Why ETFs Might Be Your Best Bet for Long-Term Growth

Investing in individual stocks can be exciting and potentially profitable. However, if you’re aiming to maximize your wealth over time, stick with exchange-traded funds (ETFs). Most pros in the trading world struggle to consistently outperform the market. Here are two notable ETFs that stand out for their solid track record and potential for long-term growth.

The Leading Contender in ETFs: Bitcoin

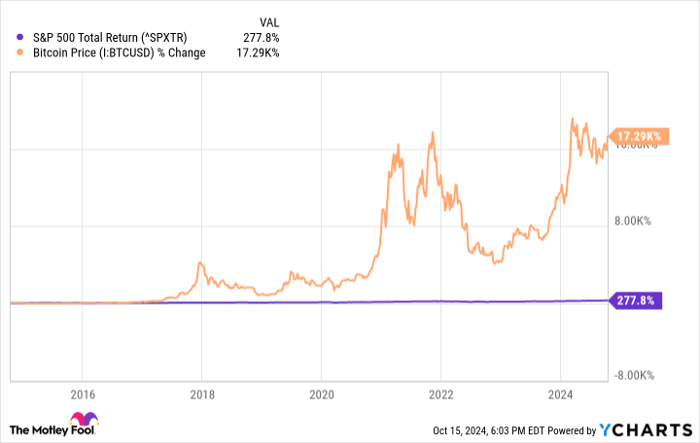

Since its inception in 2009, Bitcoin (CRYPTO: BTC) has outperformed almost all other investments. Initially, Bitcoin was worth just a few cents. Today, its value surpasses $60,000. In the last decade alone, Bitcoin’s price has outstripped the S&P 500 by over 17,000%.

While future growth may not mirror the past, Bitcoin’s ascent as a valuable asset seems to be just beginning. Its current market cap is approximately $1.3 trillion, while gold’s market cap sits near $18 trillion. To merely equal gold’s value, Bitcoin would need to increase by about 1,800%. This doesn’t even consider potential applications within the broader crypto space.

Investing directly in Bitcoin comes with challenges, particularly around storage and taxes. The iShares Bitcoin Trust ETF (NASDAQ: IBIT) simplifies this process, allowing investors to track Bitcoin’s price without the hassle of direct ownership. With a modest expense ratio of 0.12%, this ETF makes it easy to invest, starting with just $100 and adding to your position over time. If Bitcoin’s future is at all similar to its past, ETFs like this could be some of the top-performing investments ever.

^SPXTR data by YCharts.

Stick with Proven Winners: The S&P 500

Bitcoin ETFs present a promising opportunity, but don’t overlook the time-tested Vanguard S&P 500 ETF (NYSEMKT: VOO).

Research shows that many professional investors struggle to beat the market year after year. Over the last 20 years, fewer than 10% of actively managed funds have surpassed market benchmarks like the S&P 500.

By investing in Vanguard’s S&P 500 ETF and holding it long-term, you’ll likely outperform many active traders due to lower turnover. Plus, you may enjoy tax benefits inherent in ETF investments.

While exploring new opportunities like Bitcoin ETFs can enhance your portfolio, don’t underestimate the wisdom of allocating a significant portion to a reliable, low-cost ETF that mirrors a major market index like Vanguard’s S&P 500 ETF. You can start with just $100, slowly building your investment over time.

Regardless of whether you choose a Bitcoin ETF, a market index ETF, or a mix of both, consider setting up automatic investments. This allows your brokerage to consistently invest a set amount—$50, $100, or $200 each month—effortlessly. Establishing a regular investment schedule is key to putting your money to work for your future.

Don’t Miss Out on the Next Big Opportunity

If you’ve ever felt like you missed the opportunity to invest in top-performing stocks, this is your chance to consider it again.

Occasionally, our expert analysts identify a “Double Down” stock—a recommendation for companies poised to see significant growth. If you’re concerned about having missed your opportunity, now may be the time to invest before it’s too late. The data is compelling:

- Amazon: Investing $1,000 when we doubled down in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment from our 2008 recommendation could be worth $44,456!*

- Netflix: If you invested $1,000 when we doubled down in 2004, it could now be worth $411,959!*

Currently, we are issuing “Double Down” alerts for three remarkable companies. This opportunity may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024.

Ryan Vanzo has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.