Phillip Securities Boosts Rating for Bank of America Preferred Stock

On October 18, 2024, Phillip Securities upgraded their rating for Bank of America Corporation – Preferred Stock (NYSE:BML.PRL) from Neutral to Accumulate.

Fund Sentiment Shows Positive Shift

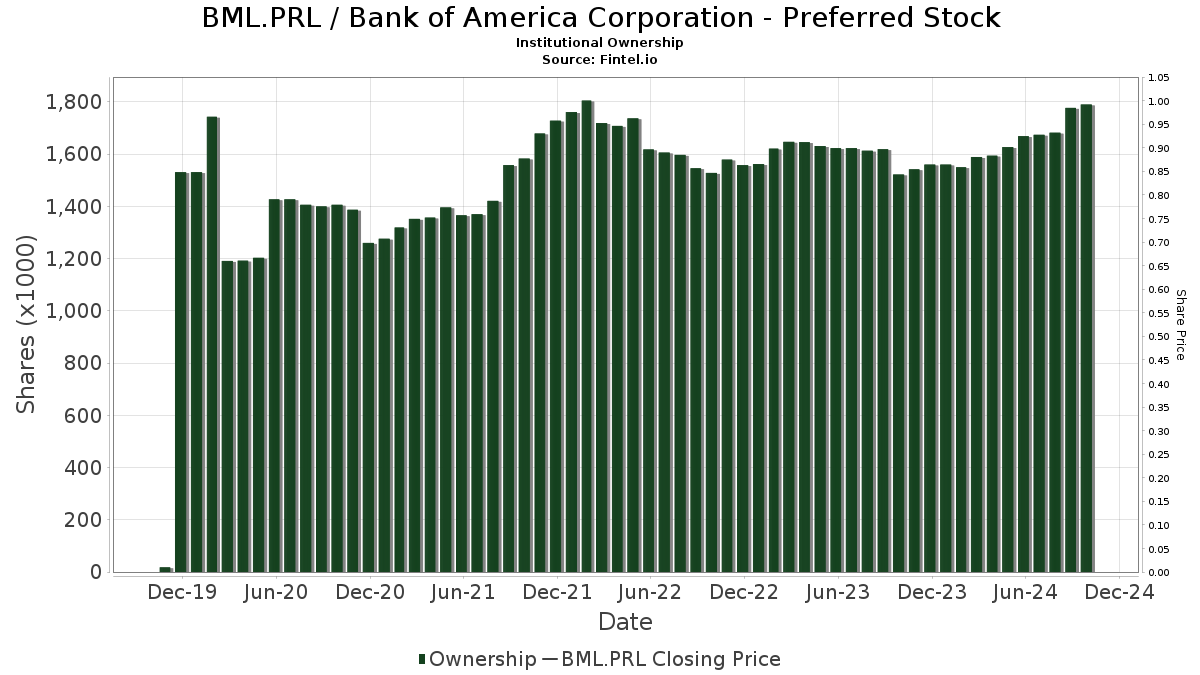

Currently, 14 funds and institutions have positions in Bank of America Corporation – Preferred Stock, marking a rise of 2 owners or 16.67% compared to the previous quarter. The average portfolio weight of all funds invested in BML.PRL is 0.40%, reflecting a 9.02% increase. Total shares held by these institutions rose by 6.91% in the last three months, reaching 1,790K shares.

Actions of Other Shareholders

The PFF – iShares Preferred and Income Securities ETF owns 801K shares, down from 851K shares in their previous filing, indicating a decrease of 6.30%. This firm also reduced its portfolio allocation in BML.PRL by 1.05% over the last quarter.

PFFD – Global X U.S. Preferred ETF has 296K shares, down from 304K shares, a decrease of 2.78%. However, they increased their portfolio allocation in BML.PRL by 3.42% during the same period.

PFFV – Global X Variable Rate Preferred ETF holds 171K shares, which is lower than the 176K shares reported previously, showing a decrease of 2.87%. Their portfolio allocation in BML.PRL decreased by 0.69% over the last quarter.

MDIV – Multi-Asset Diversified Income Index Fund owns 134K shares.

Finally, the VRP – Invesco Variable Rate Preferred ETF holds 128K shares, an increase from 120K shares in the prior filing, which represents a rise of 6.47%. Despite this, they decreased their portfolio allocation in BML.PRL by 0.30% over the last quarter.

Fintel serves as a leading research platform for individual investors, traders, financial advisors, and small hedge funds, providing extensive data on fundamentals, analyst reports, ownership statistics, fund sentiment, and various trading metrics.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.