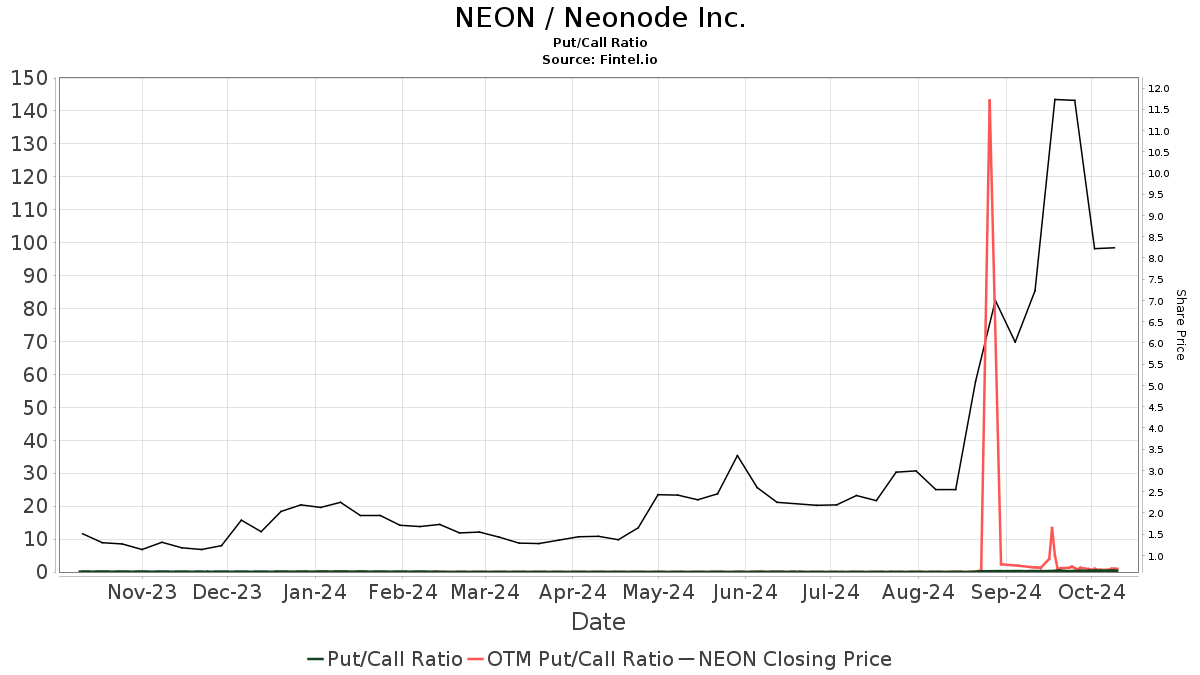

Currently, 30 funds or institutions have reported positions in Neonode, a number that has remained stable over the last quarter. The average portfolio weight of all funds dedicated to NEON is 0.00%, but this figure has seen an increase of 39.32%. Total shares owned by institutions grew by 12.10% over the last three months, reaching 707,000 shares.  The current put/call ratio for NEON is 0.42, indicating a bullish outlook among traders.

The current put/call ratio for NEON is 0.42, indicating a bullish outlook among traders.

What Other Shareholders Are Doing

VEXMX – Vanguard Extended Market Index Fund Investor Shares holds 139,000 shares, giving it a 0.90% stake in the company. Their position remained unchanged over the last quarter.

Geode Capital Management owns 112,000 shares, equating to 0.73% ownership, which marks a 5.04% increase from their previous total of 107,000 shares. However, Geode has decreased its portfolio allocation in NEON by 22.85% over the same timeframe.

Susquehanna International Group, LLP now holds 61,000 shares, reflecting a full shift from previously holding none, an increase of 100.00%. Meanwhile, FSMAX – Fidelity Extended Market Index Fund maintains a position of 60,000 shares, representing 0.39% ownership. This is a decline of 1.19% from their last reported holdings, yet they increased their overall allocation in NEON by an impressive 114.22% during the last quarter.

Citadel Advisors currently possesses 36,000 shares, translating to 0.23% ownership and a complete transition from their last report of zero shares, marking another increase of 100.00%.

Getting to Know Neonode

(This description is provided by the company.)

Founded in 2001 and headquartered in Stockholm, Sweden, Neonode Inc. offers advanced optical sensing solutions. These include technologies for contactless touch, gesture control, and in-cabin monitoring. With extensive research and development, Neonode’s tech is used across over 75 million products worldwide, supported by more than 120 patents.

The company serves numerous Fortune 500 firms across various sectors, including consumer electronics and automotive. Its operations are divided into three main areas: HMI Solutions, HMI Products, and Remote Sensing Solutions. HMI Solutions provides tailored touch and gesture controls, while HMI Products supply sensor modules applicable in many industries, such as elevators. The Remote Sensing Solutions focus on software for driver and in-cabin monitoring.

Fintel serves as a valuable investing research platform for individual investors, financial advisors, and small hedge funds.

Our comprehensive data includes fundamental analytics, analyst reports, ownership insights, fund sentiments, options data, and much more. Plus, our unique stock picks utilize advanced quantitative models to enhance profit potential.

Click to Learn More!

This article originally appeared on Fintel.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.